Meta Acquires AI Startup Manus to Enhance Agent Capabilities

Meta acquires Manus, enhancing AI agent capabilities and expanding its ecosystem with millions of users. The acquisition aligns with Meta's 2025 AI strategy.

Meta Acquires AI Startup Manus, Bolstering Intelligent Agent Capabilities in Aggressive 2025 Push

Meta Platforms has acquired Manus, a Singapore-based startup specializing in general-purpose AI agents, in a move that integrates millions of paying users and advanced automation tools into its ecosystem. The deal, announced on December 29, 2025, caps a year of bold AI investments for the tech giant, including partnerships with SoftBank and Nvidia, and positions Meta to challenge rivals like OpenAI in autonomous agent technology.

Official Manus blog header image from the acquisition announcement, featuring the "Manus Joins Meta" logo and AI agent visuals.

Background on Manus and the Acquisition

Manus, founded in 2025, rapidly emerged as a leader in AI agents—autonomous systems capable of handling complex tasks like research, automation, and multi-step workflows without constant human input. Its flagship product, a general-purpose agent launched earlier this year, has processed over 147 trillion tokens and powered the creation of more than 80 million virtual computers, demonstrating massive scale in real-world applications.

The acquisition brings Manus's subscription-based service, which serves millions of paying users globally, directly under Meta's umbrella. According to Manus CEO Xiao Hong, the deal provides "a stronger, more sustainable foundation" while preserving operational independence. The company will continue operating from Singapore, maintaining its app, website sales, and product roadmap without disruption to customers.

Reports from major outlets confirm the strategic fit: CNBC described it as capping Meta's "aggressive AI moves," while The Wall Street Journal highlighted the influx of paying users. Reuters noted Manus's Chinese roots but emphasized post-acquisition shifts, with Nikkei Asia reporting that Manus plans to "cut China ties" to align with Meta's global operations.

Screenshot of Manus AI agent interface, showing browser automation and research tools, as featured on Manus.im product page.

