Chinese AI Leaders MiniMax and Zhipu Target Hong Kong IPOs in Major Tech Expansion

Two of China's most promising AI unicorns, MiniMax and Zhipu, are preparing for initial public offerings in Hong Kong, marking a pivotal moment for the country's generative AI sector and signaling investor confidence in homegrown AI innovation.

Chinese AI Unicorns Chart Course for Hong Kong Public Markets

Two of China's most promising artificial intelligence startups, MiniMax and Zhipu, are preparing for initial public offerings in Hong Kong, marking a significant inflection point for the country's generative AI sector. The move underscores growing investor appetite for Chinese AI innovation and represents a major capital-raising opportunity for companies that have rapidly gained prominence in the competitive generative AI landscape.

The Strategic Importance of Hong Kong Listings

Hong Kong's status as a global financial hub makes it an attractive venue for Chinese tech companies seeking international capital and credibility. For MiniMax and Zhipu, a Hong Kong IPO offers several strategic advantages:

- Access to global capital markets without the regulatory complexities of US listings

- Enhanced international visibility among institutional investors and enterprise clients

- Proximity to Asia-Pacific markets where both companies have growing user bases

- Regulatory clarity in a jurisdiction familiar with Chinese tech sector dynamics

Both companies have demonstrated strong product-market fit and user growth, positioning them as serious contenders in the generative AI space dominated by OpenAI and other Western players.

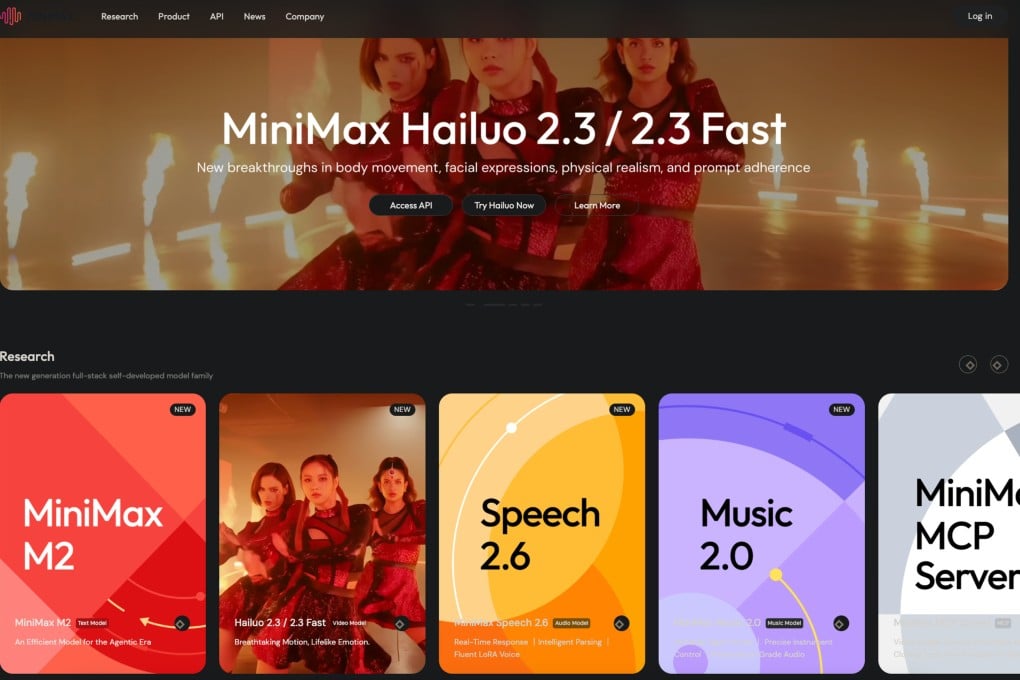

MiniMax: From Consumer Apps to Enterprise Solutions

MiniMax has built a diverse portfolio spanning consumer applications and enterprise AI solutions. The company's reach extends internationally, with successful products gaining traction in Western markets. The company's ability to serve both consumer and B2B segments provides multiple revenue streams and demonstrates operational versatility.

For practitioners evaluating AI platforms, MiniMax's approach offers flexibility across use cases. The company has invested heavily in model optimization and inference efficiency, making its solutions accessible to organizations with varying computational budgets.

Zhipu's Competitive Positioning

Zhipu has carved out a distinct niche in the Chinese AI ecosystem with its focus on large language models and enterprise applications. The company's technical capabilities and partnerships position it well for monetization through API access, enterprise licensing, and custom model development.

Practitioners considering Zhipu's offerings benefit from:

- Robust Chinese language capabilities optimized for local market needs

- Enterprise-grade infrastructure designed for production deployments

- Integration pathways with existing Chinese tech ecosystems

- Competitive pricing models targeting mid-market and enterprise segments

Market Implications and Investor Sentiment

The timing of these IPO preparations reflects broader confidence in China's AI sector despite geopolitical uncertainties. Both companies have secured significant venture funding and demonstrated sustainable business models, reducing execution risk for public market investors.

The IPO announcements also signal that Chinese AI companies are moving beyond the initial hype phase into mature, revenue-generating operations. This maturation is critical for long-term sector credibility and attracts investors seeking exposure to AI infrastructure and applications.

Practical Considerations for Enterprise Adoption

For organizations evaluating Chinese AI platforms, these IPO preparations offer important signals. Public company status typically brings:

- Enhanced financial transparency and governance standards

- Greater resources for product development and customer support

- Improved long-term viability and stability

- Stronger incentives for regulatory compliance and data security

As both MiniMax and Zhipu prepare for public markets, their focus on enterprise integrations, API accessibility, and pricing transparency will likely intensify. This competitive pressure benefits practitioners by driving innovation and improving service quality across the sector.

Key Sources

- Hong Kong Standard: "China AI unicorns MiniMax, Zhipu aim for Hong Kong IPOs soon"

- South China Morning Post: "China's generative AI tiger MiniMax pursues Hong Kong IPO"

The Hong Kong IPO pipeline for Chinese AI companies represents a watershed moment for the sector, combining capital access with international credibility as these companies scale toward global prominence.