Deutsche Bank Warns of AI Boom Risks: Infrastructure Strain and Market Instability

Deutsche Bank has raised alarms about the unsustainable pace of artificial intelligence expansion, warning that rapid infrastructure buildout and massive capital expenditures could trigger a market correction or worse.

Deutsche Bank Sounds the Alarm on AI Growth Trajectory

Deutsche Bank has issued a stark warning about the accelerating artificial intelligence boom, cautioning that the rapid expansion of AI infrastructure and investment could lead to significant market instability or even a collapse. The bank's analysis suggests that the current trajectory of AI spending and deployment is outpacing both technical feasibility and financial sustainability, creating systemic risks across the technology sector and broader economy.

The Infrastructure Crunch

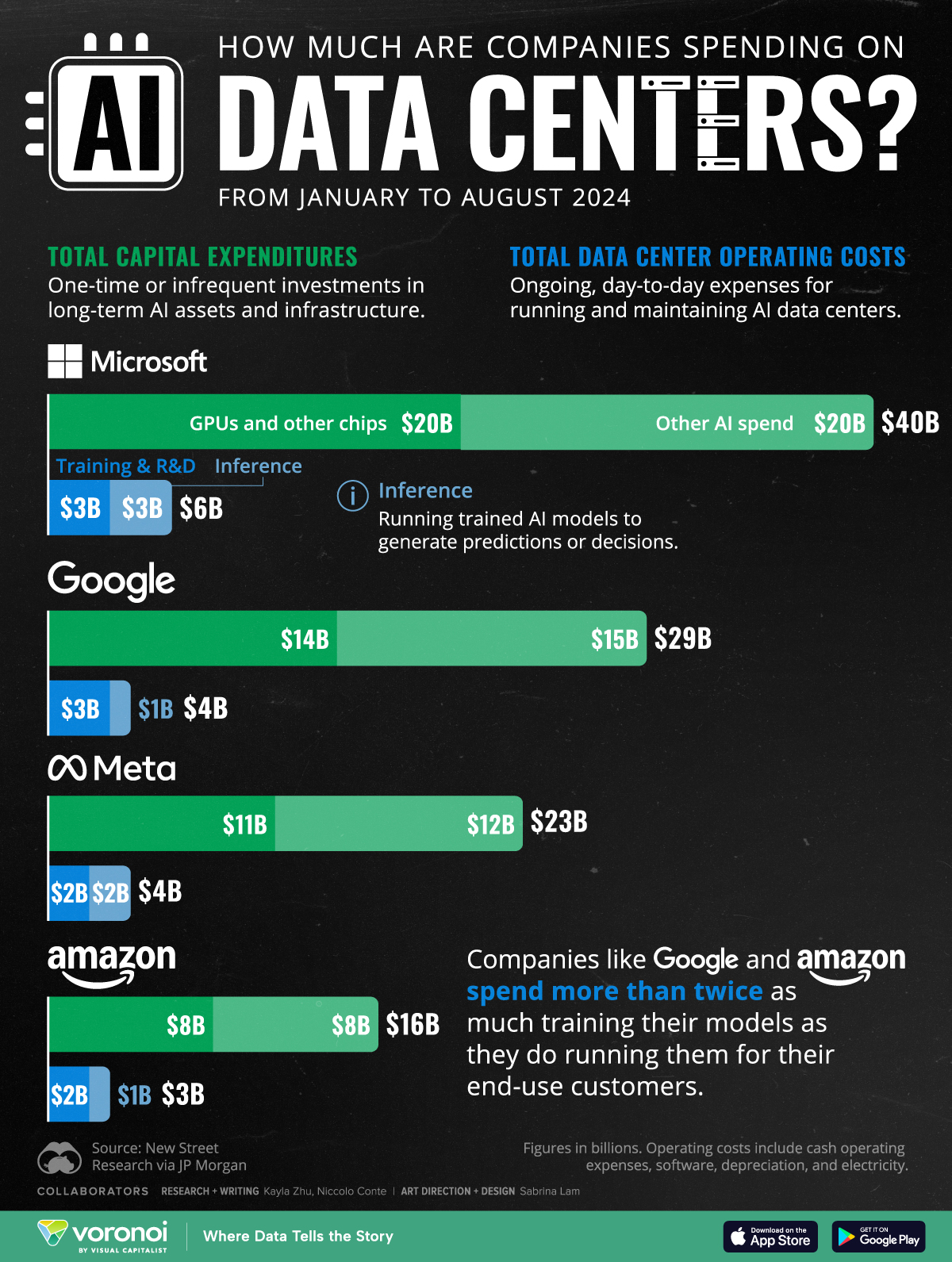

The core concern centers on the explosive growth in data center construction and capital expenditure required to support AI systems. Major technology companies are pouring unprecedented sums into building out AI infrastructure, with spending on data centers reaching record levels. This massive capital allocation creates several interconnected risks:

- Power consumption constraints: AI data centers demand extraordinary amounts of electricity, straining grid infrastructure and raising questions about long-term energy availability

- Capital inefficiency: The scale of spending may exceed what can be productively deployed, leading to stranded assets and wasted investment

- Supply chain bottlenecks: Semiconductor and infrastructure component shortages could constrain growth and inflate costs further

Market Valuation Concerns

Deutsche Bank's analysis suggests that current market valuations of AI-focused companies may not align with realistic revenue generation timelines. The bank points to a potential disconnect between:

- Massive infrastructure investments being made today

- Actual monetization pathways that remain unclear for many AI applications

- Return on investment timelines that could stretch far longer than current market expectations

This valuation gap, if corrected, could trigger significant portfolio losses and market repricing across technology stocks.

Systemic Risk Implications

Beyond individual company performance, Deutsche Bank highlights broader systemic risks:

The concentration of AI investment in a handful of mega-cap technology firms creates potential contagion effects. Should these companies face margin pressure or capital constraints, the ripple effects could spread throughout the financial system. Additionally, the energy demands of AI infrastructure could create real-world constraints on power availability for other sectors, potentially triggering inflation or economic slowdown.

The Sustainability Question

A critical element of Deutsche Bank's warning concerns the sustainability of current spending patterns. The bank questions whether:

- Current AI applications justify the infrastructure investments being made

- Alternative, more efficient approaches might emerge that render current buildouts obsolete

- Regulatory constraints on AI development could suddenly shift the investment calculus

What This Means for Investors and Stakeholders

Deutsche Bank's warning suggests a need for more rigorous due diligence on AI-related investments. The bank's analysis implies that not all AI spending will generate proportional returns, and investors should scrutinize:

- Which companies have clear paths to monetization

- Whether infrastructure investments align with realistic demand forecasts

- How regulatory and energy constraints might impact future growth

Looking Ahead

While artificial intelligence undoubtedly represents a transformative technology, Deutsche Bank's cautionary stance reflects growing concern among sophisticated market observers that the current pace and scale of investment may be unsustainable. The bank's warning serves as a reminder that even revolutionary technologies can be subject to boom-and-bust cycles if investment outpaces fundamentals.

The coming months will likely reveal whether current AI infrastructure buildout represents prudent investment in the future or a speculative bubble waiting to deflate. Market participants should monitor key indicators including data center utilization rates, AI application adoption metrics, and energy availability constraints as potential early warning signs.

Key Sources: Deutsche Bank research and analysis on AI infrastructure spending; industry reports on data center capital expenditure and power consumption trends; technology sector valuation studies examining AI company market multiples.