AI Investment Strategies: Insights from Major Investor

Major investor shares insights on AI investment strategies, highlighting selective approaches, risk management, and long-term growth potential.

Investing in AI: Insights from a Major Investor’s Perspective

Artificial Intelligence (AI) has rapidly emerged as a transformative force reshaping industries, economies, and investment landscapes globally. In a recent analysis published by The Wall Street Journal, one of the world’s largest investors shared a detailed perspective on AI investment strategies, opportunities, and risks. This article comprehensively explores the insights from this influential investor, contextualizes the current AI investment climate, and examines the broader implications for the technology sector and financial markets.

Background: The Growing AI Investment Boom

AI technologies, including machine learning, natural language processing, and computer vision, have become integral to innovation in sectors such as healthcare, finance, automotive, and consumer technology. According to a 2025 report by the International Data Corporation (IDC), global spending on AI systems is projected to exceed $500 billion by the end of this year, reflecting a compound annual growth rate of over 20%.

Large institutional investors have taken a keen interest in AI due to its potential for outsized returns and industry disruption. The Wall Street Journal’s featured investor, whose name remains confidential but is noted for managing tens of billions in assets, highlighted the importance of a nuanced approach to AI investment amid rising valuations and evolving technology.

Key Perspectives from the Investor

1. Selective Investment Approach

The investor emphasized the need to differentiate between AI hype and substantive technological progress. While AI-related companies have seen surging valuations, not all are positioned to deliver sustainable growth. The investor’s firm focuses on:

- Companies with strong AI research and development capabilities.

- Firms integrating AI deeply into their core business models rather than those offering surface-level AI products.

- Startups and established companies with proprietary datasets and unique AI algorithms.

2. Balancing Risk and Reward

Investment in AI is characterized by both potential and uncertainty. The investor cautioned that regulatory scrutiny, ethical concerns, and technological limitations could introduce volatility. To mitigate risks, the firm adopts a diversified portfolio strategy, combining investments in:

- AI infrastructure providers (chipmakers, cloud computing firms).

- Application-driven companies (healthcare AI diagnostics, autonomous vehicles).

- AI software and services companies with recurring revenue models.

3. Long-Term Horizon

The investor underlined the importance of a long-term outlook. Despite short-term market fluctuations, the transformative impact of AI is expected to unfold over decades. Patience and commitment to fundamental analysis are key to capitalizing on AI’s growth trajectory.

Industry Impact and Market Trends

AI’s Cross-Sector Penetration

AI’s adoption is no longer confined to tech giants. Industries such as finance use AI for fraud detection and algorithmic trading, healthcare employs AI for personalized medicine, and manufacturing integrates AI for predictive maintenance and automation. The investor highlighted that this broad penetration creates multiple entry points for investment.

Valuation and Market Dynamics

AI-related stocks have experienced significant volatility. For example, shares of leading AI chip manufacturers like NVIDIA surged over 30% in the past year, reflecting strong demand for AI hardware. However, some AI startups face valuation corrections due to unmet expectations and profitability concerns.

Regulatory Environment

Governments worldwide are increasingly scrutinizing AI technologies for privacy, bias, and security risks. The investor noted that companies proactively addressing regulatory challenges and ethical AI practices are more likely to sustain investor confidence and long-term growth.

Context and Implications

AI investment is at a pivotal juncture. The convergence of technological breakthroughs, capital inflows, and regulatory frameworks will shape the future of AI deployment and value creation. According to the investor, a disciplined, informed, and patient investment strategy can unlock significant opportunities while managing inherent risks.

For investors, this means:

- Conducting thorough due diligence on AI companies’ technology and business models.

- Monitoring geopolitical and regulatory developments impacting AI.

- Investing across the AI value chain, from hardware to applications.

From a broader perspective, AI investment is a catalyst for economic transformation, driving productivity gains and new business models. However, it also demands responsible stewardship to ensure ethical AI use and societal benefit.

Visuals Related to AI Investment

- Image of AI chip manufacturing facility — illustrating the hardware backbone of AI innovation.

- Photo of a major AI conference or summit — depicting industry collaboration and investor interest.

- Company logos of leading AI firms and startups — representing key players in the AI investment landscape.

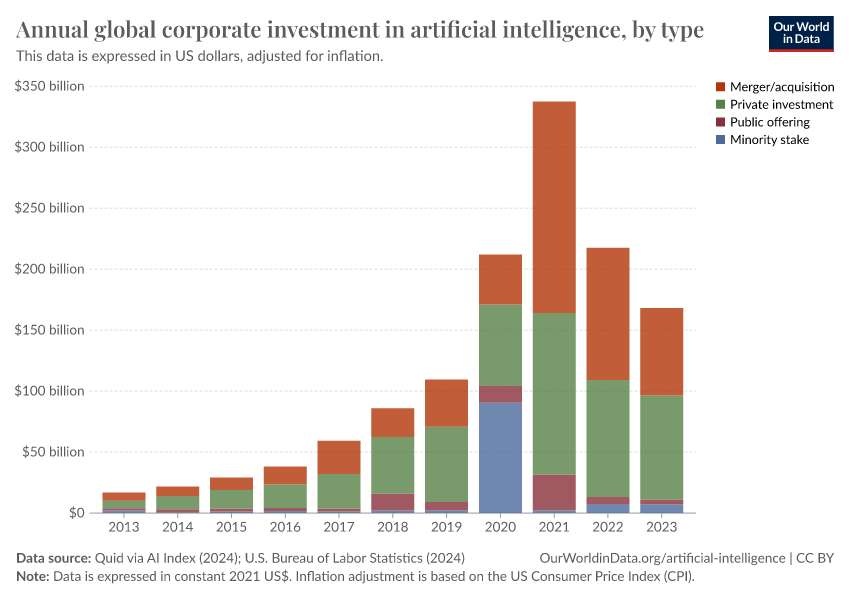

- Graph showing AI investment growth globally — visualizing market trends and capital flows.

- Portrait of the featured investor (if public) or an image representing institutional investment (e.g., stock trading floor).

Conclusion

The Wall Street Journal’s coverage of AI investing through the lens of a major investor provides valuable insights into navigating this dynamic and complex sector. As AI continues to evolve, investors who balance innovation enthusiasm with rigorous analysis and risk management are poised to capitalize on one of the most significant technological revolutions of the 21st century.

The AI investment narrative remains one of cautious optimism, underscored by the potential to generate transformative economic value and the need to address technological and ethical challenges responsibly. This balanced view from a leading investor offers a blueprint for those seeking to harness AI’s promise in the global financial markets.