AI Chip Shortage Triggers 60% Memory Price Surge Across Tech Industry

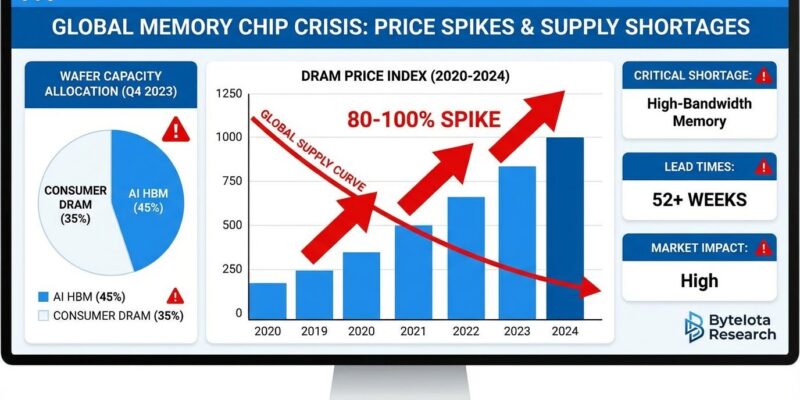

The race for AI dominance is reshaping the global memory market. As chip shortages persist, memory prices have skyrocketed 60%, threatening PC and smartphone affordability and forcing manufacturers to reassess supply chains.

The Memory Crisis Reshaping Tech Economics

The battle for AI supremacy is creating collateral damage across the entire technology supply chain. According to industry analysis, memory prices have surged 60% as artificial intelligence demand continues to strain global chip production. This isn't a temporary blip—it's a structural shift that's forcing manufacturers, retailers, and consumers to confront a new economic reality.

The core problem is straightforward: AI training and inference require massive amounts of high-bandwidth memory (HBM) and DRAM. Data centers are hoarding chips to build out their AI infrastructure, leaving consumer-grade memory in short supply. Samsung has publicly warned of memory shortages driving industry-wide price increases throughout 2026, signaling that relief won't come quickly.

Why This Matters Beyond the Data Center

The ripple effects extend far beyond enterprise computing:

- Consumer PC Pricing: IDC's market analysis projects significant price increases for personal computers and smartphones in 2026, as manufacturers pass costs downstream

- Smartphone Economics: Mid-range and budget devices face the steepest pressure, potentially pricing out emerging markets

- Profitability Paradox: While memory manufacturers enjoy record margins, system integrators and consumers bear the burden

The AI-driven demand for RAM has created a shortage that extends well into 2025, with no clear resolution timeline. Memory firms are expanding capacity, but fabrication plants take 18-24 months to come online—a lag that guarantees continued scarcity.

The Competitive Landscape

This shortage isn't random—it reflects deliberate capital allocation. Cloud providers and AI chip makers are prioritizing their own supply chains, locking in long-term contracts with manufacturers. The resulting price surge is already visible in consumer electronics, with reports of rising smartphone costs linked directly to memory constraints.

The winners are clear: memory manufacturers like Samsung, SK Hynix, and Micron are posting record profits. The losers are equally obvious—everyone else in the value chain.

What's Next?

Three scenarios are likely to unfold:

- Sustained Premium Pricing: If AI adoption accelerates, memory prices may remain elevated through 2026

- Selective Relief: Enterprise memory may stabilize while consumer-grade DRAM remains constrained

- Market Bifurcation: Premium products maintain availability while budget segments face extended shortages

The fundamental issue is one of allocation. The technology industry is making a bet that AI infrastructure is worth the cost of higher consumer prices. Whether that bet pays off depends on whether AI actually delivers the productivity gains its proponents promise—and whether consumers accept the interim price shock.

For now, the shortage persists, margins expand, and the race for AI dominance continues to reshape the economics of computing hardware.