TSMC Poised for Record Quarterly Profits as AI Chip Demand Surges

TSMC's Q4 earnings are expected to shatter records as artificial intelligence adoption drives unprecedented demand for advanced semiconductors, positioning the chip giant to capitalize on the AI boom.

The AI Chip Boom Reshapes the Semiconductor Landscape

The race for AI dominance is reshaping the semiconductor industry, and TSMC sits at the epicenter. As major technology companies race to deploy advanced AI systems, demand for cutting-edge chips has reached unprecedented levels—and TSMC's financial results are about to reflect that reality.

Analysts have turned increasingly bullish on TSMC, citing the company's strengthened pricing power and robust earnings outlook. The shift in sentiment reflects a fundamental change in the semiconductor market: AI is no longer a niche application—it's the primary driver of chip demand globally.

Q4 Earnings: What to Expect

TSMC's fourth-quarter results are poised to deliver significant surprises. According to industry expectations, the company is about to report Q4 earnings with strong performance metrics that underscore the AI-driven demand cycle.

The numbers tell a compelling story:

- Profit Surge: TSMC's Q4 profit forecast has lifted by 27%, a remarkable jump driven by sustained demand for high-end processors used in AI applications

- Pricing Power: The company has successfully maintained premium pricing for advanced nodes, a critical advantage in a competitive market

- Capacity Constraints: Demand continues to outpace supply, allowing TSMC to operate at near-maximum utilization rates

The AI Demand Catalyst

The fundamental driver behind TSMC's exceptional performance is straightforward: artificial intelligence requires advanced semiconductors. Data centers deploying large language models, training infrastructure, and inference systems all depend on the cutting-edge chips that only TSMC can manufacture at scale.

This creates a virtuous cycle for the company. As AI adoption accelerates, demand for TSMC's most advanced and profitable chips increases. The company's 3-nanometer and 5-nanometer processes are in particularly high demand, commanding premium prices that boost margins significantly.

Investment Thesis and Market Positioning

Investors are actively reassessing TSMC stock ahead of earnings, weighing whether current valuations reflect the company's growth trajectory. The consensus among analysts has shifted decidedly positive, with many upgrading price targets based on the strength of the AI cycle.

TSMC's competitive moat has widened considerably. While competitors like Samsung and Intel invest heavily in advanced manufacturing, TSMC maintains a 1-2 year technological lead. This advantage translates directly into customer lock-in and pricing power—both critical factors supporting the projected profit surge.

Looking Ahead: Sustainability Questions

The critical question facing investors is whether this AI-driven demand cycle is sustainable or cyclical. TSMC's management will likely address this during earnings calls, providing guidance on capacity expansion and long-term demand trends.

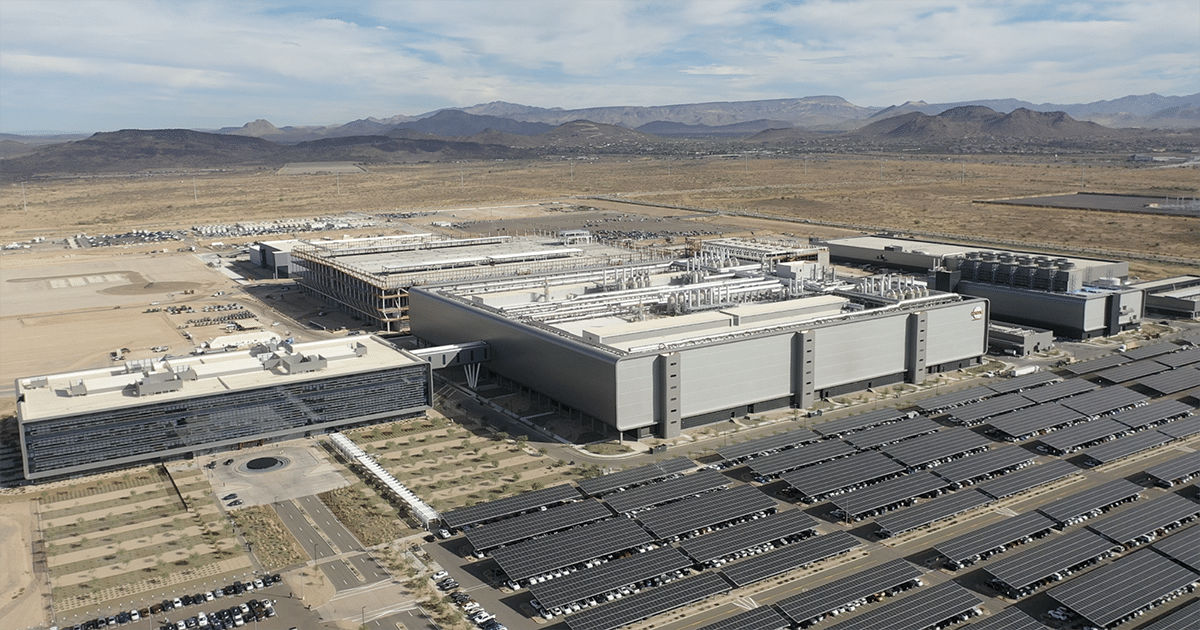

The company's massive capital expenditure programs—including its Arizona fab expansion—signal confidence in sustained demand. However, the semiconductor industry has a history of boom-bust cycles, and prudent investors should monitor whether demand growth can maintain its current trajectory.

The Bottom Line

TSMC's record quarterly profits represent more than just financial success—they reflect the structural shift toward AI-centric computing. The company's ability to supply the chips powering this transformation has positioned it as one of the most critical infrastructure players in the technology ecosystem. Whether these record profits mark the beginning of a new era or the peak of a cycle remains to be seen, but for now, TSMC is reaping the rewards of being in the right place at the right time.