Banking Sector Signals AI Productivity Gains Amid Job Displacement Concerns

Major US banks acknowledge artificial intelligence will drive productivity improvements while simultaneously reducing workforce requirements, highlighting the dual nature of AI adoption in financial services.

Banking Sector Signals AI Productivity Gains Amid Job Displacement Concerns

Major US banks are publicly acknowledging a paradox at the heart of artificial intelligence adoption: while AI technologies promise substantial productivity enhancements, they will inevitably lead to workforce reductions across the financial services industry. This dual narrative reflects the complex reality facing institutions as they accelerate digital transformation initiatives.

The Productivity Promise

Financial institutions have consistently emphasized AI's capacity to streamline operations and improve efficiency. Machine learning algorithms can process vast datasets in seconds, identify patterns that human analysts might miss, and automate routine tasks that currently consume significant labor hours. Banks view these capabilities as essential competitive advantages in an increasingly digital marketplace.

The productivity gains extend across multiple business functions:

- Risk Assessment: AI models can evaluate credit applications and detect fraudulent transactions with greater speed and accuracy than traditional methods

- Customer Service: Chatbots and virtual assistants handle routine inquiries, freeing human representatives for complex issues

- Data Analysis: Automated systems process market data and generate insights for trading and investment decisions

- Compliance: Machine learning tools monitor transactions for regulatory violations more comprehensively than manual reviews

These improvements translate directly to operational cost reductions and enhanced service delivery—outcomes that appeal to shareholders and customers alike.

The Employment Reckoning

However, banking executives have begun openly discussing the employment implications of this technological shift. As AI systems assume responsibilities previously handled by human workers, demand for certain job categories will contract. Administrative roles, data entry positions, and routine analytical functions face particular vulnerability.

The challenge extends beyond simple job elimination. The nature of work itself is transforming. Positions that survive will increasingly require workers to collaborate with AI systems rather than perform independent tasks. This shift demands new skill sets and continuous retraining—a burden that falls on both employees and institutions.

Industry Context

The banking sector's candid assessment reflects broader trends across financial services. As institutions compete for market share and profitability, those that successfully integrate AI gain measurable advantages. Competitors face pressure to adopt similar technologies or risk falling behind, creating an industry-wide acceleration of AI deployment regardless of employment consequences.

This dynamic differs markedly from previous technological transitions. Unlike earlier automation waves that unfolded over decades, AI adoption is compressing timelines significantly. Workers and institutions have less time to adjust, adapt, and retrain.

Strategic Implications

Banks are beginning to address these challenges through workforce planning initiatives. Some institutions are investing in employee retraining programs, attempting to transition displaced workers into higher-value roles that complement AI systems. Others are implementing gradual deployment strategies to spread job impacts over longer periods.

The financial services industry's transparency about AI's employment effects—however reluctant—signals a shift in how corporations discuss automation. Rather than obscuring job losses behind efficiency metrics, major banks are acknowledging the human cost of technological progress, even as they pursue it aggressively.

Key Sources

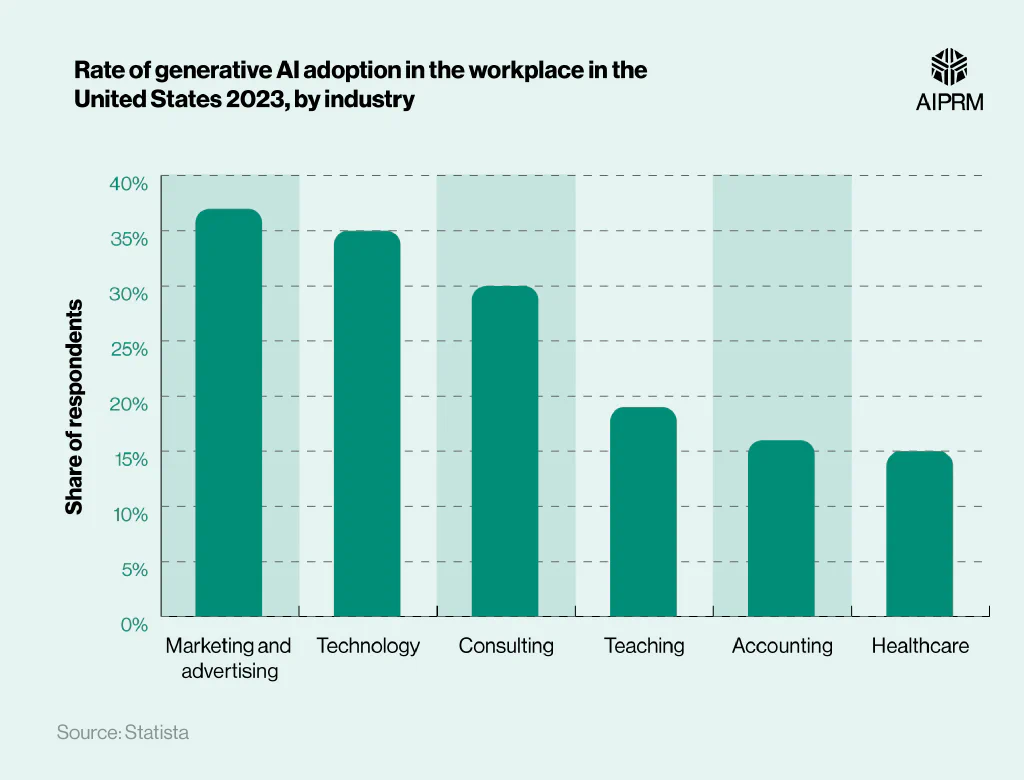

- AIPRM: 50+ AI Replacing Jobs Statistics 2024

- Graphaize: The Impact of AI on Jobs: A Visual Breakdown

- St. Thomas University: Generative AI's Real-World Impact on Job Markets