CFOs Leading the AI Revolution in Finance

CFOs are pivotal in driving AI adoption in finance, transforming roles and overcoming barriers to ensure competitive advantage in a data-driven era.

CFOs Leading the AI Revolution in Finance

Chief Financial Officers (CFOs) are rapidly emerging as pivotal figures in the adoption and integration of artificial intelligence (AI) across global finance organizations. Increasingly, CFOs are not just financial stewards but catalysts for digital transformation, according to insights from industry veterans and recent surveys. Their leadership is critical in overcoming cultural, operational, and technological barriers to AI adoption, ensuring that organizations remain competitive in a data-driven era.

The Evolution of the CFO Role

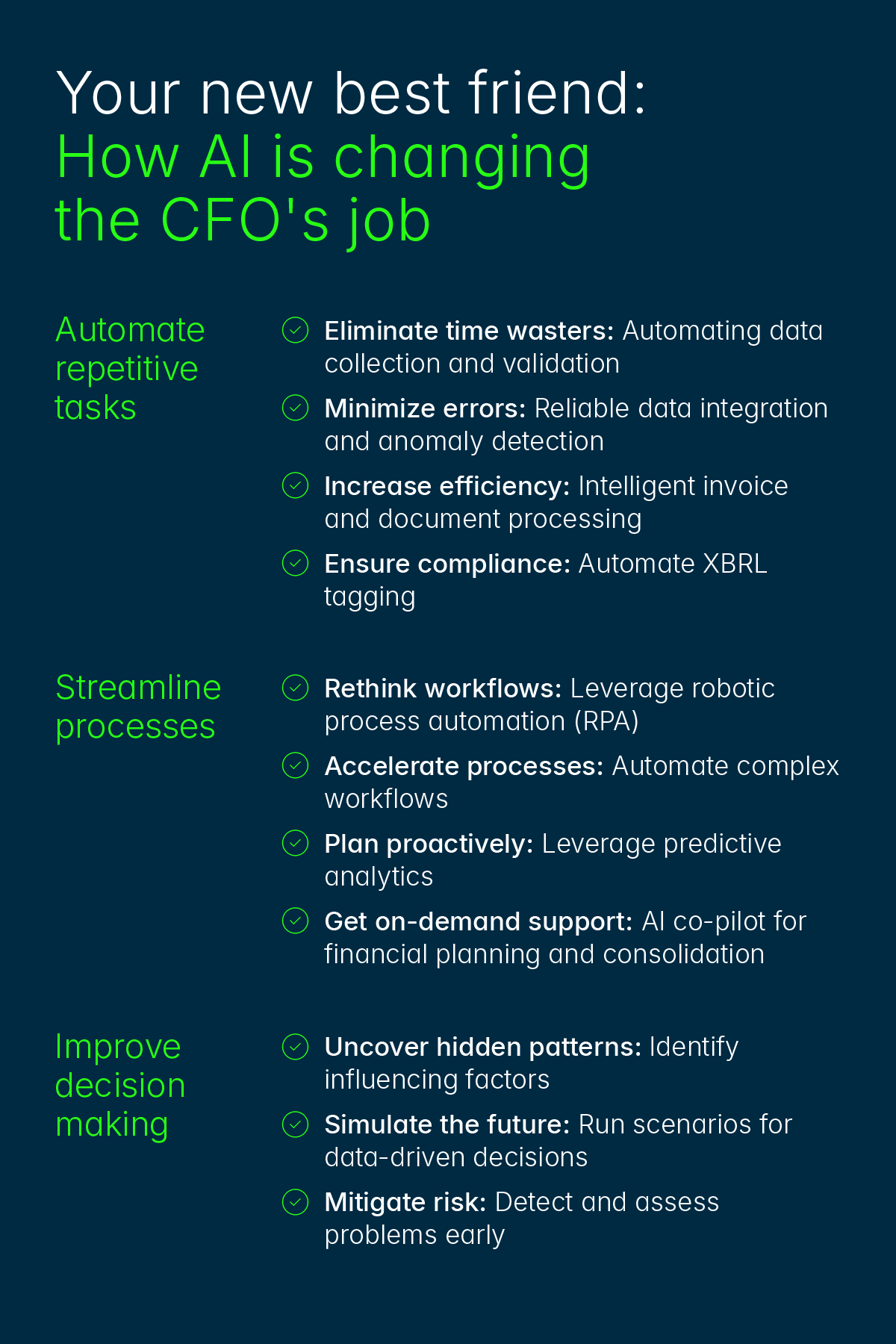

Traditionally, CFOs have been seen as guardians of financial integrity—ensuring compliance, controlling risk, and reporting accurately. However, the rapid advancement of AI is redefining their responsibilities. Today’s CFOs are expected to lead AI strategy, define budgets for digital transformation, and foster a culture that embraces innovation. This shift is not just about technology; it’s about changing mindsets across the finance function and the broader organization.

A 2025 MindBridge CFO AI Adoption Survey highlights that AI is no longer a future opportunity but a present-day competitive advantage. Leading CFOs are already investing in AI-driven analytics, automation, and machine learning to enhance forecasting, detect anomalies, and optimize resource allocation. These investments are delivering measurable results, including improved accuracy, faster decision-making, and reduced operational costs.

Overcoming Barriers to AI Adoption

Despite the enthusiasm, the journey toward AI maturity is not without challenges. A significant portion of finance leaders—30% in the early stages of AI adoption—struggle to justify the return on investment (ROI) for AI initiatives, compared to only 21% of those further along the AI journey. Deloitte recommends that CFOs take a holistic view of AI’s value, considering not just financial metrics but also trust, organizational sentiment, and long-term strategic impact.

Key barriers include:

- Cultural resistance: Shifting from a risk-averse, compliance-focused mindset to one that embraces experimentation and data-driven decision-making.

- Talent gap: The need for finance teams to acquire new technical skills in data analysis, AI, and automation. Nearly two-thirds (64%) of finance departments plan to add more technical talent by 2026, prioritizing AI and data integration.

- Integration complexity: Ensuring AI tools work seamlessly with existing financial systems and processes.

The Strategic Imperative for CFOs

