OpenAI's Infrastructure Bet: How $96 Billion in Partner Debt Is Reshaping AI Development

OpenAI's partners are taking on unprecedented debt levels—reportedly $96 billion—to fund the computational infrastructure required for next-generation AI systems. This capital-intensive shift raises critical questions about sustainability and market concentration in the AI sector.

The $96 Billion Question

OpenAI's ecosystem partners are reportedly accumulating $96 billion in debt to finance the massive infrastructure buildout required for advanced artificial intelligence development. This staggering figure underscores the capital-intensive nature of modern AI, where computational power and data center capacity have become the primary bottlenecks limiting model advancement.

The debt accumulation reflects a fundamental reality: training and deploying state-of-the-art large language models demands extraordinary computational resources. GPUs, specialized chips, and the supporting infrastructure—cooling systems, power generation, networking—represent multi-billion-dollar commitments that few organizations can self-fund entirely.

Why Infrastructure Debt Is Accelerating

Several factors are driving this debt-fueled expansion:

- Competitive pressure: Companies racing to develop frontier AI models cannot afford delays in infrastructure deployment

- Capital intensity: A single data center capable of training cutting-edge models can cost $1-5 billion

- Rapid iteration cycles: The pace of AI advancement requires continuous infrastructure upgrades

- Geopolitical considerations: Redundancy and geographic distribution add complexity and cost

The $96 billion figure represents not just OpenAI's direct needs, but the broader ecosystem of partners—cloud providers, chip manufacturers, and infrastructure specialists—all taking on leverage to support the AI boom.

Market Concentration and Risk

This debt-driven expansion raises important structural questions about the AI industry:

Concentration risk: A handful of well-capitalized players (OpenAI, Google, Meta, Microsoft) are effectively controlling access to frontier AI through infrastructure dominance. Partners dependent on debt financing may face pressure to accept unfavorable terms or risk exclusion.

Sustainability concerns: High debt levels create vulnerability to interest rate shocks, demand fluctuations, or technological disruption. If AI development hits diminishing returns or adoption slows, highly leveraged partners could face refinancing crises.

Market dynamics: The capital requirements create barriers to entry, potentially limiting competition and innovation from smaller players who cannot access debt markets on favorable terms.

