AI's Gradual Yet Unstoppable Impact on Finance

AI's transformation of finance is gradual yet decisive, reshaping the industry with enhanced efficiency and strategic decision-making.

AI's Gradual Yet Unstoppable Impact on Finance

The transformation of finance by artificial intelligence (AI) is unfolding gradually yet decisively, reshaping the industry in ways that are incremental but irreversible. This evolution is characterized by the growing integration of AI-driven technologies into financial operations, enhancing efficiency, reducing errors, and enabling more strategic decision-making. While the pace of change may appear steady, the cumulative impact of AI adoption is profoundly altering how financial institutions operate and compete.

Gradual but Steady AI Adoption in Finance

Unlike sudden, disruptive shifts, AI's integration into finance is incremental, progressing through stages of increasing sophistication and adoption. Many financial organizations initially deploy AI for routine tasks such as data reconciliation, expense approvals, and compliance monitoring. These applications improve operational efficiency by automating repetitive processes, minimizing human error, and freeing finance professionals to focus on higher-value activities.

This phase is marked by the use of LLM-powered information retrieval agents and single-task AI workflows, which provide immediate productivity gains but do not yet revolutionize entire financial processes. As AI matures, more complex, multi-system agentic workflows emerge, enabling cross-functional orchestration and collaborative AI agents that can handle intricate financial operations and decision-making.

Key Drivers of AI Transformation in Finance

Several factors contribute to the ongoing AI-driven transformation in finance:

-

Autonomous finance agents: These intelligent systems learn and adapt in real time, going beyond scripted automation to make context-aware decisions that evolve with business needs. They support forecasting, budgeting, risk management, procurement, and strategic planning, turning finance functions into engines of agility and foresight.

-

Technology talent integration: With talent shortages in finance, many firms are prioritizing the recruitment and development of AI and data analysis skills. Nearly two-thirds of finance departments plan to enhance their technical capabilities by 2026, underscoring the strategic role AI plays in future finance teams.

-

Holistic AI valuation: CFOs and financial leaders are encouraged to consider AI's value beyond immediate financial returns, including trust, organizational readiness, and cultural adaptation. This holistic approach helps justify investments and supports sustainable AI integration.

-

Advanced AI capabilities: Leading tech companies are pushing the envelope with agentic AI—systems that coordinate multiple AI agents across workflows, handle unstructured data, and communicate with various SaaS applications. This next level of AI promises more intelligent and autonomous financial operations in the near future.

Industry Impact and Examples

AI is not only automating routine tasks but also enabling proactive leadership and agility in finance. For example, finance leaders equipped with AI-driven insights can anticipate market trends, optimize capital allocation, and mitigate risks more effectively. This capability is critical as merger and acquisition activity rises, demanding rapid yet informed financial analysis and decision-making.

Companies like Sprinklr, with new CFOs experienced in technology-driven finance strategies, exemplify how leadership is evolving to embrace AI's potential. Similarly, the growing use of autonomous agents in forecasting and compliance reflects a broader industry trend toward embedding AI deeply into financial workflows for compounded gains.

Challenges and Future Outlook

Despite progress, AI adoption in finance faces barriers such as:

-

ROI justification challenges, especially in early adoption stages, where benefits may be intangible or long-term.

-

Compliance and regulatory concerns, requiring careful governance and risk controls to ensure AI-driven decisions meet legal and ethical standards.

-

Workforce readiness, with ongoing needs to reskill finance professionals and integrate AI fluency into corporate culture.

Nonetheless, the trend toward AI-enabled finance is unstoppable. As AI technologies evolve from simple automation to complex agentic systems capable of orchestrating multifaceted workflows, finance functions will become increasingly strategic, agile, and insight-driven.

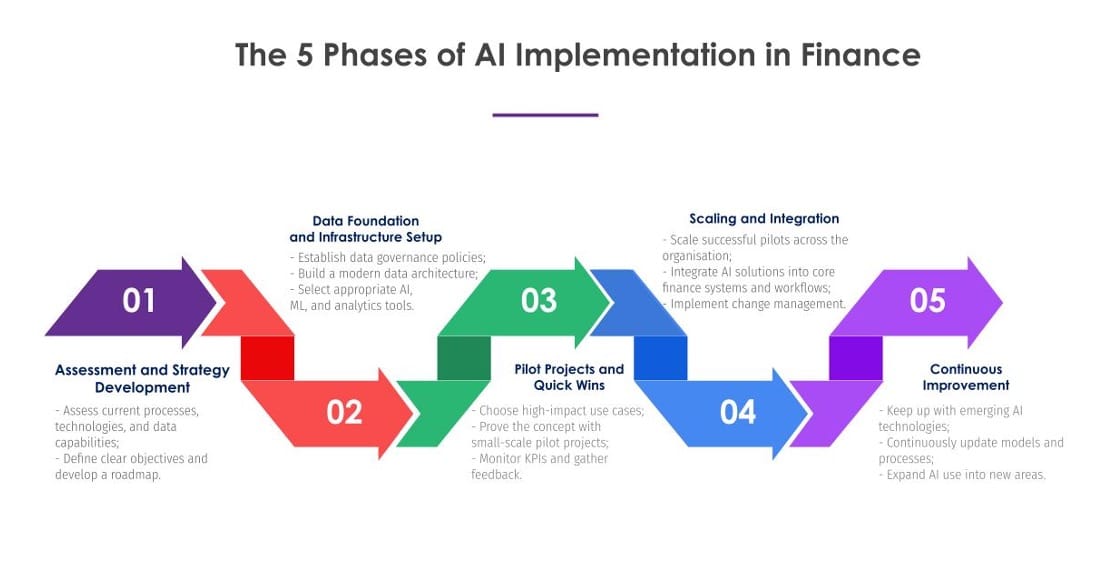

Visualizing AI's Financial Transformation

Relevant visuals could include:

-

Diagrams illustrating the levels of agentic AI in finance workflows, from simple information retrieval to multi-agent orchestration.

-

Infographics showing the growth of AI skills in finance teams and the expanding applications of AI in budgeting, forecasting, and compliance.

-

Photos or logos of companies leading AI adoption in finance, such as Sprinklr or SAP, highlighting leadership driving transformation.

AI's transformation of finance is a gradual yet irreversible journey, moving finance from traditional number-crunching to a future defined by intelligent agents, real-time insights, and strategic foresight. While challenges remain, the integration of AI continues to accelerate, promising a more agile and proactive financial landscape by 2026 and beyond.