AI Innovations Propel Market Surge, Tesla Gains Momentum

AI optimism drives stock market to new highs, with Tesla gaining momentum amid tech surge.

AI Innovations Propel Market Surge, Tesla Gains Momentum

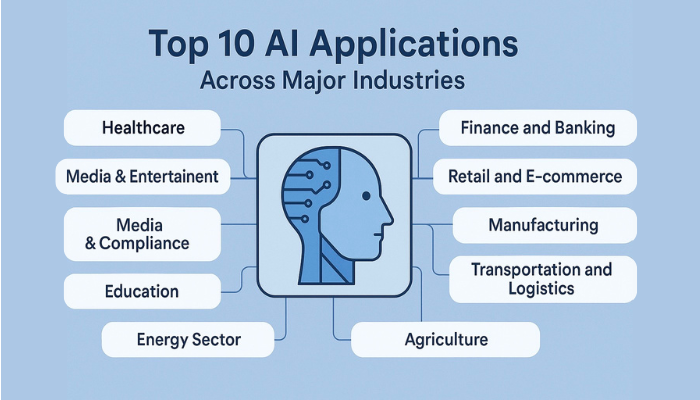

The U.S. stock market has reached new record highs, driven by renewed optimism surrounding artificial intelligence (AI) developments and strong performances in the technology sector. The S&P 500 and Nasdaq indexes have resumed their upward momentum, buoyed by investor enthusiasm that AI innovation will continue to fuel growth across industries. Among the standout performers, Tesla (NASDAQ: TSLA) emerged with a fresh technical buy signal, signaling potential gains supported by AI-driven advancements and solid company fundamentals.

Market Rally Fueled by AI-Driven Optimism

Investor confidence in AI technologies has rekindled a broad market rally, propelling major indexes to their peak levels. The S&P 500 and Nasdaq both closed at all-time highs, overcoming earlier uncertainties including geopolitical tensions and concerns about the Federal Reserve’s interest rate policies. Analysts attribute this rally largely to the transformative potential of AI in sectors ranging from automotive to software and cloud computing, which is expected to accelerate corporate earnings growth and productivity gains.

- Gold prices also climbed alongside equities, reflecting a complex interplay of safe-haven demand and inflation expectations amid the Fed’s signaling of potential future rate cuts.

- The Federal Reserve minutes released recently hinted at a dovish tilt, suggesting interest rates might be lowered sooner than anticipated, which further spurred investor appetite for growth stocks, especially in the tech sector.

Tesla’s New Buy Point and AI Integration

Tesla, a bellwether in technology-driven automotive innovation, has reached a significant new buy point, according to technical market analysts. After closing above the critical $362.39 level about a month ago, Tesla’s stock has been in a longer-term buy signal phase, with analysts projecting an upside target near $524.64 in the coming months. Recent price action shows Tesla testing resistance levels around $464 to $470, suggesting the potential for further gains if it can decisively break above these ceilings.

- Tesla's AI initiatives, including advancements in its Full Self-Driving (FSD) software and AI-powered manufacturing processes, are central to its growth narrative.

- The company continues to leverage AI to improve vehicle autonomy, battery technology, and production efficiency, which investors view as catalysts for sustained revenue and profit expansion.

Broader Tech Sector Strength and Economic Signals

The rally extends beyond Tesla and the automotive sector, encompassing a wide range of technology companies innovating with AI. Cloud computing giants, semiconductor manufacturers, and software firms have all contributed to the Nasdaq’s record close, overshadowing concerns about the U.S. government shutdown risks and macroeconomic uncertainties.

- Market participants are closely monitoring upcoming economic data and corporate earnings reports for confirmation that growth can be maintained even as the Fed potentially eases monetary policy.

- The positive momentum in tech stocks is seen as a bellwether for overall market resilience, with AI playing an increasingly prominent role in investor expectations for the future.

Visualizing the Rally and Tesla’s Momentum

Context and Implications

The current rally underscores an important shift in market dynamics, where AI innovation is not just a technological trend but a fundamental driver of equity valuations. Tesla’s position at the forefront of AI integration in electric vehicles exemplifies how companies that can successfully harness AI are rewarded with investor confidence and capital inflows.

- However, analysts caution that while the technical signals are positive, market volatility remains a risk, especially given geopolitical tensions and the potential for policy shifts.

- Investors are advised to watch key resistance levels and economic indicators closely.

In summary, the combination of AI optimism, a supportive Federal Reserve stance, and strong earnings prospects has propelled the U.S. stock market to new heights, with Tesla exemplifying the sector’s growth potential through its new buy point and AI-driven business strategies. This environment presents both opportunities and challenges for investors looking to capitalize on the ongoing tech-driven transformation of the global economy.