AI Investment Boom Fuels Debt Concerns and Bubble Warnings

As artificial intelligence investments surge to record levels, financial analysts are raising red flags about mounting corporate debt, unsustainable valuations, and the growing risk of a market correction that could reshape the tech landscape.

The AI Investment Frenzy Reaches Critical Levels

The artificial intelligence sector is experiencing unprecedented capital inflows, with venture capital, corporate spending, and public market investments hitting all-time highs. Yet beneath the optimism lies a troubling reality: the pace of investment growth is significantly outpacing demonstrable revenue generation and profitability metrics, creating conditions reminiscent of previous technology bubbles.

Major technology companies have committed tens of billions of dollars to AI infrastructure, research, and acquisitions. This capital deployment reflects genuine belief in AI's transformative potential, but it also raises fundamental questions about whether current valuations can be justified by near-term financial returns.

The Debt Accumulation Problem

Corporate balance sheets are straining under the weight of AI-related expenditures. Companies are taking on substantial debt to fund:

- Infrastructure buildout for data centers and computing resources

- Acquisition of AI startups at premium valuations

- Research and development initiatives with uncertain timelines

- Talent acquisition in a competitive market for AI expertise

The challenge intensifies when companies lack clear pathways to monetize these investments. Many organizations are investing in AI capabilities speculatively, betting that competitive necessity will eventually justify the costs. This dynamic mirrors the dot-com era, when companies burned through capital on unproven business models.

Market Valuation Concerns

Valuation multiples for AI-focused companies have reached levels that demand extraordinary growth trajectories to justify. Investors are pricing in decades of superior returns based on technologies that remain largely experimental in commercial applications.

Several warning indicators suggest overheating:

- AI startup valuations doubling or tripling year-over-year without proportional revenue growth

- Public company stock prices increasingly decoupled from earnings fundamentals

- Venture capital firms deploying capital at accelerating rates despite market saturation in certain segments

- Declining average deal sizes masking a proliferation of underfunded ventures

The Bubble Risk Framework

Financial analysts point to three conditions that historically precede market corrections:

Excessive Leverage: Companies are borrowing aggressively to fund AI initiatives, amplifying downside risk if investments underperform.

Speculative Capital Allocation: A significant portion of AI funding flows to companies with minimal revenue and unproven business models, driven by FOMO (fear of missing out) rather than fundamental analysis.

Narrative-Driven Valuations: Stock prices and funding rounds are increasingly justified by AI's transformative potential rather than concrete financial metrics.

Differentiation Between Hype and Reality

Not all AI investment concerns are equally valid. Established technology companies with diversified revenue streams can absorb AI R&D costs without existential risk. The real vulnerability lies in:

- Specialized AI startups dependent on continued venture funding

- Companies with single-product AI solutions facing commoditization

- Organizations with high debt-to-equity ratios funding speculative AI initiatives

What Could Trigger a Correction

Market analysts identify several potential catalysts for a significant pullback:

- Disappointing earnings reports from major AI vendors

- Rising interest rates making debt servicing more expensive

- Regulatory actions constraining AI development or deployment

- Technological breakthroughs that render current infrastructure investments obsolete

- Venture capital drying up as returns on earlier AI investments disappoint

The Path Forward

The AI sector's long-term potential remains substantial. However, the current investment environment demands greater discipline around capital allocation and realistic timelines for return on investment. A market correction, while painful, could ultimately strengthen the sector by eliminating unsustainable ventures and forcing companies to demonstrate genuine commercial value.

Investors and corporate leaders must balance enthusiasm for AI's possibilities with rigorous financial discipline. The technology's transformative potential is real—but so are the risks of overheated markets and excessive leverage.

Key Sources

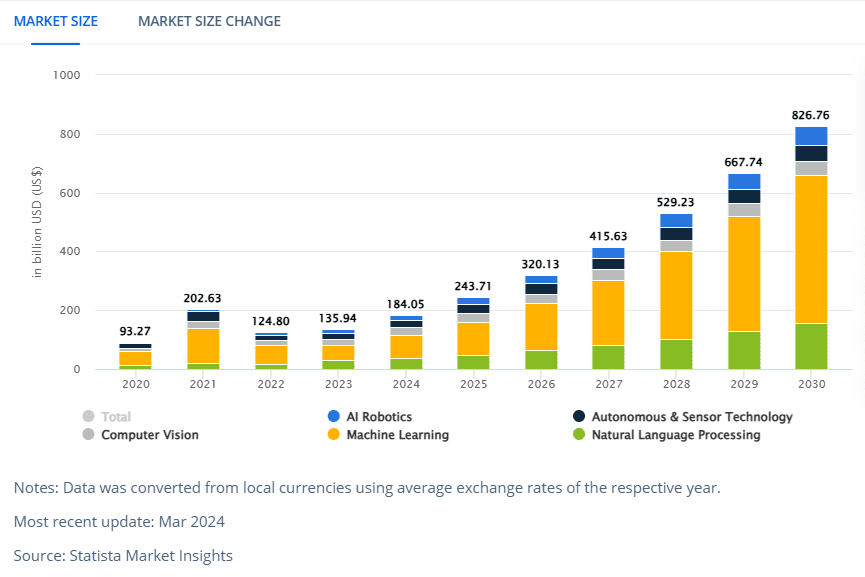

- Precedence Research: Artificial Intelligence Market Size projections through 2030

- Keywords Everywhere: AI Market Size Statistics and Growth Forecasts

- Hostinger: Enterprise AI Adoption Trends and Usage Patterns