Leopold Aschenbrenner: AI Visionary and Financial Maverick

Leopold Aschenbrenner's journey from AI researcher to hedge fund leader reshapes tech and finance, influencing Silicon Valley and Washington.

Leopold Aschenbrenner: AI Visionary and Financial Maverick

Leopold Aschenbrenner, a 23-year-old former OpenAI researcher, has rapidly become one of the most influential figures at the intersection of artificial intelligence, finance, and policy. In just a few years, he has pivoted from academic research into building a $1.5 billion (and growing) hedge fund, Situational Awareness, while his sweeping manifesto on the future of AI has reshaped debates in Silicon Valley and Washington alike. His journey—from academic prodigy to controversial insider, and now to AI-powered financier—offers a case study in how technical foresight, entrepreneurial hustle, and geopolitical urgency can converge in the age of artificial general intelligence (AGI).

Background: The Making of an AI Prodigy

Born and raised in Germany, Aschenbrenner attended the John F. Kennedy School in Berlin before graduating as valedictorian from Columbia University at age 19 in 2021. His early academic focus was on AI alignment—the challenge of ensuring advanced AI systems act in accordance with human values—a field he pursued at Oxford’s Global Priorities Initiative and later at OpenAI.

Aschenbrenner’s rise accelerated in 2023 when he joined OpenAI’s “Superalignment” team, a high-profile group tasked with solving the hardest problems in AI safety as models grew more powerful. There, he gained a reputation for both technical acumen and a willingness to challenge institutional norms. Colleagues noted his “instinct to act”—pushing projects like watermarking AI-generated text to increase transparency—even when others hesitated.

However, his tenure at OpenAI ended abruptly in April 2024 amid allegations of an information leak, which Aschenbrenner disputes, claiming he only shared a brainstorming document. The incident coincided with internal tensions and the eventual dissolution of the Superalignment team, marking a turning point in his career.

The Viral Manifesto: “Situational Awareness”

