Intel's Breakthrough: Microsoft’s Maia 2 AI Chip on 18A Node (2025 Insight)

Intel partners with Microsoft to manufacture the Maia 2 AI processor on the advanced 18A node, marking a significant milestone in AI hardware.

Breaking: Intel Foundry to Manufacture Microsoft’s Next-Gen Maia 2 AI Processor

Intel Foundry has reportedly secured a major contract to manufacture Microsoft’s next-generation Maia 2 artificial intelligence (AI) processor using its advanced 18A/18A-P process node, according to industry sources cited by Tom’s Hardware. This partnership marks a significant milestone for Intel’s foundry ambitions and signals a potential long-term collaboration between two of the world’s largest technology companies in the race for AI hardware supremacy.

Background

- Intel Foundry Services (IFS) is Intel’s contract chip manufacturing division, aiming to compete with industry leaders TSMC and Samsung in producing chips for external clients.

- Microsoft has been investing heavily in custom AI silicon, following its earlier Maia 100 processor, to power its Azure cloud infrastructure and AI services.

- The 18A/18A-P node represents Intel’s most advanced manufacturing technology, promising higher performance, lower power consumption, and greater transistor density compared to previous generations.

The Deal and Its Significance

- Contract Details: While exact financial terms remain undisclosed, the agreement covers the production of Microsoft’s Maia 2 AI accelerator, a chip designed specifically for training and running large-scale AI models.

- Strategic Move: For Intel, this is a crucial win in its bid to regain leadership in semiconductor manufacturing. For Microsoft, partnering with a U.S.-based foundry aligns with broader supply chain resilience and geopolitical strategies.

- Technical Edge: The 18A/18A-P process is expected to deliver significant improvements in power efficiency and compute density, critical for AI workloads that demand both performance and energy savings.

Industry Context

The AI hardware market is undergoing rapid transformation, with cloud providers like Microsoft, Google, and Amazon developing proprietary chips to reduce reliance on general-purpose GPUs from Nvidia and AMD. This shift is driven by the unique requirements of generative AI, large language models, and other advanced workloads that benefit from custom architectures and tight integration with cloud platforms.

- Custom Silicon Trend: Major cloud providers are increasingly designing their own AI accelerators to optimize performance, cost, and energy use for specific workloads.

- Foundry Competition: Intel’s ability to attract a marquee client like Microsoft underscores its progress in process technology and foundry services, challenging TSMC’s dominance.

- Geopolitical Factors: The partnership may also reflect a broader trend toward regionalizing semiconductor supply chains, especially in the U.S. and Europe, amid ongoing global tensions.

Technological Implications

- Process Leadership: The 18A/18A-P node is Intel’s answer to TSMC’s 2nm-class processes, featuring innovations like RibbonFET transistors and PowerVia backside power delivery.

- AI Performance: Maia 2, built on this node, is expected to deliver substantial gains in AI training and inference speeds, enabling more complex models and faster response times for Azure AI services.

- Ecosystem Impact: Success with Maia 2 could encourage other cloud and enterprise clients to consider Intel Foundry for their custom silicon needs, accelerating the diversification of the global semiconductor supply chain.

Challenges and Risks

- Execution Risk: Intel has faced delays and technical challenges in ramping up new process nodes in the past. Delivering 18A/18A-P on schedule and at scale will be critical.

- Competitive Pressure: TSMC and Samsung continue to advance their own technologies, and both have extensive experience in high-volume manufacturing for leading-edge clients.

- Market Dynamics: The AI accelerator market is highly competitive, with rapid innovation cycles and shifting customer requirements.

What’s Next

- Product Rollout: Microsoft is expected to deploy Maia 2-powered systems in its Azure data centers, supporting next-generation AI applications and services.

- Partnership Expansion: If initial production meets expectations, the collaboration could expand to include additional custom chips for Microsoft’s growing portfolio of AI and cloud infrastructure.

- Industry Watch: The semiconductor industry will closely monitor yield rates, performance benchmarks, and time-to-market for Maia 2 as indicators of Intel’s foundry competitiveness.

