Micron's Strategic Leap in AI-Driven Memory Solutions

Micron Technology leads in AI-driven memory solutions with strategic HBM investments, enhancing its market position and financial performance.

Micron's Strategic Leap in AI-Driven Memory Solutions

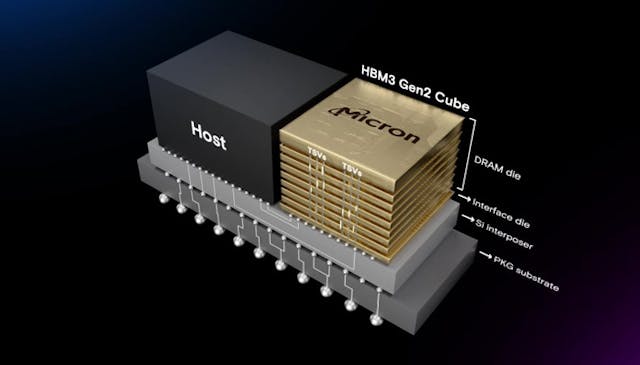

Micron Technology, a leading semiconductor company, is at the forefront of transforming the memory landscape with its strategic focus on High Bandwidth Memory (HBM), driven by the rapidly growing demand for Artificial Intelligence (AI) applications. As AI technologies continue to advance, the need for high-performance memory solutions has become critical, positioning Micron as a key player in this sector.

Background

Micron Technology, listed on NASDAQ under the ticker symbol MU, has been a significant force in the semiconductor industry for decades. However, its recent strategic investments in HBM have catapulted it to the center of the AI-driven memory revolution. HBM is a premium memory technology designed to support high-bandwidth applications such as AI computing, data centers, and high-performance computing systems. Its ability to provide high data transfer rates and low latency makes it an essential component for next-generation AI accelerators.

In recent years, Micron has aggressively expanded its HBM production to meet the surging demand from hyperscale data centers and AI-driven applications. By 2025, Micron aims to triple its HBM output to 60,000 wafers per month, reflecting its commitment to supporting the AI ecosystem. This expansion is part of a broader strategy to enhance supply chain resilience, including a $7 billion investment in a Singapore facility.

Key Features and Developments

HBM Expansion and Technological Advancements

-

HBM3e Chips: Micron's HBM3e chips are powering Nvidia’s Blackwell platforms, marking a significant milestone in its partnership with major AI hardware providers. This collaboration underscores Micron's ability to deliver high-performance memory solutions tailored to the needs of AI applications.

-

HBM4 Roadmap: Micron is developing HBM4, which promises to offer 2TB/s bandwidth and consume 20% less power compared to previous generations. This technological leap is expected to outpace competitors, further solidifying Micron's position in the market.

-

Supply Chain Resilience: The company's strategic investments in facilities like the Singapore plant are designed to enhance its supply chain resilience. This move not only ensures consistent production but also mitigates geopolitical risks, providing a stable foundation for future growth.

Financial Performance and Market Impact

In fiscal 2025, Micron reported a record revenue of $37.38 billion, with its DRAM segment playing a crucial role in powering AI servers and data centers. The DRAM business, which accounts for nearly four-fifths of Micron's revenue, is expected to see significant growth driven by AI-driven demand for high-bandwidth memory.

For the fourth quarter of 2025, Micron is expected to report a substantial increase in revenue, driven largely by the surge in demand for HBM. Analysts predict a 43% rise in revenue to $11.1 billion, with HBM revenue projected to increase more than sixfold to $2.1 billion. The premium pricing of HBM, with average selling prices of $1.49 per unit, highlights its importance to Micron's earnings profile.

Industry Impact and Context

The AI-driven memory market is undergoing a seismic shift, with HBM emerging as a critical component. Global HBM revenue is projected to reach $34 billion by 2025, driven by the insatiable demand for AI workloads in hyperscale data centers. This growth is not only benefiting Micron but also intensifying competition in the market, with SK Hynix currently leading with a 62% market share.

Micron's strategic investments and technological advancements are positioning it as a compelling long-term investment. As AI continues to redefine global computing, Micron's ability to innovate and adapt will be crucial in maintaining its competitive edge.

Implications for Investors and the Industry

-

Investor Confidence: Micron's strong financial performance and strategic investments have boosted investor confidence. The company's Q3 revenue of $9.3 billion reflects its robust market position and potential for future growth.

-

Market Competition: The intensifying competition in the HBM market, particularly with SK Hynix, underscores the importance of continuous innovation and production scaling. Micron's HBM4 roadmap and supply chain enhancements are key to maintaining its competitive stance.

-

Future Outlook: As AI technologies continue to advance, the demand for high-bandwidth memory is expected to remain robust. Micron's ability to capitalize on this trend will be crucial in defining its success in the burgeoning AI-driven memory market.

In conclusion, Micron Technology's strategic pivot towards AI-driven memory solutions has positioned it at the forefront of the semiconductor industry's transformation. With ongoing investments in HBM production and technological innovation, Micron is poised to navigate the evolving landscape of AI computing and continue to drive growth in the memory market.