Unveiling the AI Investment Surge: A Historical Perspective

The AI investment surge is massive yet not unprecedented, echoing past tech booms. Its scale and implications for global industries are profound and far-reaching.

Unveiling the AI Investment Surge: A Historical Perspective

The global surge in artificial intelligence (AI) investment is capturing unprecedented attention across industries, governments, and investors worldwide. While the scale of spending on AI technologies today is massive, experts emphasize that it is not without historical precedent. This nuanced perspective sheds light on the dynamics behind the AI spending boom, its drivers, and its potential implications for the future of technology and the economy.

The Current AI Spending Landscape: Who, What, and How Much?

The AI industry is experiencing a staggering growth in investment, with global AI spending expected to surpass $500 billion annually by 2026, according to market research firms such as IDC and McKinsey. This figure encompasses expenditures on AI software, hardware infrastructure, R&D, and related services. The boom is being fueled by a combination of factors, including:

- Adoption of AI-enabled automation and analytics by enterprises seeking productivity gains.

- Expansion of generative AI applications, such as large language models and image synthesis tools.

- Robust venture capital investments pouring into AI startups.

- Significant government funding initiatives aimed at securing technological leadership.

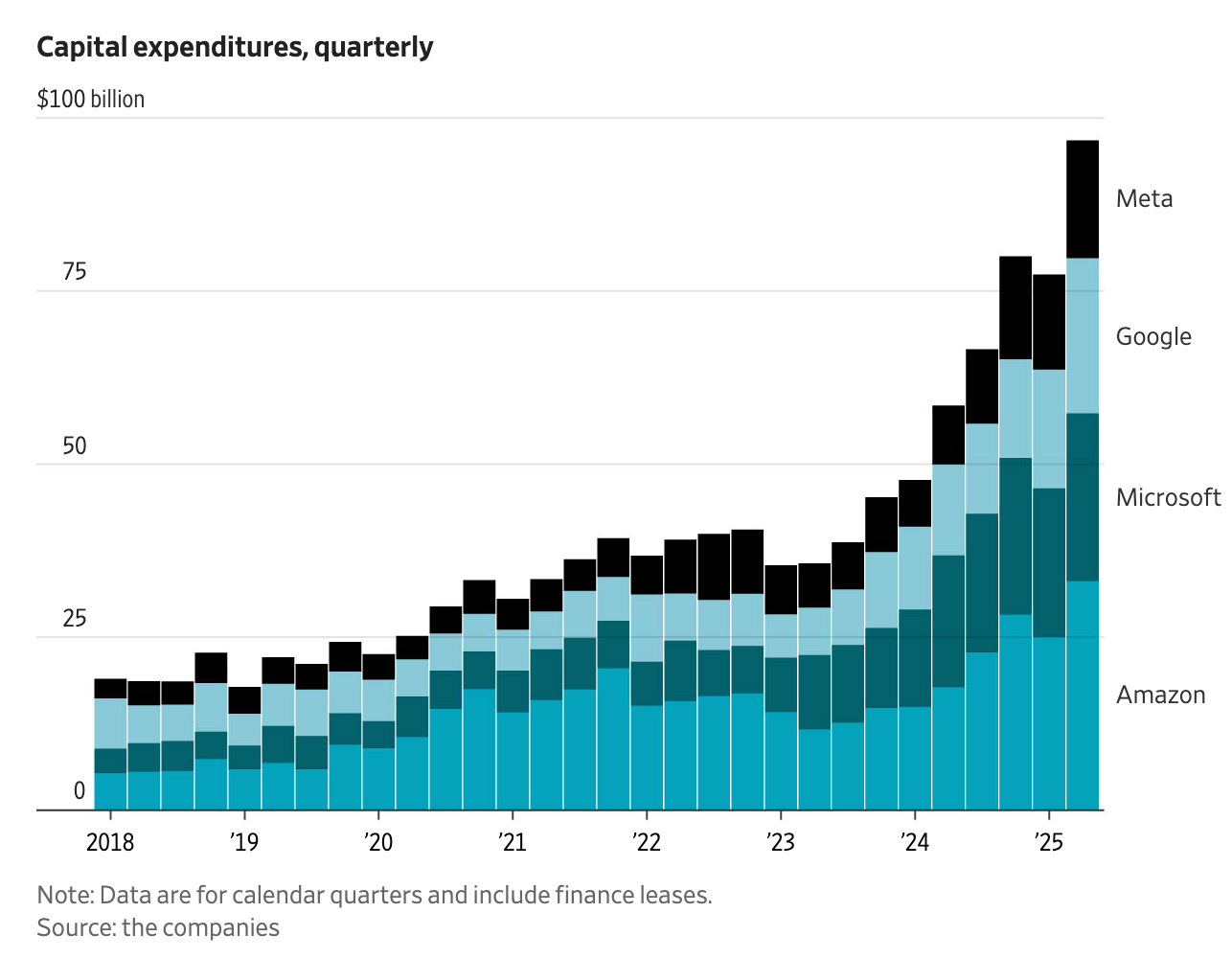

Major technology companies—such as Google, Microsoft, Amazon, and Meta—are leading the charge, collectively investing tens of billions of dollars annually in AI research and deployment. For example, Microsoft’s multi-billion dollar partnership with OpenAI underscores the strategic significance of AI in cloud computing and software services.

Historical Context: AI Spending Surges Are Not New

Despite today’s intense focus on AI investment, experts argue that the scale of spending, while large, is not entirely unprecedented. The technology sector has witnessed similar waves of elevated investment in transformative technologies in previous decades:

- The Dot-Com Boom (late 1990s - early 2000s): Fueled by the internet revolution, investments surged in software, networking, and e-commerce platforms.

- Mobile and Cloud Computing Expansion (late 2000s - 2010s): Massive capital flowed into smartphone ecosystems, cloud infrastructure, and SaaS business models.

- Big Data and Analytics Growth (mid-2010s): Enterprises invested heavily in data infrastructure and machine learning capabilities.

In comparison, the current AI spending boom resembles these earlier waves in terms of the speed of capital deployment and the strategic imperative to dominate emerging markets. However, unlike previous booms, AI’s impact spans across virtually every sector—from healthcare and finance to manufacturing and entertainment—making its economic and societal significance more pervasive.