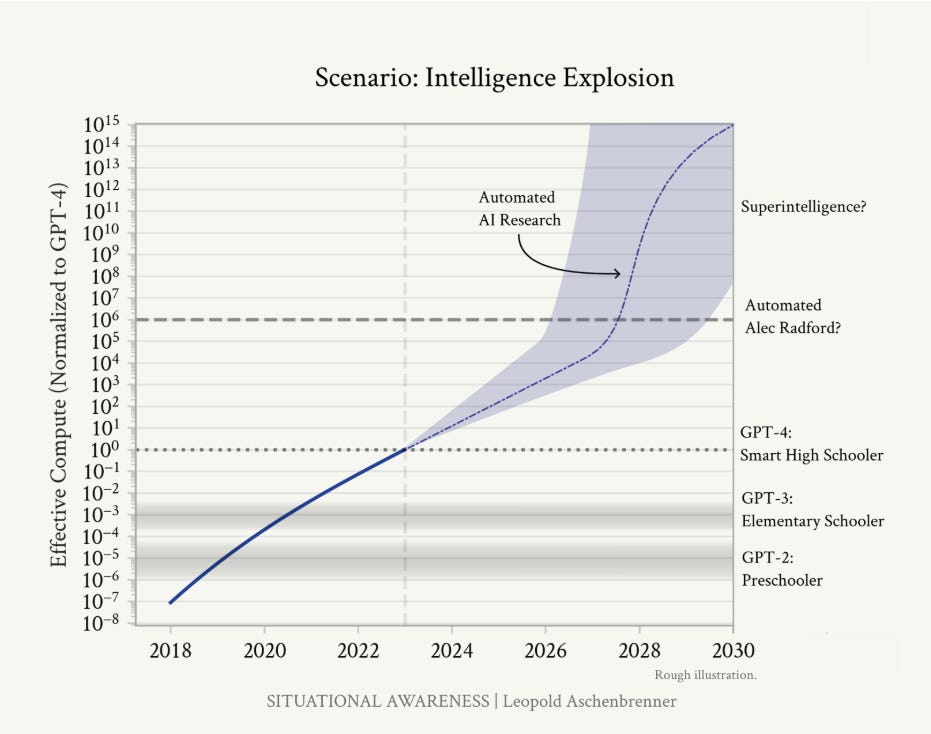

Aschenbrenner’s breakout moment came with the publication of his essay, Situational Awareness: The Decade Ahead, in 2024. The document, self-published and later expanded into a book, offered a bold, insider’s forecast of AI’s trajectory: rapid capability gains, driven by scaling laws and compute breakthroughs, could lead to superintelligence within a decade, with profound and potentially destabilizing geopolitical consequences.

The manifesto struck a nerve. Tech founders and investors circulated it urgently, while policymakers and national security officials treated it as a classified briefing. Aschenbrenner argued that the U.S. must treat AGI development as a matter of national survival, preparing not just for economic disruption but for existential risks. His core thesis: foresight, policy, and engineering must converge to navigate what he calls “the most consequential decade in human history.”

From Prophecy to Profit: The Birth of Situational Awareness Fund

Capitalizing on the attention, Aschenbrenner co-founded the Situational Awareness hedge fund in late 2024, partnering with prominent tech investors Patrick and John Collison, Daniel Gross, and Nat Friedman. The fund, named after his essay, quickly amassed over $1.5 billion in assets under management and, as of mid-2025, reportedly exceeds $2 billion.

The fund’s strategy is as distinctive as its origins. Leveraging Aschenbrenner’s expertise in AI, it seeks to identify both winners and losers in the AI revolution, making concentrated bets on semiconductor companies poised to benefit from the AI boom while hedging against those likely to be disrupted. For example, the fund holds major positions in select chipmakers but has also taken a significant short position against the broader semiconductor industry via put options on the VanEck Semiconductor ETF (SMH). This contrarian approach reflects a belief that AI will create massive opportunities for some firms while rendering others obsolete.

Influence Beyond Finance: A Voice in Policy and Culture

Aschenbrenner’s impact extends far beyond asset management. His ideas have rippled through Silicon Valley boardrooms and the halls of Washington, framing AGI not just as a technological challenge but as a geopolitical imperative. Critics, however, question whether his rhetoric repackages insider safety concerns into an investment thesis, blurring the line between prophecy and promotion.

Regardless, Aschenbrenner’s narrative has become a touchstone for debates on AI governance, national security, and the ethics of acceleration. His call for urgent preparation—both technological and institutional—has resonated with those who see AI as the defining issue of the century.

Context and Implications

Aschenbrenner’s trajectory underscores several broader trends:

- The Rise of the AI-Investor Hybrid: Technical experts are increasingly moving into finance, using their domain knowledge to identify asymmetric opportunities in rapidly evolving markets.

- The Power of Narrative in Tech: A well-articulated vision can galvanize both capital and policy, especially when paired with actionable investment vehicles.

- The Geopoliticization of AI: As AI capabilities advance, the stakes for national security and economic competitiveness grow, drawing figures like Aschenbrenner into the spotlight.

- The Tension Between Safety and Speed: Aschenbrenner’s story highlights the unresolved tension between the desire to accelerate AI progress and the imperative to manage its risks—a tension that tore apart OpenAI’s Superalignment team and continues to shape industry dynamics.

Conclusion

Leopold Aschenbrenner’s journey—from OpenAI’s inner circles to the helm of a multibillion-dollar AI hedge fund—exemplifies how technical insight, narrative power, and entrepreneurial ambition are reshaping the frontiers of both technology and finance. His story is more than a personal success; it is a lens through which to view the converging forces of AI, capital, and geopolitics in the 2020s. Whether his bets on AGI pay off remains to be seen, but his influence on the discourse—and the dollars flowing into AI—is already undeniable.