Anthropic CEO Warns on AI Spending Risks: Financial Stability at Stake

Anthropic's leadership has raised critical concerns about unsustainable capital expenditure in the AI sector, highlighting potential financial stability risks as companies race to build competing large language models without clear paths to profitability.

The Warning Signal from Anthropic

Anthropic's CEO has issued a stark warning about the financial trajectory of the artificial intelligence industry, cautioning that excessive spending by certain AI firms poses significant risks to both individual companies and broader market stability. The concern centers on a fundamental mismatch: massive capital outlays for infrastructure and model development are not yet translating into sustainable revenue streams or clear business models.

The Spending Paradox

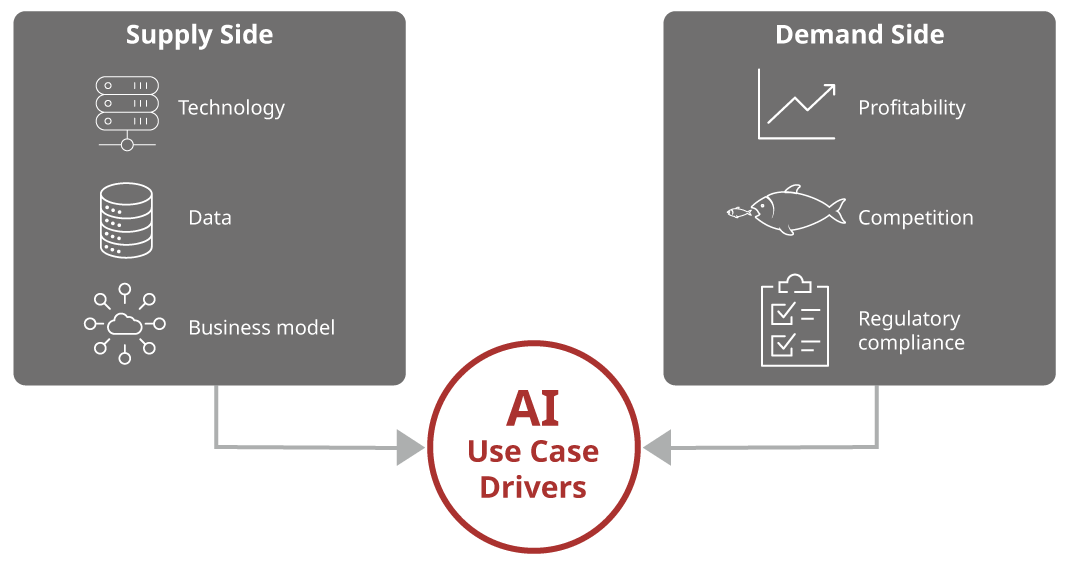

The AI sector faces a critical paradox. Companies are investing billions in compute infrastructure, data acquisition, and talent recruitment—often before demonstrating viable monetization strategies. This pattern mirrors historical technology bubbles, where speculative fervor outpaces fundamental economics.

Key concerns include:

- Infrastructure costs: Training and deploying large language models requires enormous computational resources, with some estimates suggesting billions in annual spending across the industry

- Competitive pressure: Fear of falling behind drives companies to spend aggressively, regardless of near-term returns

- Talent acquisition: Bidding wars for AI researchers and engineers have inflated compensation costs across the sector

- Uncertain ROI: Many AI applications remain experimental, with unclear paths to revenue generation

Financial Stability Implications

The Anthropic CEO's warning aligns with broader concerns raised by financial regulators and economists about AI's role in market dynamics. When capital allocation becomes untethered from fundamentals, systemic risks can accumulate. This is particularly concerning given AI's increasing integration into financial systems and critical infrastructure.

The concern extends beyond individual company performance. If major AI firms face funding pressures or financial distress, the ripple effects could impact:

- Cloud infrastructure providers dependent on AI workloads

- Semiconductor manufacturers supplying chips for AI training

- Venture capital markets that have concentrated heavily on AI investments

- Public markets where AI-focused companies trade at elevated valuations

Industry Response and Accountability

The warning from Anthropic's leadership represents a notable moment of candor within an industry often characterized by optimistic rhetoric. It suggests that even well-funded, technically sophisticated companies recognize the unsustainability of current spending trajectories.

Some firms are beginning to emphasize efficiency metrics and cost-per-inference improvements. Others are exploring alternative business models, including licensing arrangements and API-based services designed to generate recurring revenue. However, these efforts remain nascent.

The Path Forward

Sustainable AI development likely requires a recalibration of expectations and spending patterns. This could involve:

- Efficiency focus: Prioritizing model optimization and inference cost reduction over raw capability increases

- Revenue clarity: Developing concrete monetization strategies before massive capital deployment

- Market consolidation: Potential consolidation among weaker players unable to sustain spending

- Regulatory scrutiny: Increased attention from financial regulators to systemic risks

Key Sources

The financial stability concerns raised by Anthropic's leadership reflect broader industry analysis from organizations tracking AI's economic impact and systemic implications. These warnings echo discussions within financial regulatory bodies examining AI's role in market dynamics and potential concentration risks.

The CEO's intervention is significant because it comes from within the industry itself—not from external critics or skeptics. When technology leaders acknowledge spending risks, it signals that even optimistic stakeholders recognize the need for financial discipline and sustainable business models.

As the AI sector matures, the distinction between companies with viable business models and those dependent on continued capital infusions will become increasingly apparent. Anthropic's warning serves as a timely reminder that technological capability alone does not guarantee financial viability or market sustainability.