CFOs are uniquely positioned to bridge the gap between finance and technology. Marie Myers, a prominent CFO, emphasizes that AI is being used to empower teams to become strategic partners, leveraging data and technology to drive enterprise-wide value. This requires CFOs to:

- Champion AI at the executive level: Advocate for AI investments and align them with corporate strategy.

- Foster cross-functional collaboration: Work closely with IT, data science, and business units to ensure AI initiatives deliver tangible benefits.

- Measure and communicate impact: Develop new KPIs that reflect the value of AI beyond cost savings, such as improved forecasting accuracy, risk mitigation, and enhanced stakeholder trust.

Industry Impact and Future Outlook

The transformation driven by CFOs is reshaping the finance function. Companies that successfully integrate AI are seeing not only operational efficiencies but also enhanced strategic capabilities. For example, AI-powered analytics enable real-time insights into cash flow, risk exposure, and market trends, allowing CFOs to act as proactive advisors to the CEO and board.

The demand for AI skills among finance professionals is expected to grow exponentially. Organizations are prioritizing upskilling programs and hiring tech-savvy talent to keep pace with innovation. Moreover, AI is becoming a key solution for addressing talent shortages, automating routine tasks, and freeing up finance professionals to focus on higher-value activities.

Context and Implications

The centrality of CFOs in the AI mindset shift reflects a broader trend in business leadership. As organizations navigate digital disruption, CFOs must balance their traditional roles with new responsibilities as innovation leaders. This dual mandate requires not only technical acumen but also strong change management skills and a forward-looking vision.

The implications are profound:

- Competitive differentiation: Companies with AI-empowered finance functions gain a decisive edge in agility, insight, and resilience.

- Risk management: Enhanced analytics and automation improve the ability to detect fraud, manage compliance, and anticipate financial risks.

- Organizational culture: Successful AI adoption depends on fostering a culture of continuous learning, collaboration, and adaptability.

Conclusion

CFOs are no longer just the guardians of financial integrity—they are the catalysts for the AI-driven transformation of finance. By leading the charge on AI adoption, CFOs are enabling their organizations to harness data, automate processes, and deliver strategic value at scale. The journey is complex, but the rewards for those who embrace this new role are substantial, positioning their companies for sustained success in an increasingly digital world.