Gemini Breaks 21% Market Share as ChatGPT's Dominance Erodes

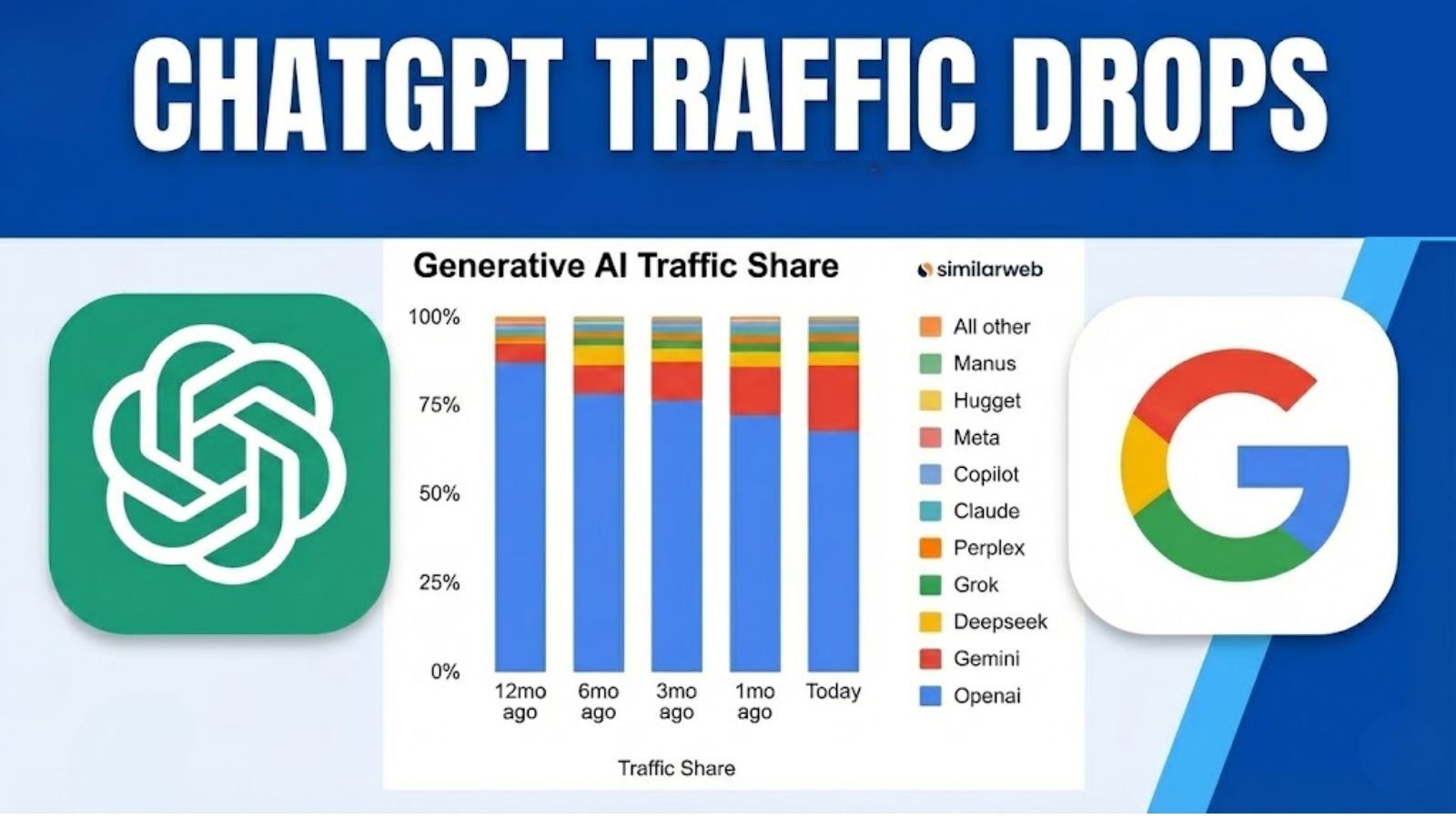

Google's Gemini has surged to 21% market share, marking a decisive shift in the AI chatbot landscape as ChatGPT loses ground to aggressive competition. The market dynamics reveal a fundamental reshuffling of user preferences and enterprise adoption patterns.

The AI Chatbot Market Enters a New Era

The dominance of ChatGPT in the generative AI space is no longer assured. According to recent market data, Google's Gemini has captured 21% market share, signaling a fundamental realignment in how users and enterprises choose their AI tools. This isn't a minor fluctuation—it represents a structural shift in a market that ChatGPT once controlled with near-monopolistic grip.

The implications are significant. ChatGPT is actively losing market share as competitors expand their capabilities and distribution. What was once a two-horse race between OpenAI and Microsoft has become a multi-player arena where Google's integration advantages, Elon Musk's Grok, and other emerging players are fragmenting the market.

Understanding Gemini's Rapid Ascent

Google's success with Gemini stems from several converging factors:

- Integrated Ecosystem: Seamless integration with Gmail, Google Workspace, and Search gives Gemini distribution advantages competitors cannot easily replicate

- Enterprise Adoption: Market analysis shows Gemini gaining traction in enterprise settings, where IT departments prefer solutions aligned with existing Google infrastructure

- Competitive Pricing: Google's willingness to offer aggressive pricing and free tier access has accelerated user acquisition

- Technical Improvements: Recent iterations of Gemini have narrowed the capability gap with ChatGPT, particularly in reasoning and multimodal tasks

According to ElectroIQ's analysis, Gemini's web traffic growth has been exponential, reflecting both organic user migration and Google's promotional efforts across its platform.

The Broader Market Fragmentation

The 21% milestone for Gemini doesn't tell the complete story. Market share data reveals a more nuanced competitive landscape, where multiple players are carving out niches:

- ChatGPT remains the largest player but with declining growth rates

- Grok has overtaken Perplexity in some metrics, showing how quickly market positions can shift

- Specialized tools are fragmenting use cases away from general-purpose chatbots

- Regional variations show different adoption patterns across geographies and industries

This fragmentation reflects market maturation. Early adopters consolidated around ChatGPT due to first-mover advantage and brand recognition. Now, as the technology commoditizes, users are optimizing for specific use cases, pricing, and integration needs.

What This Means for the Industry

The erosion of ChatGPT's dominance has several implications:

For OpenAI: The company must accelerate innovation and improve its enterprise value proposition. Relying on brand recognition is no longer sufficient in a market where competitors offer comparable capabilities at lower costs.

For Google: Gemini's growth validates the company's strategy of leveraging its ecosystem. However, maintaining momentum requires continued product improvements and preventing user churn to emerging alternatives.

For Users and Enterprises: Increased competition drives innovation and pricing pressure, benefiting those willing to evaluate alternatives. The days of a single "best" AI tool are ending.

For the Market: The shift toward 21% for Gemini and declining ChatGPT share suggests the AI chatbot market is normalizing. Expect continued consolidation around 3-5 major players, with specialized tools serving niche demands.

The Competitive Landscape Ahead

Gemini's 21% market share represents a watershed moment, but it's not the end of the story. ChatGPT still commands the largest user base, and OpenAI's technical capabilities remain formidable. However, the trajectory is clear: the era of single-vendor dominance in AI chatbots is over. The market is entering a phase of sustained competition where integration, pricing, and specialized capabilities will determine winners and losers.

For stakeholders across the industry, the message is unambiguous: complacency is no longer an option.