S&P 500 Closes Near 6,800 Amid Fed Rate Cut and AI Concerns

S&P 500 closes near 6,800 after Fed rate cut and amid AI concerns, reflecting mixed economic signals and investor caution.

S&P 500 Holds Steady Near 6,800 Amid Fed Rate Cut, Payrolls Data, and AI-Driven Market Caution

The S&P 500 closed at 6,816.51 on December 15, 2025, maintaining its position near the 6,800 level despite mixed economic signals from strong payrolls, persistent inflation concerns, and growing investor anxiety over artificial intelligence's economic impact. This performance followed the Federal Reserve's 0.25% interest rate cut the previous day, which propelled the index to a new record high on Thursday before a slight pullback amid profit-taking and uncertainty.

Market Performance and Key Metrics

The benchmark index exhibited resilience, opening at 6,860.19 and fluctuating between a high of 6,861.59 and a low of 6,801.49, ultimately ending the day down 0.16%. This came after a weekly gain of 0.6% for the S&P 500, with broader market segments showing strength:

- S&P Mid Cap rose 0.9%

- Russell 2000 advanced 1.2%

- MSCI EAFE climbed 0.9%

- MSCI Emerging Markets edged up 0.4%

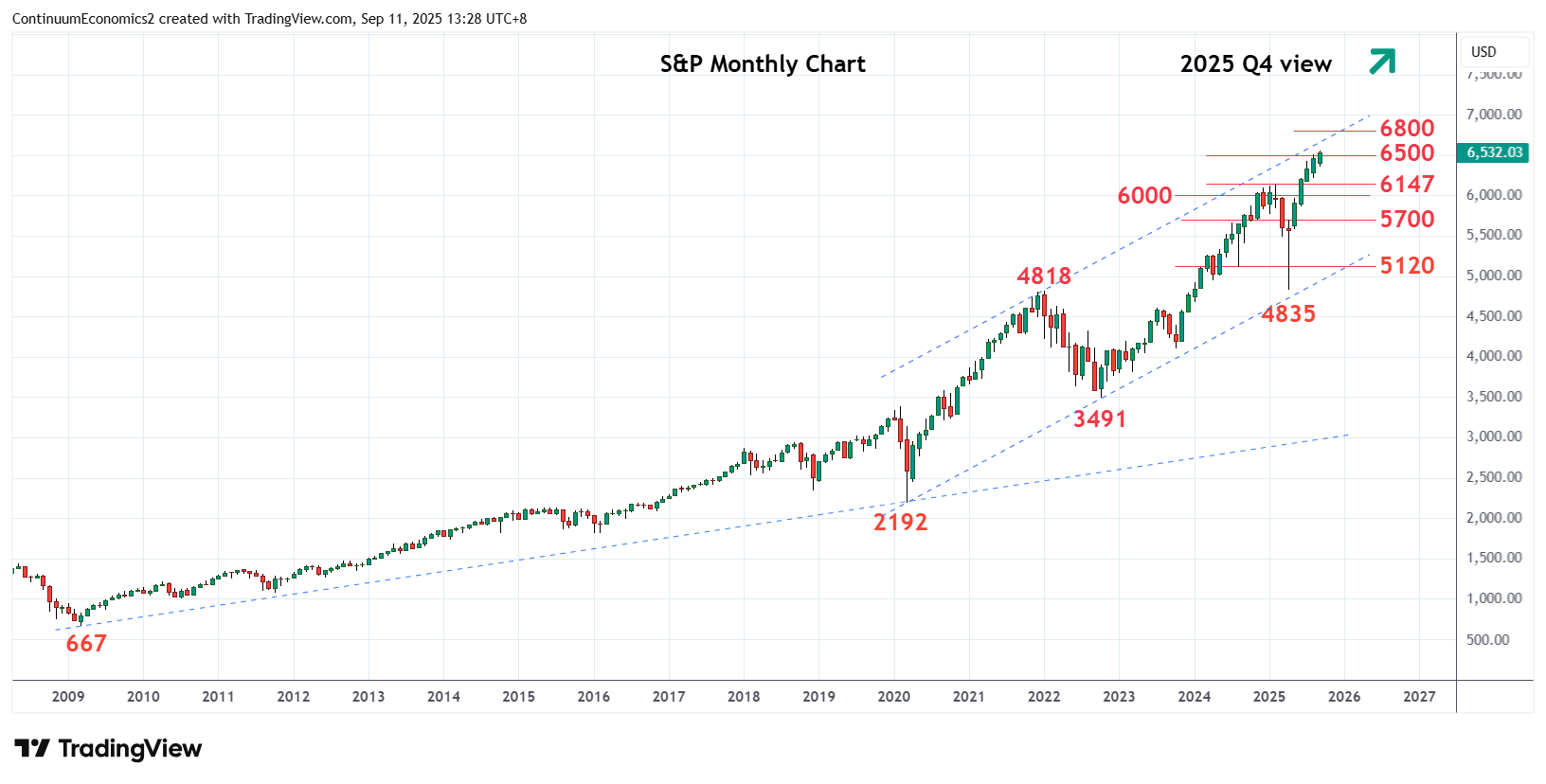

Visual representation of the S&P 500's recent performance as of December 15, 2025, showing the close at 6,816.51 and year-to-date gains of 12.65%.

The 10-year US Treasury yield ticked higher from 4.14% to 4.20%, reflecting tempered expectations for aggressive rate easing. Technology stocks, a perennial market driver, underperformed recently, while the financials sector hit a record close, buoyed by gains in credit card processing giants like Visa and Mastercard.

Federal Reserve's Pivotal Rate Decision

The Fed's Federal Open Market Committee voted 9-3 to lower the federal funds rate by 0.25 percentage points to a range of 3.5-3.75%, marking a three-year low. Fed Chair Jerome Powell highlighted a labor market cooling "gradually, maybe just a touch more gradually than we thought," signaling cautious optimism. Dissenters included two votes to hold rates steady and one for a bolder 0.50% cut.

Updated Fed projections revealed a split: six officials anticipate higher rates by the end of 2026 compared to pre-cut levels, though the majority penciled in one additional cut next year. Markets, per Refinitiv Eikon data, now price in two more cuts by end-2026, tempering earlier aggressive easing bets.

Fed Chair Jerome Powell speaks following the December rate decision, emphasizing gradual labor market cooling.