Visuals to Include

- Official Intel Foundry and Microsoft logos (from company press kits or investor relations pages)

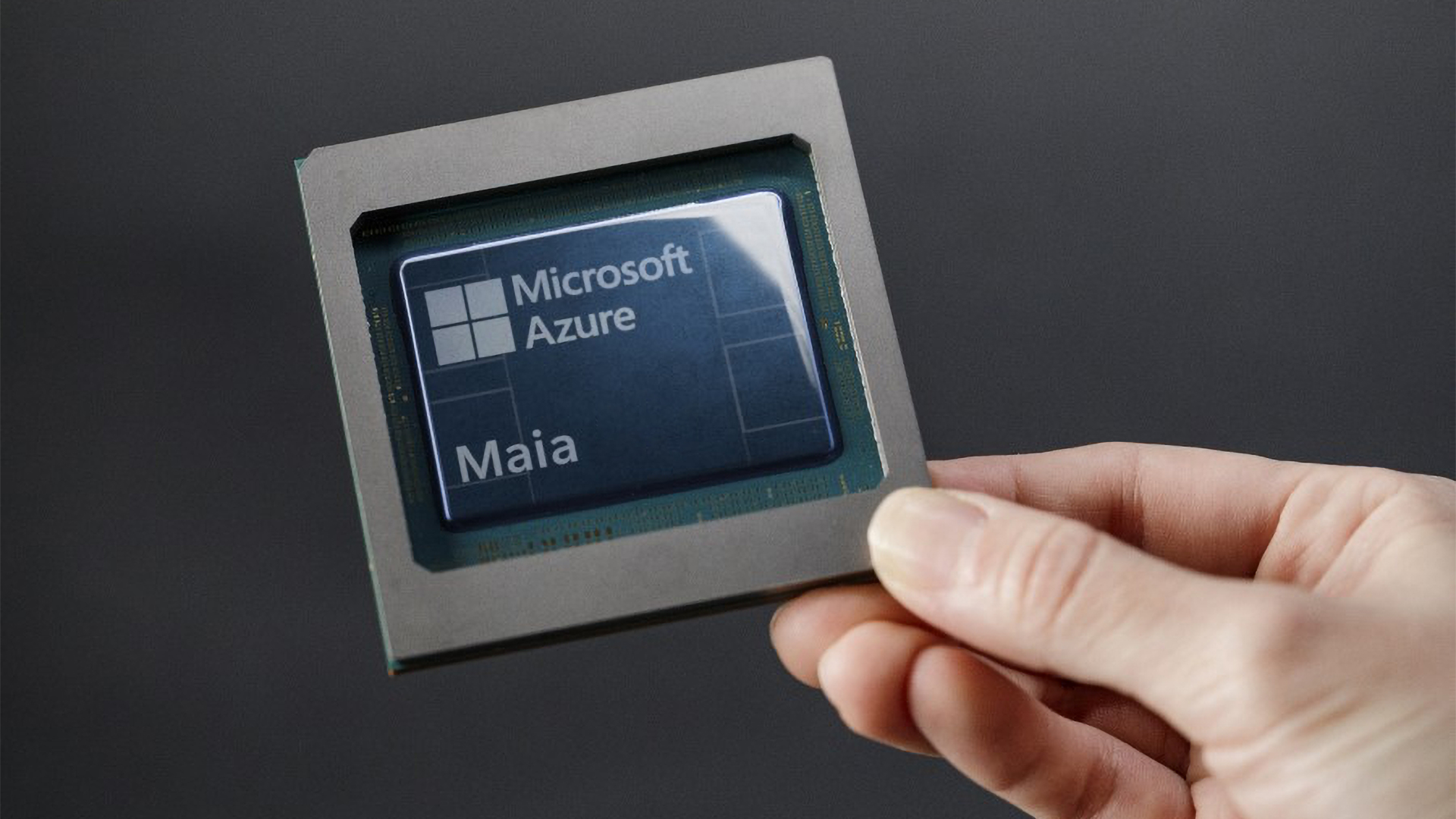

- Rendering or die shot of the Maia 2 AI accelerator (if available from Microsoft or Intel announcements)

- Infographic comparing 18A/18A-P node features with competing nodes from TSMC and Samsung

- Photos of key executives (e.g., Intel CEO Pat Gelsinger, Microsoft Azure hardware lead) at signing ceremonies or industry events

- Data center imagery highlighting AI server racks and Azure infrastructure

Conclusion

The Intel-Microsoft Maia 2 deal represents a pivotal moment in the AI hardware arms race, combining Microsoft’s software and cloud expertise with Intel’s renewed focus on leading-edge semiconductor manufacturing. If successful, this partnership could reshape the competitive landscape for AI accelerators, reduce reliance on a single foundry provider, and accelerate innovation in a critical sector of the global economy. The coming months will reveal whether Intel can deliver on its promise and whether Microsoft’s bet on custom silicon will pay off in the era of generative AI.

For the latest images, search for “Intel Foundry Microsoft Maia 2 announcement,” “Maia 2 AI processor die shot,” and “18A process node infographic” on reputable tech news sites, company press releases, and official social media channels. Always verify image rights and usage permissions before publication.