AI Drives Growth in China's 2025 Earnings Season

China's 2025 earnings season highlights AI as a key growth driver, boosting semiconductor and tech sectors with strong financial performances.

AI Drives Growth in China's 2025 Earnings Season

China’s corporate earnings season for 2025 is highlighting a significant trend: artificial intelligence (AI) is emerging as a crucial growth driver across various sectors. Leading Chinese companies, especially in technology manufacturing and semiconductor production, are reporting strong financial performances fueled by AI demand and innovation. This article examines the firms benefiting most from AI, how this trend is reshaping China’s earnings landscape, and the broader implications for the global tech industry.

Strong Earnings Driven by AI in China’s Tech Sector

The ongoing earnings season reveals that companies closely tied to AI hardware and infrastructure are posting robust results. This is part of a global AI boom, where demand for AI chips, memory, and processing units is skyrocketing due to increased adoption of AI applications in data centers, cloud computing, and consumer electronics.

ASMPT: AI Fuels Consistent Growth in Semiconductor Equipment

ASM Pacific Technology (ASMPT), a leading supplier of semiconductor assembly and packaging equipment, announced impressive third-quarter results for 2025. The company reported bookings of approximately US$462.5 million, marking a 14.2% year-over-year increase, with AI-related orders driving sustained growth for six consecutive quarters. ASMPT emphasized its technological leadership in advanced logic and high-bandwidth memory (HBM) packaging, key components in AI chip manufacturing.

- Revenue increased 9.5% year-over-year to HK$3,661.2 million (approx. US$468 million).

- Despite some margin pressure due to strategic restructuring, ASMPT maintains profitability on an adjusted basis.

- Recurring orders from memory and logic chip customers underscore the steady demand for AI-capable semiconductor equipment.

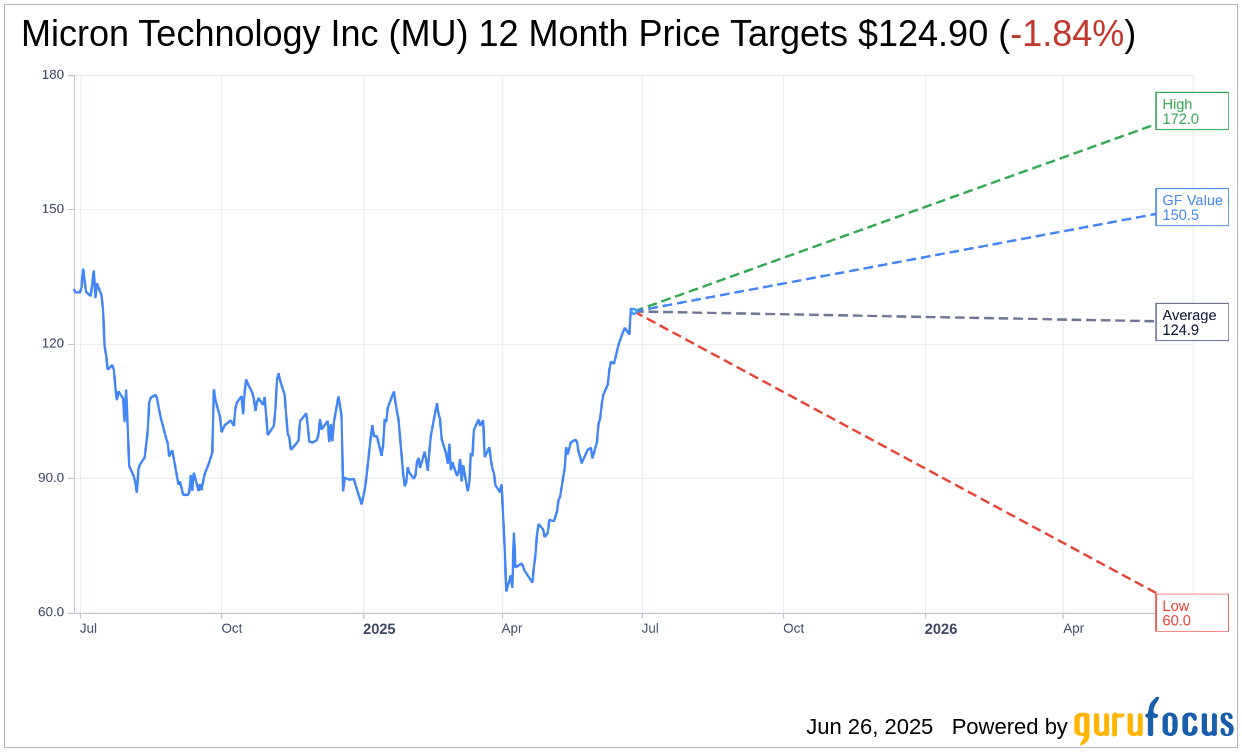

Micron Technology: Record Revenues from AI Memory Demand

Though based in the U.S., Micron Technology's results are highly relevant to China's semiconductor ecosystem due to the interconnected global supply chain. Micron reported a record revenue of $9.3 billion in its fiscal third quarter of 2025, driven predominantly by AI-related demand. The company’s data center and HBM memory products saw exceptional growth, with a 37% year-over-year revenue increase.

- Non-GAAP gross margin hit 39%, with operating income reaching $2.5 billion.

- Net income was $2.2 billion, with earnings per share of $1.91.

- Cash flow from operations was strong at $4.6 billion, evidencing healthy financial stability.

- This surge reflects AI’s transformation of memory and storage needs in data centers and consumer devices.

Who Else is Benefiting? Emerging Winners in AI-Driven Growth

While ASMPT and Micron are marquee names, other Chinese companies are also capitalizing on AI momentum:

- Semiconductor manufacturers and equipment suppliers focused on advanced logic and memory solutions are experiencing increased orders.

- Cloud computing and AI service providers in China are expanding infrastructure to accommodate AI workloads, indirectly boosting demand for hardware.

- AI software and chip design firms are receiving investments and contracts, signaling a growing domestic AI innovation ecosystem.

- Some mining and data center companies, like Cipher Mining, are also benefiting indirectly through partnerships with AI cloud providers, reflecting AI’s broad industrial impact beyond just chip makers.

Broader Industry and Economic Implications

China’s 2025 earnings season underscores several important trends:

- AI as a Growth Catalyst: AI is no longer a niche application but a core driver of revenue growth in tech hardware sectors, particularly semiconductors and memory.

- Supply Chain Integration: Even non-Chinese firms like Micron influence and reflect China’s tech ecosystem due to globalized manufacturing and technology supply chains.

- Strategic Focus on AI: Chinese companies are investing heavily in AI-related technologies, including advanced chip packaging, memory innovation, and data center infrastructure.

- Challenges and Margin Pressure: Some firms face margin compression due to restructuring and competitive dynamics, indicating that while AI drives volume, cost control remains critical.

Visualizing the AI Earnings Surge in China

Relevant images to illustrate this story include:

- ASMPT’s corporate logo and visuals of semiconductor packaging equipment, highlighting AI-driven product lines.

- Charts and graphs from Micron’s Q3 2025 earnings presentation showing record revenues and AI-related product growth.

- Infographics depicting AI’s influence on semiconductor demand in China’s tech ecosystem.

- Photos of AI data centers or chip manufacturing facilities in China to contextualize infrastructure expansion.

China’s 2025 earnings season confirms AI’s role as a transformative economic force, driving record financial results for companies focused on next-generation semiconductor technology and AI infrastructure. With sustained demand and innovation, these firms are well-positioned for continued growth, reinforcing China’s strategic ambitions in the global AI and tech competition.