The Broader Infrastructure Landscape

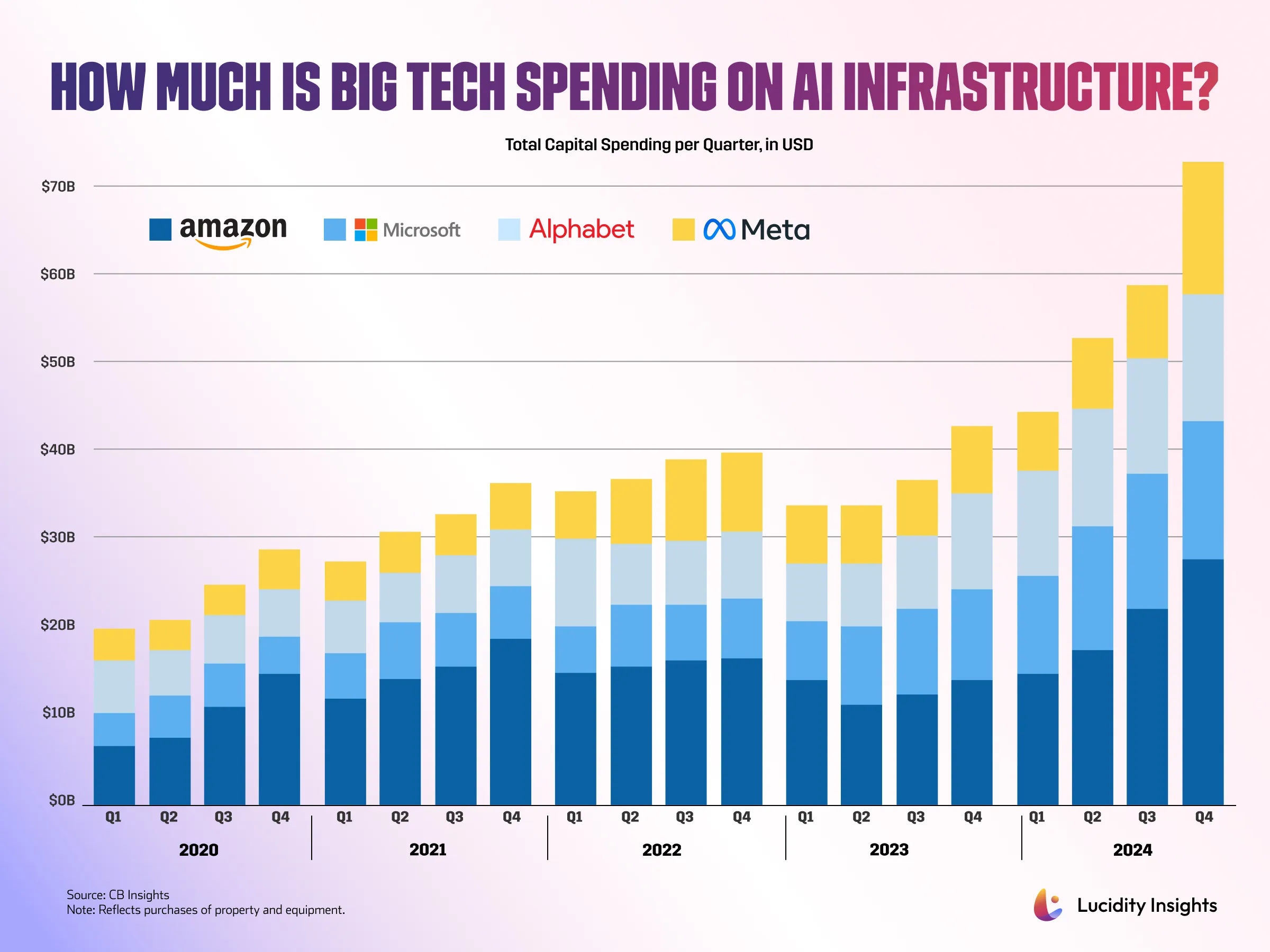

Industry analysts project that major technology companies will collectively spend over $300 billion on AI infrastructure in 2025 alone. This spending encompasses data centers, GPUs, networking equipment, and power infrastructure. The $96 billion in partner debt represents a significant portion of this capital formation, suggesting that debt financing—not equity or retained earnings—is becoming the primary funding mechanism.

This shift has implications beyond individual companies. It affects:

- Energy markets: Massive data center expansion is driving electricity demand and influencing power infrastructure investment

- Real estate: Competition for suitable data center locations is intensifying

- Supply chains: GPU and chip availability remains constrained, limiting infrastructure deployment speed

- Financial markets: Debt issuance by infrastructure-focused companies is reshaping credit markets

Looking Ahead

The sustainability of this debt-driven model depends on several factors: continued strong demand for AI services, successful monetization of AI capabilities, and stable financing conditions. Any disruption—regulatory changes, technological breakthroughs that reduce computational requirements, or macroeconomic headwinds—could stress highly leveraged partners.

For OpenAI and its ecosystem, the $96 billion debt figure represents both opportunity and risk. It demonstrates the sector's confidence in AI's transformative potential, but it also signals that the industry is betting heavily on continued growth and capital availability.

The coming years will reveal whether this infrastructure investment generates sufficient returns to justify the debt burden, or whether the AI sector faces a reckoning with overleveraged partners and stranded assets.

Key Sources

- Industry analysis on AI infrastructure spending and capital requirements

- Market reports on technology sector debt issuance and financing trends

- Analysis of competitive dynamics in AI infrastructure provision