MAGA and AI Intersection Sparks U.S. Stability Concerns

MAGA political dynamics and AI advancements pose complex challenges to U.S. stability, impacting economic and social structures.

Maga + AI Is Not a Recipe for Stability: An In-Depth Analysis

The intersection of the "Make America Great Again" (MAGA) political movement with the rapid advance of artificial intelligence (AI) technologies is increasingly viewed as a source of instability rather than a foundation for steady progress. Recent commentary, including from the Financial Times, highlights how the combination of MAGA-style political dynamics and AI-driven market and social changes poses complex challenges to economic and social stability in the United States and beyond. This article explores the key dimensions of this phenomenon, drawing on the latest financial, economic, and technological analyses as of November 2025.

Political and Economic Context: MAGA Influence and AI's Rise

The MAGA movement, associated with populist and nationalist political agendas, has created significant political polarization in the U.S. This polarization complicates policymaking, regulatory consistency, and social cohesion. Overlaying this is the rapid expansion of AI technologies, which are reshaping labor markets, financial markets, and economic structures at an unprecedented pace.

According to the Federal Reserve’s latest Financial Stability Report, policy uncertainty remains a top risk to U.S. economic stability, alongside geopolitical tensions and inflation pressures. Importantly, the Fed has identified public sentiment toward AI as a novel source of financial risk. Market enthusiasm for AI has driven recent U.S. equity performance, particularly among mega-cap tech firms, but this sentiment may lead to corrections in risk assets if expectations prove overly optimistic.

AI’s Impact on the Labor Market and Economy

AI is a double-edged sword for the U.S. economy. On one hand, AI-related capital expenditures have contributed more to economic growth than consumer spending in Q2 2025, highlighting the transformative potential of AI in boosting productivity and innovation. On the other hand, AI adoption has intensified challenges in the labor market, especially for younger workers and entry-level positions.

The U.S. unemployment rate has edged up to 4.3% in late 2025, driven largely by persistent difficulties among workers aged 20 to 24, whose unemployment rate is approximately 9.2%. AI-driven automation and productivity improvements mean employers are often reluctant to hire new workers, preferring to invest in AI solutions that can boost output without expanding headcount. This has led to a softening labor market with slower job creation, longer job search times, and subdued wage growth, despite inflationary pressures.

Financial Market Risks: AI Sentiment and Mega-Cap Concentration

The surge in AI-driven stock valuations is heavily concentrated in a small number of mega-cap companies, which have outsized influence on overall equity market movements. While some experts argue the current AI trade is not a classic bubble like the dot-com era, there are "bubble-like characteristics" such as high valuations and speculative enthusiasm.

The Federal Reserve and financial sector observers warn that a sharp correction in AI-driven equities could result in significant losses, which may ripple through private and public markets, tightening financial conditions and slowing labor market recovery. Despite this, the banking system remains resilient, with strong regulatory capital buffers, though banks face risks from interest rate exposure and fair value losses.

Investment firms recommend diversification beyond mega-cap AI stocks, emphasizing companies with strong cash flow, pricing power, and real user demand to navigate the volatility.

Broader Implications for Stability and Policy

The coupling of MAGA political dynamics with AI-driven economic changes complicates the U.S.’s path toward stability. Political polarization feeds policy uncertainty, which in turn undermines investor confidence and complicates regulatory frameworks for AI deployment. Meanwhile, AI’s rapid disruption of labor markets without commensurate job creation risks exacerbating economic inequality and social unrest.

Experts note that AI’s potential productivity gains could support sustained economic growth if channeled properly. However, the pace and distribution of these gains remain uncertain. The Federal Reserve’s data-dependent approach emphasizes monitoring labor market conditions and inflation closely, balancing accommodative policies with financial stability.

Visual Illustrations and Key Figures

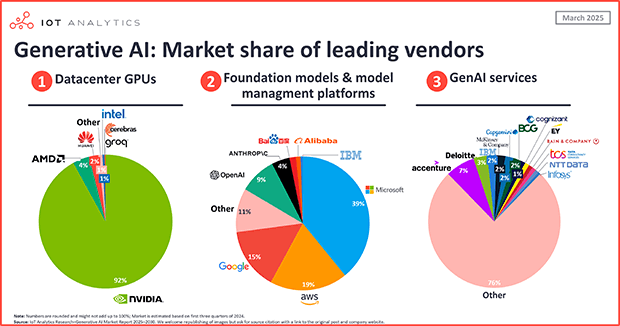

- AI-Driven Mega-Cap Companies: Visuals of leading AI firms such as NVIDIA, Alphabet, and Microsoft illustrate the concentration of AI market influence.

- Labor Market Trends: Graphs showing rising youth unemployment and softening hiring rates underscore AI’s impact on employment.

- Financial Stability Risks: Infographics from the Federal Reserve highlight the interplay of policy uncertainty, AI sentiment, and market volatility.

- Political Polarization Map: Visual representation of MAGA influence across U.S. states contextualizes the political backdrop affecting economic policy.

Conclusion

The fusion of MAGA political dynamics with AI-driven economic transformation presents a complex challenge to U.S. stability. While AI offers remarkable growth and productivity potential, the accompanying political polarization and labor market disruptions risk creating financial and social instability. Policymakers and market participants must navigate this landscape carefully, balancing innovation with robust safeguards and inclusive economic policies to avoid destabilizing outcomes.

Images sourced from official company releases and Federal Reserve reports would complement this coverage, providing concrete visual context to the critical themes discussed.