Peter Lynch's Cautionary Take on AI Investments

Peter Lynch's skepticism about AI stocks underscores the importance of understanding and familiarity in investment decisions, offering a cautionary note for investors.

Background

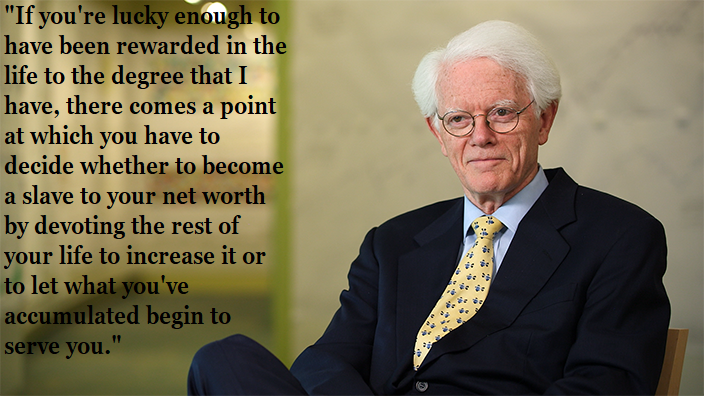

Renowned investor Peter Lynch, known for his successful management of Fidelity's Magellan Fund from 1977 to 1990, has expressed skepticism about investing in the AI sector. In a recent statement, Lynch humorously admitted that he couldn't even pronounce the name of Nvidia, a leading AI technology company, until about eight months ago. This candid admission highlights Lynch's long-standing principle of only investing in companies whose business models he thoroughly understands. This approach is reflective of his broader investment philosophy, which emphasizes the importance of knowledge-based investing.

Investment Philosophy: Understanding the Business

Lynch's investment strategy is built on the idea that investors should only invest in companies they can explain to an 11-year-old in a minute or less. This philosophy underscores the need for investors to have a clear understanding of a company's business before investing. Lynch has consistently emphasized that the fundamentals of investment remain unchanged despite the evolution of the investment landscape. He has noted that the key to successful investing is not about playing the market but about buying good companies and understanding what they do.

Lynch's skepticism towards AI stocks is also influenced by his experience with previous market bubbles. He has expressed uncertainty about whether the current AI boom resembles the dot-com bubble of the late 1990s. This cautious approach reflects his belief that investors should focus on opportunities in familiar sectors rather than chasing trends in emerging technologies.

The AI Boom and Market Dynamics

The AI sector has been booming since the launch of ChatGPT in late 2022, with stocks like Nvidia, Meta, and Microsoft driving significant growth in the market. The S&P 500 has seen a remarkable 73% increase since the start of 2023, largely fueled by AI-driven growth. However, some analysts are concerned that a bubble may be forming in the broader market, given the high price-to-earnings ratio and the CAPE ratio, which adjusts for inflation.

Despite these concerns, the AI sector continues to attract significant investment, with many investors betting on the long-term potential of AI technology. The Magnificent Seven tech giants, including Nvidia and Microsoft, have been at the forefront of this growth. However, Lynch's comments suggest that not all investors are convinced by the AI hype, especially those who prefer to stick with what they know.

Industry Impact and Diversification

The AI boom has also raised questions about traditional investment strategies, such as diversification. In the past, Lynch has suggested that owning a single stock can be acceptable if the company is well-understood and has strong fundamentals. This approach challenges the conventional wisdom that a diversified portfolio is always the best strategy.

The implications of Lynch's views on AI and diversification are significant. They highlight the tension between embracing new technologies and sticking to familiar investment principles. While AI stocks continue to attract attention, Lynch's cautionary approach serves as a reminder that understanding a company's business model is crucial for long-term success.

Context and Implications

Lynch's skepticism about AI stocks reflects broader concerns about market valuations and the potential for bubbles. His comments come at a time when the S&P 500 is trading at historically high multiples, sparking debates about whether the market is overvalued. The AI sector, despite its growth potential, is not immune to these concerns, as investors weigh the risks and rewards of investing in emerging technologies.

In conclusion, Peter Lynch's stance on AI stocks underscores the importance of understanding and familiarity in investment decisions. His approach serves as a reminder that successful investing often requires a deep understanding of the companies in which one invests, rather than chasing the latest trends or technologies.

Conclusion

Peter Lynch's decision to avoid AI stocks highlights the ongoing debate about the role of emerging technologies in investment portfolios. While AI continues to drive market growth, Lynch's emphasis on understanding and familiarity offers a cautionary note for investors. As the investment landscape evolves, Lynch's principles remain relevant, reminding investors that knowledge and fundamentals are key to long-term success. Whether or not the AI boom will sustain itself remains to be seen, but for now, Lynch's approach serves as a timely reminder of the importance of investing in what you know.