Cisco Stock Rises on Strong AI Demand and Earnings Beat

Cisco's stock rises on strong AI demand and earnings beat, with upgraded fiscal 2026 revenue forecast and significant AI infrastructure orders.

Cisco Stock Rises on Strong AI Demand and Earnings Beat

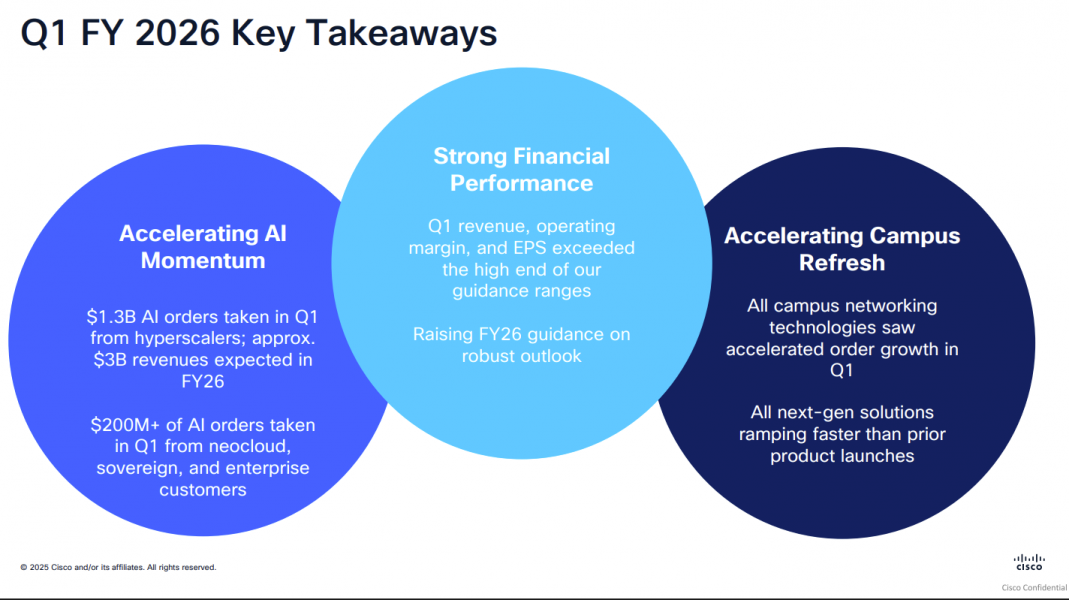

Cisco Systems has reported a significant earnings performance that surpassed Wall Street expectations, leading to a notable increase in the company's stock. The announcement highlighted robust AI infrastructure orders and an upgraded fiscal 2026 revenue forecast, marking a pivotal moment in Cisco's transformation into an AI-era technology leader.

Strong Earnings Performance Drives Market Confidence

- Revenue: Cisco reported third-quarter revenue of $15.02 billion, exceeding analyst estimates of $14.78 billion.

- Earnings Per Share: Adjusted earnings per share reached $1.04, surpassing the expected $0.98.

- Stock Movement: The stock climbed over 7% in after-hours trading.

- Product Orders: Orders grew approximately 20% year-over-year, with 9% growth excluding the Splunk acquisition.

AI Infrastructure Orders Accelerate Beyond Expectations

- AI Orders: Cisco reported $1.3 billion in AI infrastructure orders for the quarter.

- Fiscal 2025 Total: Over $2 billion in AI infrastructure orders have been accumulated, more than doubling the original target.

- Enterprise Confidence: The demand trajectory validates Cisco's strategic investments in AI networking technologies.

Fiscal 2026 Guidance Raises Investor Expectations

- Revenue Outlook: Projected revenues between $60.2 billion and $61.0 billion.

- Earnings Guidance: Upgraded to a range of $4.10 to $4.20 per share.

- Strategic Positioning: Reflects confidence in sustained AI infrastructure demand and successful Splunk integration.

Splunk Integration Driving Platform Synergies

- Integration Progress: Faster-than-expected integration of Splunk.

- Joint Customers: Over 400 joint customers attracted to the combined platform.

- Revenue Model Shift: Transition toward higher-margin recurring revenue models.

Margin Resilience Amid Tariff Pressures

- Gross Margins: Improved margins suggest better cost control and product mix optimization.

- Operational Efficiency: Helped offset cost pressures despite tariff concerns.

Market Implications and Analyst Sentiment

- Analyst Sentiment: Shifted to moderately bullish.

- Stock Performance: Year-to-date performance over 20%.

- Price Targets: Projections of $70 and above if performance continues.

Looking Ahead: The AI Infrastructure Opportunity

Cisco's Q3 earnings validate the company's AI infrastructure strategy. The convergence of strong demand, successful Splunk integration, and operational efficiency positions Cisco to continue delivering shareholder value. As enterprises invest in networking and observability infrastructure, Cisco is well-positioned to capture a significant share of this opportunity.

Original Source Info: "Cisco’s stock climbs as AI networking demand drives earnings beat - MarketWatch"