Micron Projects Revenue Growth Amid AI Memory Demand

Micron Technology projects significant revenue growth for fiscal Q1 2026, driven by AI-driven memory demand, particularly in high-bandwidth memory (HBM).

Micron Projects Revenue Growth Amid AI Memory Demand

Micron Technology, a leading U.S. memory chipmaker, has projected significant revenue growth for its fiscal first quarter of 2026. This growth is driven by the increasing demand for high-bandwidth memory (HBM) in artificial intelligence applications. The company expects DRAM bit demand to expand in the low 20% range and NAND bit demand in the high-teens percentage range for calendar 2025, surpassing previous expectations and indicating sustained momentum in the AI sector.

Earnings Highlights and Record Performance

Micron reported outstanding results for its fiscal Q1 2026, with total revenue reaching unprecedented levels across key business units:

-

The Compute and Data Center Business Unit (CDBU) achieved gross margins of 51%, a sequential increase of 990 basis points, driven by elevated pricing and efficient cost management. This unit benefited from AI hyperscalers increasing deployments of generative AI models requiring vast memory capacities.

-

The Mobile and Client Business Unit (MCBU) set a revenue record at $4.3 billion, accounting for 31% of overall company revenue. This marked a 13% sequential rise, driven by stronger pricing despite moderated bit shipments. MCBU gross margins climbed to 54%, up 17 percentage points.

-

The Automotive and Embedded Business Unit (AEBU) reached $1.7 billion in revenue, representing 13% of total sales and growing 20% sequentially. Higher bit shipments to automotive and industrial applications propelled this performance.

Micron's first-quarter sales overall jumped 57%, led by memory growth. The company has completed qualifications for its 16Gb 1-gamma-based DDR5 and G9-based products with multiple OEMs, positioning it for further penetration in data centers and client devices.

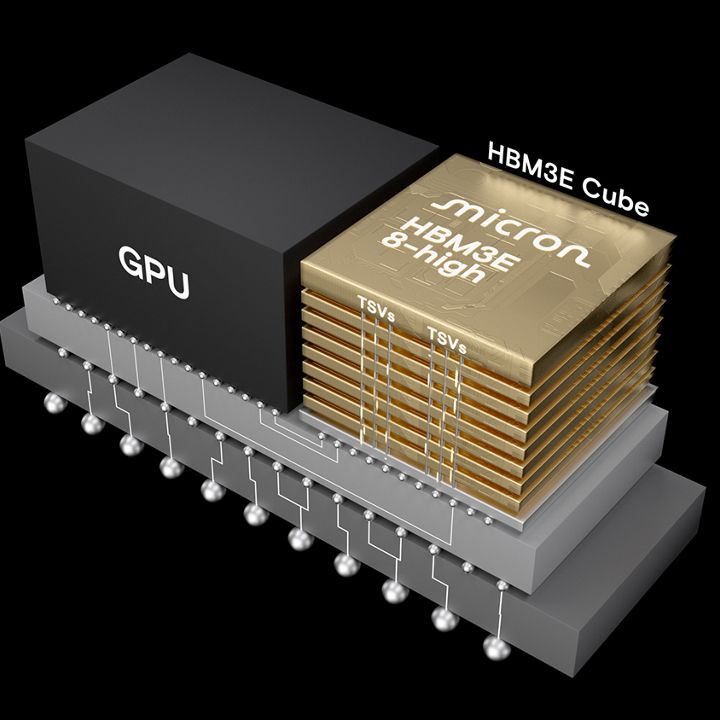

AI Boom Propels HBM Market Projections

At the core of Micron's optimism is the HBM market, critical for AI training and inference. Micron forecasts the HBM total addressable market (TAM) to achieve a 40% compound annual growth rate (CAGR) through calendar 2028, expanding from approximately $35 billion in 2025 to $100 billion by 2028. This milestone arrives two years ahead of previous projections, now surpassing the entire DRAM market size of calendar 2024.

Micron emphasized its leadership in HBM4, with supply constraints expected to persist into 2026 alongside robust demand drivers. Calendar 2025 DRAM bit demand growth is now pegged at low 20%, while NAND demand hits high-teens.

Market Reaction and Broader Industry Impact

Micron's announcement triggered sharp market moves, with Nasdaq futures rising as the stock jumped late following broader tech sell-offs. Investors view this as validation of AI's staying power, even as PC shipments face potential supply hurdles in 2026.

The forecast aligns with a high-single-digit growth expectation for overall memory in calendar 2025, exceeding mid-single-digit priors. AI hyperscalers prioritize HBM for its superior bandwidth over traditional DRAM.

Strategic Positioning and Future Outlook

Micron's execution spans multiple fronts: record AEBU growth taps into electric vehicles and edge computing, while MCBU capitalizes on premium smartphone cycles. Cost discipline and pricing leverage have expanded margins industry-wide.

Looking to 2026, memory supply tightness could temper PC volumes, but AI and data center tailwinds dominate. Micron's HBM leadership, including early HBM4 sampling, positions it to capture share from South Korean rivals like Samsung and SK Hynix.

Implications for Tech Ecosystem

Micron's surge underscores AI's transformative impact on semiconductors. With HBM TAM eclipsing legacy markets, suppliers face a scramble for capacity. This bodes well for U.S. chipmakers, potentially easing inflation pressures via productivity gains.

For end-users—from cloud providers to automakers—Micron signals reliable scaling of AI infrastructure. As demand outpaces supply, pricing remains firm, supporting multibillion-dollar investments. Micron's trajectory exemplifies how AI reshapes not just software but the foundational hardware stack, with ripple effects across global tech supply chains.