AI Drives Major Earnings Growth for Tech Giants in 2025

AI drives major earnings growth for tech giants in 2025, with the "Magnificent Seven" leading S&P 500 gains. Concerns rise over market concentration.

AI Drives Major Earnings Growth for Tech Giants in 2025

Artificial intelligence (AI) has become the dominant force driving corporate earnings and market capitalization in 2025. A select group of tech giants, known as the “Magnificent Seven,” are responsible for nearly all of the S&P 500’s gains. Recent analyses reveal that AI-related stocks have contributed 75% of the S&P 500’s total returns, 80% of earnings growth, and 90% of capital spending growth since the launch of ChatGPT in November 2022. This concentration of economic value is reshaping the global financial landscape, raising concerns about market imbalances and the sustainability of current growth trajectories.

The Rise of AI-Driven Earnings

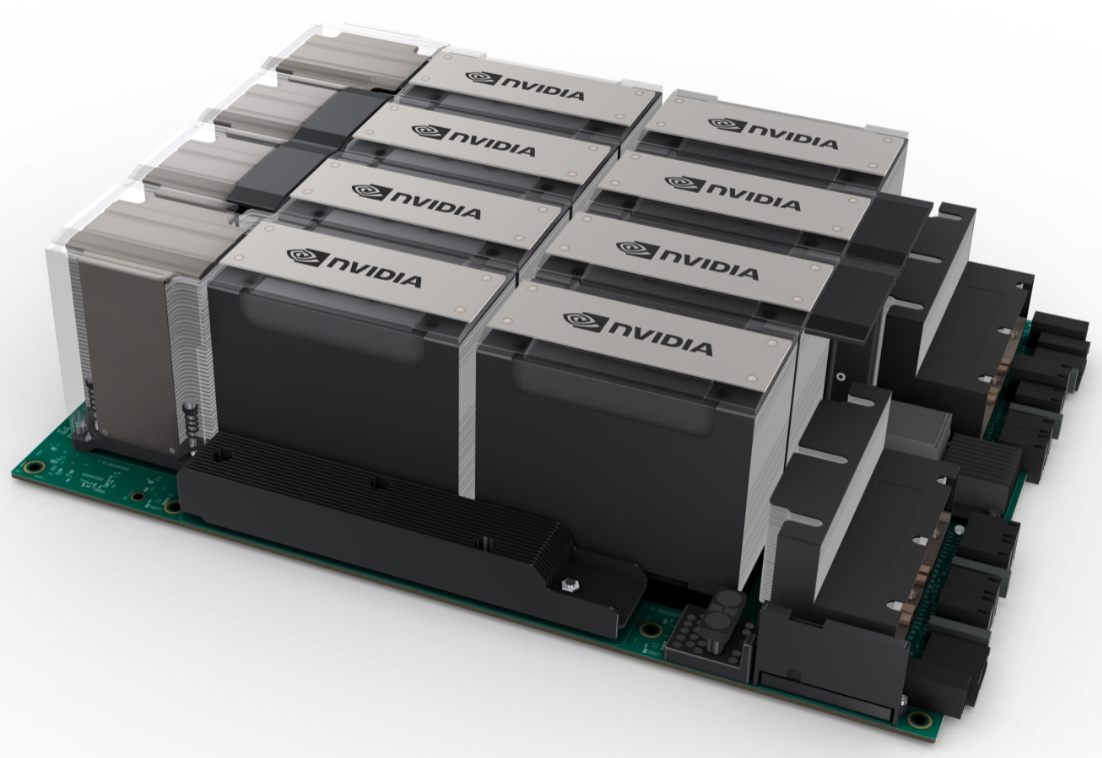

The surge in AI-driven earnings is most visible in the performance of the “Magnificent Seven”—Apple, Microsoft, Amazon, Alphabet (Google), Meta, Nvidia, and Tesla. These companies have leveraged investments in AI infrastructure, cloud computing, and generative AI technologies to capture an outsized share of market gains. Nvidia, in particular, has emerged as a central player, with its GPUs powering the AI revolution and its stock price soaring as demand for AI chips continues to outpace supply.

Recent data from JP Morgan Asset Management highlights this trend: since late 2022, AI-related stocks have accounted for 75% of S&P 500 returns and 80% of earnings growth. Capital expenditures related to AI have also surged, surpassing consumer spending as the primary driver of U.S. economic growth in the first half of 2025. This shift underscores the transformative impact of AI on corporate profitability and investment patterns.

Market Concentration and Investor Concerns

While the commercial outlook for AI remains enthusiastic among business leaders, there are growing concerns about the concentration of earnings and market capitalization in a small group of companies. The gap between the tech sector’s share of market cap and its net income has widened significantly since late 2022, raising questions about the sustainability of current valuations. Analysts warn that the rapid growth of AI-related stocks may be outpacing underlying fundamentals, creating the potential for a market correction.

At the Yale Chief Executive Leadership Institute CEO Summit in June 2025, over 150 top CEOs, venture capitalists, and technology founders expressed mixed views on the AI boom. While 60% of CEOs polled did not believe that AI hype had led to overinvestment, the remaining 40% raised significant concerns about the direction of AI exuberance, with many predicting an imminent correction. These concerns are echoed in reports from leading financial institutions, which note that the growth rates of the “Magnificent Seven” are expected to converge with the rest of the S&P 500 in the coming year.

The Broader Impact on the Economy

The dominance of AI-driven earnings is not limited to the tech sector. Across industries, companies are investing heavily in AI to improve efficiency, drive innovation, and gain a competitive edge. According to a McKinsey global survey conducted in June and July 2025, 39% of respondents attribute some level of EBIT impact to AI, with the most significant revenue increases reported in marketing and sales, strategy and corporate finance, and product and service development. However, the survey also found that most organizations have yet to see significant enterprise-wide EBIT impact from AI, with the majority of benefits coming from individual use cases in software engineering, manufacturing, and IT.

Visualizing the AI Earnings Boom

To illustrate the dominance of AI in the market, consider the following images:

- Nvidia’s AI Chip: A close-up of Nvidia’s H100 GPU, the workhorse of modern AI infrastructure.

- S&P 500 Earnings Chart: A chart showing the disproportionate contribution of AI-related stocks to S&P 500 earnings growth.

- Magnificent Seven Logos: Logos of Apple, Microsoft, Amazon, Alphabet, Meta, Nvidia, and Tesla, highlighting the companies driving the AI earnings boom.

Implications for the Future

The concentration of earnings in AI-driven companies has profound implications for the global economy. While AI continues to drive innovation and productivity gains, the risks of market imbalances and overvaluation cannot be ignored. As the gap between the tech sector’s market cap and net income widens, investors and policymakers must remain vigilant to ensure that the AI revolution benefits the broader economy, not just a select few.

In conclusion, AI is indeed “eating all the earnings” in 2025, but the sustainability of this trend remains uncertain. As the market evolves, the focus will shift from rapid growth to long-term value creation, with implications for investors, companies, and the global economy as a whole.