Nebius Stock Declines, CoreWeave Stabilizes Amid AI Selloff

Nebius stock declines while CoreWeave stabilizes amid AI selloff, highlighting market volatility and operational challenges in AI infrastructure.

Nebius Stock Declines, CoreWeave Stabilizes Amid AI Selloff

Shares of Nebius experienced a notable decline recently, while CoreWeave managed to stabilize after a sharp selloff in AI-related stocks. This market turbulence follows mixed earnings reports and operational challenges in the rapidly growing AI infrastructure sector, raising concerns that additional setbacks could be imminent.

Background: The AI Infrastructure Market and Recent Selloff

The surge in demand for AI computing power has fueled rapid expansion in companies providing cloud infrastructure, specialized GPUs, and AI-as-a-Service platforms. Both Nebius and CoreWeave are among the key players benefiting from this boom, as enterprises and hyperscalers race to deploy AI workloads.

However, recent volatility in AI stocks reflects growing investor caution. After a strong rally earlier in 2025, stocks like Nebius and CoreWeave have been hit by concerns over profitability, capital expenditures (CapEx), and operational risks tied to supply chain and delivery delays.

Nebius vs. CoreWeave: Contrasting Financial Performances

Nebius

Nebius reported a 355% year-over-year revenue increase to $146 million in Q3 2025 and achieved a 19% adjusted EBITDA margin, signaling strong operational leverage and profitability focus. The company is aggressively scaling up with a $5 billion CapEx plan for 2025, targeting expansion of its AI cloud platform capacity.

Strategic partnerships with tech giants like Meta ($3 billion deal) and Microsoft ($17.4-19.4 billion deal) have diversified Nebius’s revenue base and reduced risk exposure. This disciplined approach has earned Nebius favor among analysts who prioritize profitability and scalable growth.

Despite these positives, Nebius’s stock fell sharply amid the broader AI sector selloff, suggesting investor concerns about market saturation and potential overvaluation.

CoreWeave

CoreWeave, backed by Nvidia, reported a $110 million net loss in Q3 2025 and drastically cut its 2025 CapEx guidance by 40% to $12-$14 billion, citing ongoing delivery delays and supply chain constraints. This reduction raised questions about the company's capacity to meet demand and capitalize on the AI boom fully.

Nevertheless, CoreWeave showed signs of operational strength with an adjusted EBITDA margin of 61% and an operating income of $51.8 million (4% margin), indicating thin but positive profitability. The company also plans to double CapEx spending in 2026, signaling confidence in long-term demand despite near-term challenges.

CoreWeave’s stock steadied after the sharp AI selloff, reflecting cautious optimism about its recovery and growth prospects.

Industry Challenges: Delivery Delays and Capacity Crunch

Both companies face significant operational risks related to data center buildouts and GPU supply. CoreWeave’s CEO refused to confirm whether issues with Core Scientific—a major data center operator—contributed to delays, fueling uncertainty. These bottlenecks have forced CoreWeave to lower its annual revenue forecast due to a capacity crunch.

Analysts warn that such delays could trigger further stock volatility as investors reassess growth timelines and capital efficiency in a capital-intensive industry.

Market Implications and What Could Happen Next

-

Further Stock Pressure Possible: Given the recent AI selloff and operational headwinds, another wave of declines could affect both Nebius and CoreWeave if delivery delays persist or if AI demand growth slows.

-

CapEx Discipline vs. Growth-at-All-Costs: Nebius’s focus on profitability and measured CapEx contrasts with CoreWeave’s aggressive expansion plans, presenting two distinct investment profiles. Investors will likely favor companies demonstrating capital efficiency as the market matures.

-

AI Infrastructure as a Long-Term Growth Sector: Despite short-term hiccups, analysts remain bullish on AI infrastructure’s growth potential, driven by sustained demand for cloud GPU capacity and AI model training.

-

Strategic Partnerships as Risk Mitigation: Deals with Meta and Microsoft provide Nebius with revenue stability, while CoreWeave’s Nvidia backing ensures access to key AI hardware.

Visuals to Accompany the Article

- Nebius Corporate Logo and Q3 2025 Earnings Presentation Slides: Highlighting revenue growth and CapEx plans.

- CoreWeave Data Center Images: Showing GPU server racks or construction sites illustrating capacity expansion.

- CEO Photos or Conference Call Screenshots: Especially CoreWeave’s CEO discussing delivery delays.

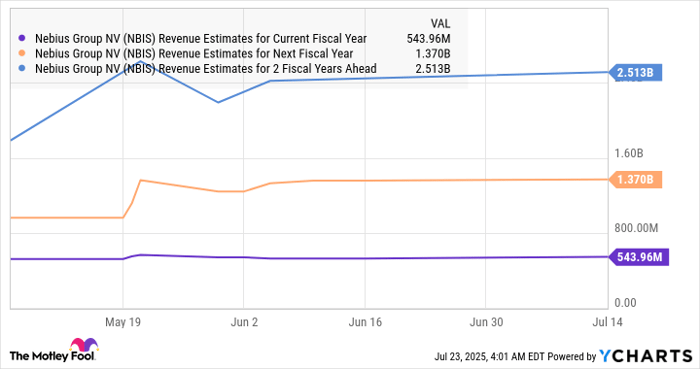

- Stock Price Charts: Visualizing the recent price movements of Nebius and CoreWeave amid the AI selloff.

- Infographics: Comparing Nebius and CoreWeave’s financial metrics and CapEx strategies.

The contrasting fortunes of Nebius and CoreWeave embody the growing pains of the AI infrastructure industry. While Nebius’s disciplined approach has won analyst praise, CoreWeave’s bold expansion faces near-term execution risks. Investors will be watching closely to see if another shoe drops as these companies navigate a complex market landscape marked by soaring demand and critical delivery challenges.