Analyst Warns of Growing AI Bubble Risk Amid Market Surge

Analyst warns of AI bubble risk as stock valuations surge, echoing past tech bubbles. Investors urged to exercise caution amid market enthusiasm.

AI Bubble Risk Rises, Warns Veteran Market Analyst

A growing chorus of financial experts is sounding the alarm over the potential for an AI bubble in global markets, with one prominent stock-market bull recently highlighting a chart that underscores the mounting risks. The warning comes amid a surge in investment and speculation surrounding artificial intelligence technologies, particularly in the wake of breakthroughs from companies like Nvidia, Microsoft, and Google. The chart, cited by MarketWatch, illustrates how valuations and investor enthusiasm for AI-related stocks have reached levels reminiscent of previous tech bubbles, raising concerns about a possible market correction.

Chart Signals Growing AI Bubble Risk

The chart referenced by the analyst tracks the performance of leading AI-focused companies and compares their price-to-earnings ratios, market capitalizations, and investor sentiment against historical benchmarks. It reveals a sharp uptick in valuations over the past 18 months, with many AI stocks trading at multiples far above their long-term averages. For example, Nvidia’s market cap has soared to over $2 trillion in 2025, driven by its dominance in AI chips, while other AI-centric firms have seen similar meteoric rises.

Why the Bubble Fears Are Mounting

Several factors are fueling concerns about an AI bubble:

- Speculative Investment: Retail and institutional investors are pouring money into AI startups and publicly traded companies, often based on future potential rather than current earnings.

- Valuation Disconnect: Many AI companies are valued at levels that far exceed their revenue or profit generation, echoing the dot-com bubble of the early 2000s.

- Media Hype: The relentless media coverage of AI breakthroughs and “next big thing” narratives is amplifying investor excitement and driving up prices.

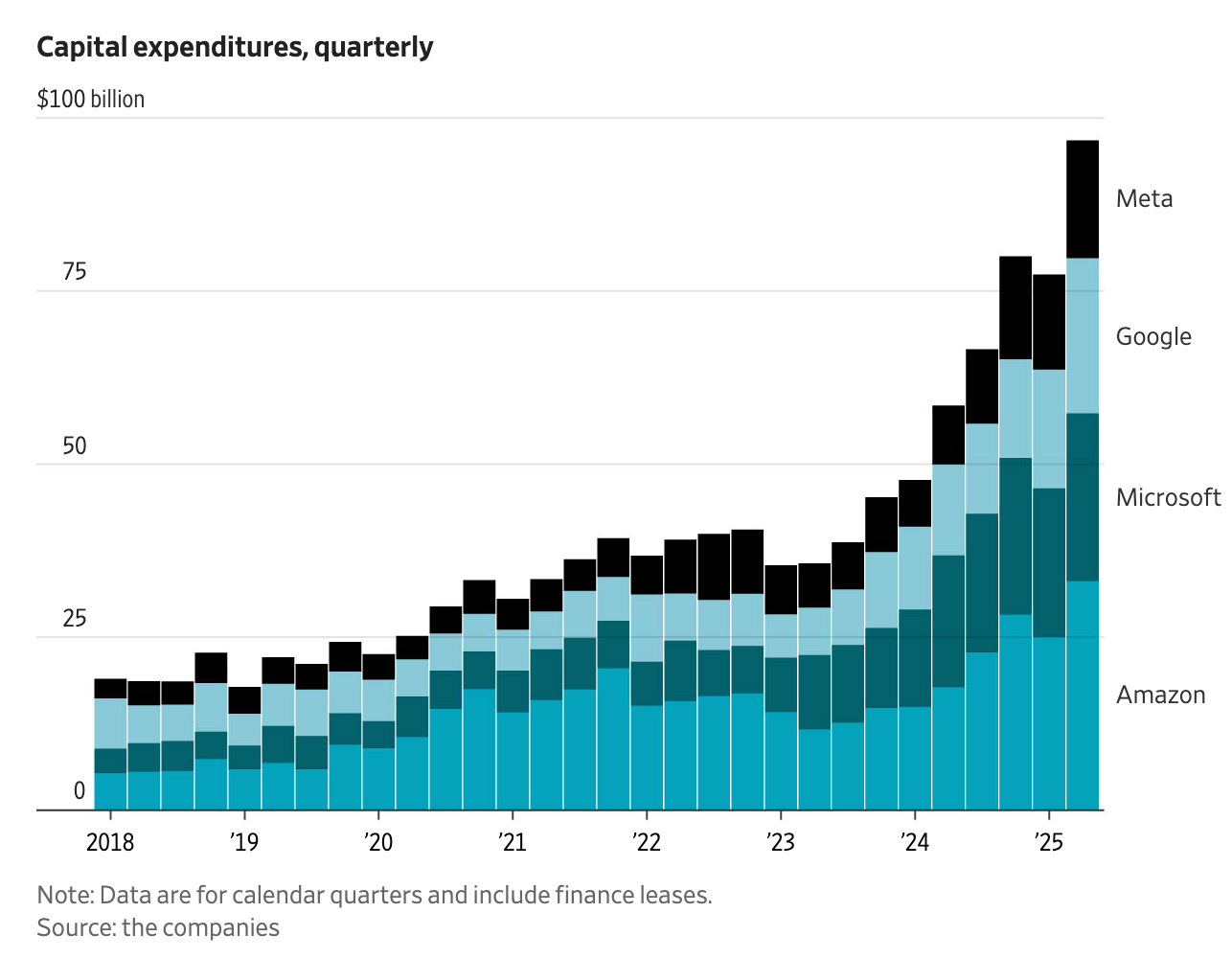

- Market Concentration: A handful of companies—Nvidia, Microsoft, Alphabet, and Meta—dominate the AI sector, making the market vulnerable to shocks if any one of them falters.

Expert Opinions and Historical Parallels

Veteran market bulls, typically known for their optimism, are now expressing caution. One such analyst, who has a long history of bullish calls, stated that the current AI rally “bears an uncanny resemblance to the dot-com bubble,” warning that “when valuations get this stretched, the risk of a sharp correction increases.”

Historical parallels are hard to ignore. During the dot-com era, investors bid up internet stocks to unsustainable levels, leading to a crash that wiped out trillions in market value. Similarly, the rapid rise of AI stocks—many of which are not yet profitable—has raised red flags among financial professionals.

Industry Impact and Broader Implications

The potential bursting of an AI bubble could have wide-ranging consequences:

- Market Volatility: A sharp decline in AI stock prices could trigger broader market sell-offs, affecting investor confidence and retirement portfolios.

- Tech Sector Slowdown: Companies relying on AI funding may face difficulties raising capital, slowing innovation and growth.

- Regulatory Scrutiny: Governments and regulators may step in to impose stricter oversight on AI investments and disclosures.

Despite these risks, many experts stress that AI remains a transformative technology with long-term potential. The challenge lies in distinguishing between genuine innovation and speculative excess.

What Investors Should Watch

- Valuation Metrics: Monitor price-to-earnings ratios, revenue growth, and profit margins for AI companies.

- Market Sentiment: Track investor enthusiasm and media coverage for signs of overheating.

- Regulatory Developments: Stay informed about new rules and guidelines for AI investments.

Conclusion

The risk of an AI bubble is growing, as evidenced by soaring valuations and heightened investor enthusiasm. While AI technology holds immense promise, the current market dynamics echo past bubbles, underscoring the need for caution and due diligence. Investors, regulators, and industry leaders must remain vigilant to ensure that the AI revolution is built on solid foundations, not speculative frenzy.