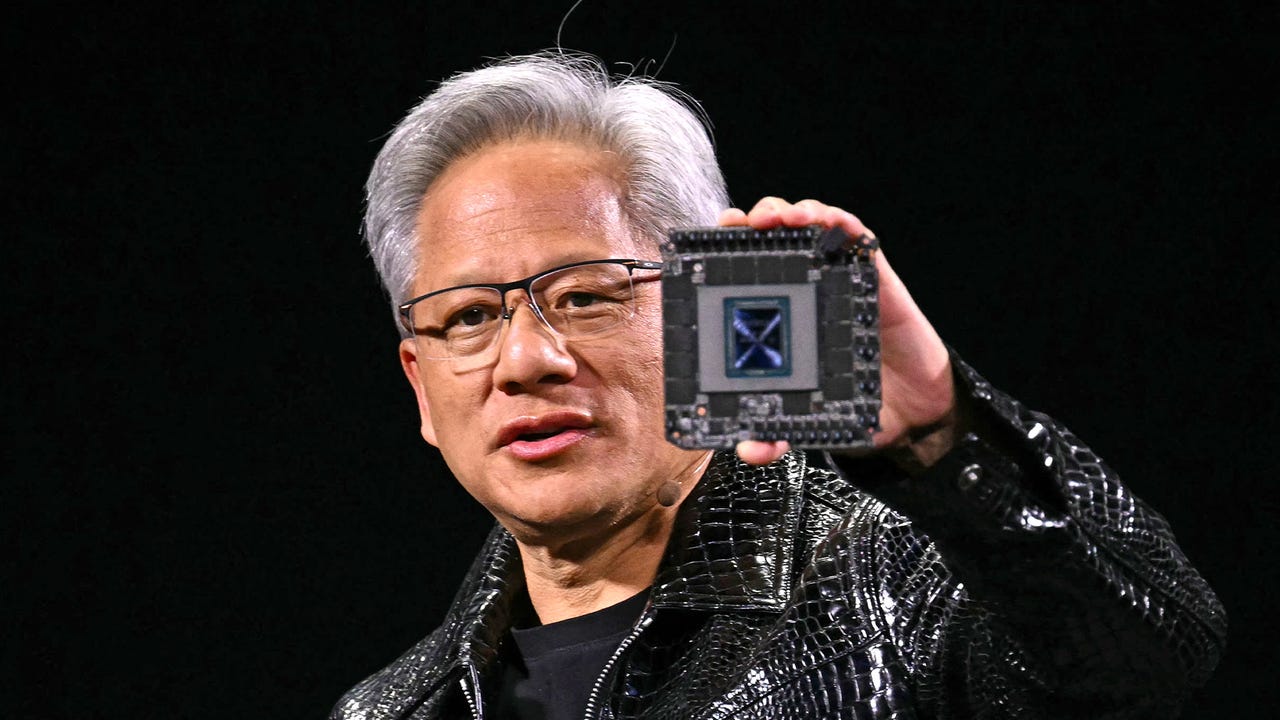

Trump Administration Permits Nvidia AI Chip Sales to China Under 25% Commission Framework

The Trump administration has greenlit Nvidia's continued operations in China through a new licensing arrangement that imposes a 25% commission on AI chip sales, marking a significant shift in U.S. export control policy toward Beijing.

Trump Administration Permits Nvidia AI Chip Sales to China Under 25% Commission Framework

The Trump administration has greenlit Nvidia's continued operations in China through a new licensing arrangement that imposes a 25% commission on AI chip sales, marking a significant shift in U.S. export control policy toward Beijing. The decision allows the semiconductor giant to maintain its presence in one of the world's largest markets while establishing a revenue-sharing mechanism that effectively monetizes restrictions on advanced chip exports.

Policy Framework and Commercial Terms

Under the new arrangement, Nvidia can resume selling its artificial intelligence processors to Chinese customers, but with a substantial financial obligation to the U.S. government. The 25% commission structure represents a novel approach to export control enforcement—rather than an outright ban, the framework permits commerce while capturing a significant portion of transaction value.

This licensing model differs from previous blanket restrictions on advanced chip sales to China, which have been a cornerstone of U.S. technology competition strategy since 2022. The commission-based approach suggests the administration is balancing national security concerns with economic pragmatism, particularly given Nvidia's dominant position in the global AI chip market.

Strategic Implications for Nvidia

Market Access and Revenue Impact

The decision provides Nvidia with critical market access during a period of intense competition in AI infrastructure. China represents a substantial portion of global demand for high-performance computing chips, and the licensing arrangement allows the company to capture revenue that would otherwise flow to competitors or remain untapped.

Operational Considerations

- Nvidia must implement compliance mechanisms to track and report sales volumes

- The 25% commission creates a cost structure that affects pricing competitiveness

- Licensing terms likely include quarterly reporting and verification requirements

- Export documentation and approval processes remain mandatory for each transaction

Broader Export Control Landscape

The Trump administration's decision reflects evolving priorities regarding technology competition with China. Rather than maintaining absolute restrictions, the framework acknowledges that some level of commercial engagement may be preferable to complete market closure, particularly when coupled with revenue-capture mechanisms.

This approach differs from the Biden administration's strategy of comprehensive export controls on advanced semiconductors. The shift suggests the current administration views negotiated access—with financial guardrails—as a viable alternative to unilateral restrictions.

Industry and Geopolitical Context

Nvidia's ability to operate in China remains strategically significant given the company's 80%+ market share in AI accelerators. Competitors including AMD and Intel have faced similar export restrictions, but Nvidia's dominant position makes its market access particularly consequential for both the company and the broader semiconductor industry.

The licensing arrangement also reflects China's continued demand for advanced computing capabilities despite years of U.S. restrictions. Chinese companies have invested heavily in developing domestic alternatives, but performance gaps remain substantial, creating ongoing demand for imported solutions.

Key Sources

- Trump Administration Export Control Policy Framework (2025)

- Nvidia Corporate Communications and Licensing Announcements

- U.S. Department of Commerce Bureau of Industry and Security Guidance

Looking Ahead

The 25% commission model may establish a precedent for future export control negotiations, potentially extending to other restricted technologies or companies. The framework's success will depend on compliance enforcement and whether the revenue mechanism proves sufficient to address national security concerns while maintaining commercial viability for U.S. technology companies operating in restricted markets.

The decision underscores the ongoing tension between economic interests and national security strategy in semiconductor policy, with the Trump administration attempting to navigate both through a hybrid licensing approach.