This move catalyzed the S&P 500's Thursday record, underscoring investor relief over policy support amid economic softening.

Economic Data: Payrolls Strength Meets Inflation Hurdles

December 15's trading unfolded against fresh labor data showing robust nonfarm payrolls growth, exceeding forecasts and underscoring labor market resilience. Yet, this strength fueled inflation worries, as a tight job market could sustain wage pressures and delay disinflation.

AI anxiety added another layer, with investors fretting over the technology's disruptive potential on employment and productivity. Reports highlighted concerns that rapid AI adoption—led by firms like Nvidia and OpenAI—might accelerate job displacement, even as it boosts corporate efficiencies. This tension contributed to tech sector languish, capping broader gains.

Sector Breakdown and Broader Implications

Financials led with record highs, driven by rate-sensitive banks and payment processors benefiting from the Fed's pivot. Conversely, tech's lag reflects valuation worries post-AI hype, with the sector's heavy S&P weighting amplifying its drag.

Heatmap illustrating December 15 sector moves, with financials in green and tech subdued.

The index's 1-year return stands at 12.65%, covering roughly 80% of US market cap across 500 leading firms. Globally, related ETFs like the 10X S&P 500 and 1nvest S&P500 Feeder underscore the benchmark's international footprint.

Future Outlook: Balancing Growth, Rates, and Tech Risks

Looking ahead, markets eye upcoming inflation readings and the next Fed meeting. Strong payrolls suggest the labor market's buffer against recession, but elevated rates projections signal policy normalization. AI's double-edged sword—driving innovation yet stoking unemployment fears—could define 2026 volatility, particularly if tech earnings disappoint.

Economists note the S&P 500's range-bound action near 6,800 reflects this equilibrium: Fed support versus data-dependent caution. Historical data shows the index's 52-week range from 6,755.63 to 6,819.27, positioning it near peaks. Investors may rotate into small-caps and financials, betting on broader participation beyond megatech.

In context, this session encapsulates 2025's narrative: post-pandemic recovery, AI-fueled rallies, and monetary fine-tuning. With the index up significantly year-to-date, sustained 6,800s levels signal underlying strength, though AI anxiety and inflation vigilance loom large.