AI-Driven Surge Propels S&P 500 to Record Highs Amid Caution

The S&P 500 hits new highs driven by AI tech giants, but experts warn of potential risks from profit-taking and economic uncertainties.

AI-Driven Surge Propels S&P 500 to Record Highs Amid Caution

The S&P 500 surged to new record highs this week, propelled largely by the dominant tech giants spearheading the artificial intelligence (AI) boom, according to Jim Santoli’s Wednesday market wrap-up on CNBC. However, despite this bullish momentum, market strategists, including Citi’s Montagu, warn that the rally may be at risk due to potential profit-taking and broader macroeconomic uncertainties.

Tech Titans Lead Market Gains

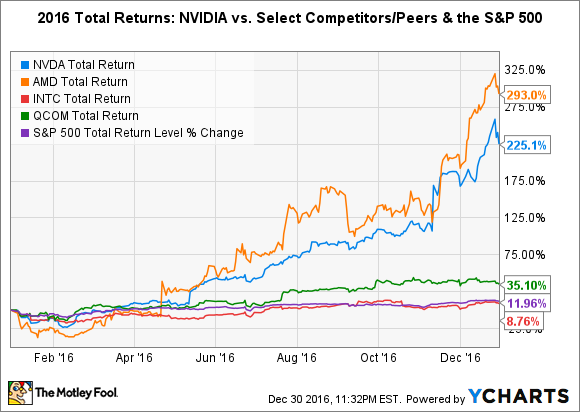

The recent rally in the S&P 500 has been driven by the "usual flag carriers" of the AI era—major technology companies that have made significant advancements and investments in AI technologies. These include giants like Apple, Microsoft, Nvidia, and Alphabet, whose shares have surged as investors bet on AI's transformative potential across industries. Nvidia, in particular, has been a standout performer given its dominance in AI chip manufacturing, which has become essential for powering large-scale AI models.

Santoli’s analysis highlights how investor enthusiasm for AI-related stocks has pushed the index upward, reflecting optimism about the sector’s long-term growth prospects. This surge forms part of a broader narrative where AI is viewed as a key driver of innovation and productivity gains in the near future.

Caution from Citi’s Montagu and Other Experts

Despite the strong performance, Citi’s Montagu has sounded a note of caution. He warns that the tech rally might be vulnerable to profit-taking, especially as valuations have become stretched in certain segments. This means investors might start selling shares to lock in gains, which could slow or reverse the upward momentum.

Other market watchers echo this sentiment, noting that while the AI boom is powerful, it is not immune to broader economic headwinds such as inflation pressures, potential interest rate hikes by the Federal Reserve, and geopolitical risks. The Wall Street Journal reports that some investors are increasingly concerned the stock market rally could be "on borrowed time," with a correction possible if earnings reports or economic data disappoint.

Market Risks and Possible Outcomes

Analysts are outlining several scenarios that could spook stocks in the near term. One prominent risk scenario involves an AI bubble bursting, which could lead to a substantial decline in the S&P 500—potentially between 10% and 20% or more. This decline could be triggered if investors become disillusioned with AI companies failing to meet lofty growth expectations, or if regulatory challenges emerge.

At the same time, some strategists remain hopeful about a year-end rally, driven by strong corporate earnings and resilient consumer demand, as discussed on platforms like Seeking Alpha. This optimism is tempered by the recognition that volatility may increase as markets digest mixed economic signals and evolving Fed policy.

The Broader Economic Context

The current market environment is shaped by a complex interplay of factors:

-

Inflation and Interest Rates: The Federal Reserve’s recent moves to adjust interest rates remain a critical focus. Higher rates can dampen growth stocks, including tech companies heavily reliant on future earnings.

-

Corporate Earnings: Upcoming earnings reports will be closely scrutinized for signs of AI-driven revenue growth versus cost inflation pressures.

-

Geopolitical Tensions: Global trade dynamics and geopolitical events continue to add uncertainty, influencing investor risk appetite.

Visualizing the AI Market Surge

Visual representations often show the soaring stock prices of AI leaders like Nvidia and Microsoft, alongside charts depicting the S&P 500’s recent trajectory. Logos of these companies and snapshots from CNBC's market wrap-ups capture the essence of this tech-driven rally, while risk warnings from Citi provide a counterpoint to the exuberance.

In summary, the S&P 500’s new highs reflect the strong influence of AI-focused tech stocks, but caution is warranted. Profit-taking, valuation concerns, and economic uncertainties could temper or reverse gains in the near term. Investors are advised to monitor earnings and economic data closely as the AI boom continues to reshape market dynamics.

Relevant Images for Context

- Nvidia Logo and Stock Chart: Illustrating the AI chipmaker’s role in the rally.

- S&P 500 Index Chart: Showing recent new highs driven by tech stocks.

- Jim Santoli’s CNBC Market Wrap Screenshot: Highlighting his analysis.

- Citi’s Montagu Portrait: Representing the cautionary voice on profit-taking.

- Visual of AI Technology in Data Centers: Contextualizing the technological foundation behind the market surge.

These images provide a concise visual narrative accompanying the market story of AI-driven optimism tempered by prudent caution.