Drivers Behind the AI Spending Surge

Several key factors are driving the rapid escalation of AI-related expenditures:

-

Technological Breakthroughs: Advances in neural networks, natural language processing, and specialized AI chips have dramatically improved AI capabilities, encouraging further investment.

-

Corporate Strategic Imperatives: Companies view AI as essential to competitive advantage, prompting large-scale investments to integrate AI into products and operations.

-

Government Policies: Nations worldwide are boosting AI funding to foster innovation ecosystems and secure national competitiveness, with countries like the U.S., China, and EU states leading the charge.

-

Investor Enthusiasm: Venture capital and private equity are flooding the AI startup ecosystem, fueling innovation and commercialization.

Economic and Industry Implications

The massive AI spending boom is reshaping the technology landscape in profound ways:

- Acceleration of AI Adoption: Companies are rapidly incorporating AI-driven automation, predictive analytics, and generative AI, changing workflows and customer interactions.

- Job Market Transformations: While AI creates new roles in development and data science, it also raises concerns about automation-driven job displacement.

- Competitive Dynamics: Firms unable to invest heavily in AI risk falling behind, intensifying market consolidation among leading tech players.

- Innovation Ecosystems: Increased funding is enabling startups and research institutions to push AI frontiers in areas like autonomous vehicles, drug discovery, and climate modeling.

Challenges and Risks

Despite the enthusiasm, the AI spending boom carries potential risks:

- Overinvestment and Valuation Bubbles: Some analysts warn about the possibility of inflated valuations and inefficient capital allocation reminiscent of past tech bubbles.

- Ethical and Regulatory Concerns: The rapid deployment of AI raises questions about privacy, bias, and accountability that require thoughtful governance.

- Geopolitical Tensions: AI competition is increasingly a geopolitical issue, with technology leadership tied to national security and economic power.

Conclusion: A Boom with Historical Echoes but Unique Scale

The ongoing AI spending boom is undeniably massive, mobilizing hundreds of billions in investment and transforming industries worldwide. However, historical comparisons reveal that while the scale is extraordinary, the pattern of rapid investment in disruptive technology is a familiar phenomenon in the tech sector. What distinguishes the current wave is the breadth of AI’s applicability and the profound implications for the global economy, geopolitics, and society.

As enterprises, governments, and investors continue to pour resources into AI, the challenge will be to balance rapid innovation with sustainable growth, ethical use, and inclusive benefits. The AI investment boom is not just about spending—it is about shaping the future of technology-driven human progress.