Nvidia Poised for AI Market Leadership by 2026

Nvidia is poised for AI market leadership by 2026 due to its technological innovation, strategic positioning, and strong ecosystem presence.

Nvidia Poised for AI Market Leadership by 2026

Introduction

As the AI revolution progresses, investors are keen to identify companies set to lead the market in the coming years. Nvidia emerges as a potential major winner by 2026, thanks to its unique competitive advantages, robust growth prospects, and strong industry backing. This article examines Nvidia’s strategic position, market trends, and expert analyses, including insights from Bank of America and other financial institutions.

Background: The AI Market Landscape

Artificial intelligence is one of the fastest-growing sectors globally, with applications in cloud computing, autonomous vehicles, healthcare, financial services, and more. The AI chip market is expected to grow at a compound annual growth rate (CAGR) exceeding 30% through the mid-2020s, driven by demand for enhanced processing power and efficiency.

Leading companies such as Nvidia, Alphabet (Google), AMD, and Intel have made significant investments in AI hardware and software, fueling competition and innovation. Among these, Nvidia is receiving particular attention for its potential to outpace peers due to technological innovation, market positioning, and strategic partnerships.

The AI Stock in Focus: Nvidia’s Continued Dominance

Why Nvidia?

Nvidia, known for its AI-optimized graphics processing units (GPUs), is a primary candidate for AI stock winners in 2026. Reports from The Motley Fool and CNBC highlight several reasons for Nvidia’s continued growth:

-

Technological Edge: Nvidia's GPUs are essential for AI applications, offering unmatched processing speed and energy efficiency with its latest architecture, Hopper.

-

Ecosystem Expansion: Nvidia has developed a comprehensive AI ecosystem, including software frameworks like CUDA and platforms like Nvidia AI Enterprise.

-

Market Demand: The rise of generative AI and AI-driven cloud services increases demand for high-performance computing hardware, with Nvidia’s chips integral to datacenters operated by Google, Microsoft, and Amazon.

-

Strategic Acquisitions: Nvidia’s acquisition strategy, including the purchase of Mellanox Technologies and plans for Arm Holdings, aims to expand its capabilities in data transport and CPU architectures.

Bank of America’s Take

Bank of America recently highlighted Nvidia as one of five AI-related stocks with significant growth potential. Their analysis points to Nvidia’s robust earnings growth, strong order backlog, and expanding addressable market, justifying its premium valuation.

Industry and Market Dynamics

Competitors and Challenges

While Nvidia leads, competition is intensifying. Google invests heavily in custom AI chips like the Tensor Processing Unit (TPU), and AMD and Intel are developing AI-optimized processors. Despite this, Nvidia’s first-mover advantage and ecosystem depth create high entry barriers for competitors.

Stock Market Sentiment

Nvidia’s stock price has experienced volatility amid broader tech market fluctuations. However, analyses from Barron’s and Yahoo Finance suggest that dips may represent buying opportunities as Nvidia strengthens its product offerings.

Implications for Investors and the AI Industry

Investment Outlook for 2026

Investors should consider Nvidia’s potential as a comprehensive AI platform provider. Its ability to innovate and scale AI solutions positions it for significant revenue growth and market share expansion.

Broader Industry Impact

Nvidia’s advancements accelerate AI adoption across industries, enabling applications like autonomous driving and AI-assisted drug discovery. Its leadership influences industry standards and innovation trends.

Conclusion

Nvidia could be a huge winner in 2026 due to its technological innovation, strategic market positioning, and strong ecosystem presence. Supported by expert analyses, Nvidia’s growth trajectory appears robust amid increasing AI adoption globally.

While competition remains fierce, Nvidia’s blend of cutting-edge hardware, software ecosystem, and strategic acquisitions poises it for sustained leadership in the AI sector.

Relevant Images

- Nvidia logo illustrating the brand identity.

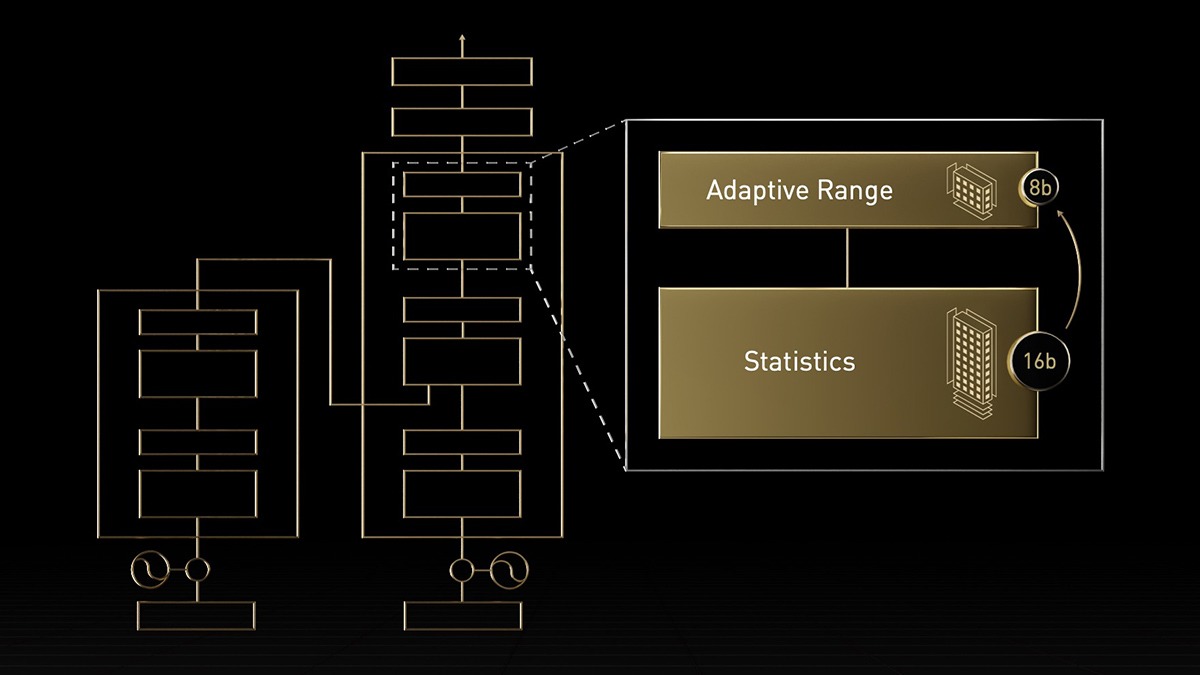

- Nvidia Hopper GPU architecture diagrams showcasing AI-optimized hardware.

- Market charts highlighting Nvidia stock performance and growth projections.

- Photo of Jensen Huang, Nvidia’s CEO.

- Visual representation of Nvidia’s AI ecosystem including GPUs, software, and cloud partnerships.