Key Details of the Deal and Technology

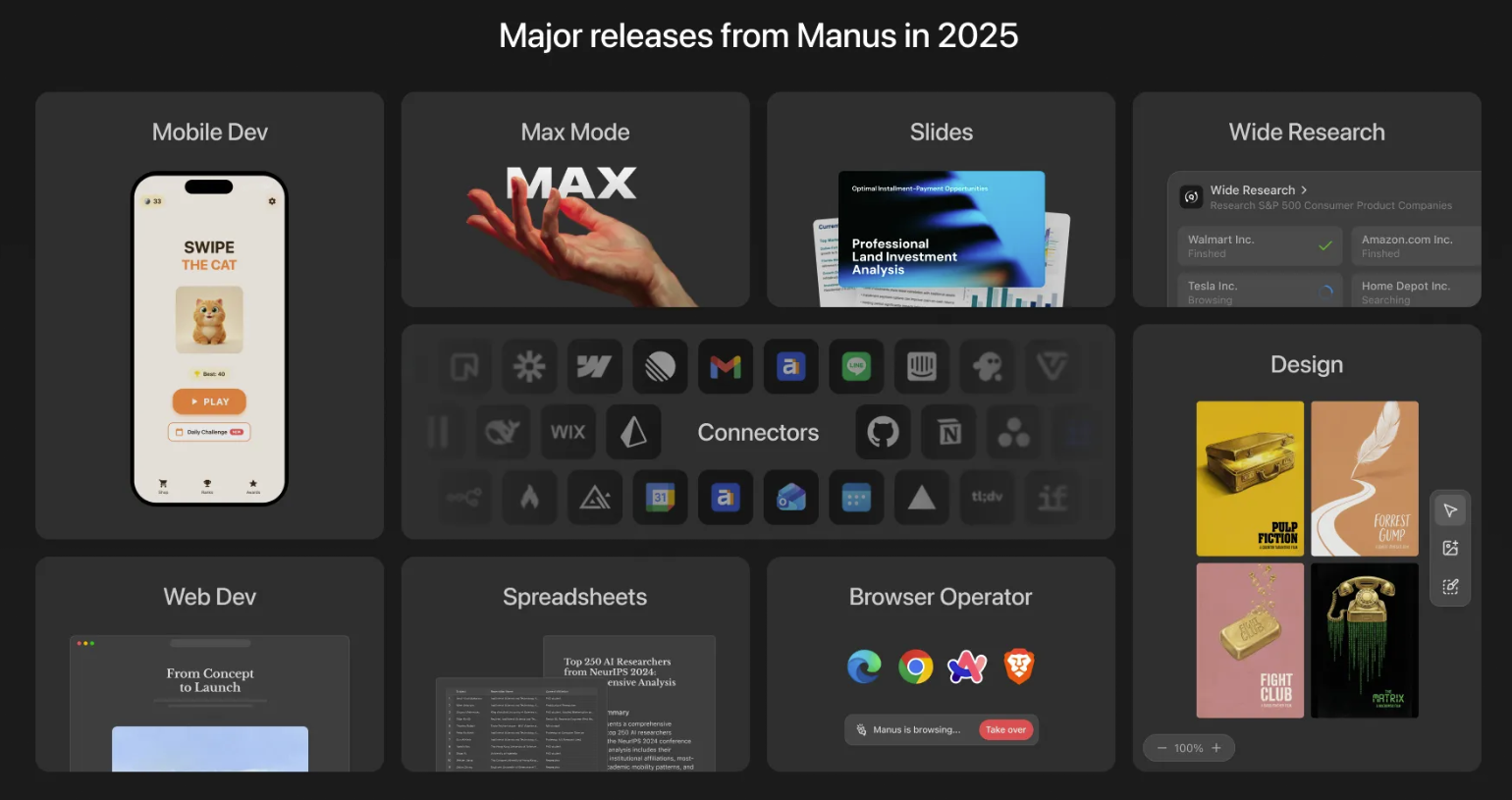

Financial terms remain undisclosed, but industry analysts peg the valuation in the hundreds of millions, given Manus's user traction and token processing volume. The startup's tech stack includes tools like Manus Browser operator, Wide Research, Mail Manus, and Slack integration, enabling agents to execute end-to-end tasks such as generating AI slides, design prototypes, and managing virtual environments.

Post-acquisition, Manus aims to integrate with Meta's vast platforms, potentially expanding to billions of users on Facebook, Instagram, and WhatsApp. "Joining Meta allows us to... expand this subscription to the millions of businesses and billions of people on Meta’s platforms," Xiao Hong stated. This echoes Meta's broader 2025 strategy, marked by holiday-season AI splurges alongside SoftBank and Nvidia, as reported by The Information.

Manus's agents stand out for reliability in "real-world settings," iterating on capabilities like processing unstructured data and scaling virtual compute. Since launch, the platform has focused on turning advanced AI models into "execution layers" for practical use cases, from enterprise automation to individual productivity.

Strategic Implications for Meta's AI Ambitions

This acquisition accelerates Meta's pivot toward agentic AI, where systems act independently rather than just responding to queries. CEO Mark Zuckerberg has long championed open-source AI, and Manus fits by enhancing Llama models with agentic behaviors. It addresses gaps in Meta AI's current offerings, which lag behind competitors like Anthropic's Claude or Google's Gemini in multi-tool orchestration.

For Manus users, continuity is assured: subscriptions persist via existing channels, with promises of "accelerated product improvements." The deal also sidesteps geopolitical risks; despite early Chinese development ties, Manus's Singapore base and planned decoupling ensure compliance with U.S. export controls.

Portrait of Manus CEO Xiao Hong from the official team page, credited in the acquisition blog post.

Industry Impact and Broader Context

The move intensifies the AI arms race. OpenAI's o1 model and Google's agent prototypes face stiffer competition, as Meta gains proprietary data from Manus's 80 million virtual computers—fuel for training more capable successors. Analysts predict agent tech could unlock a $100 billion market by 2030, per McKinsey estimates, with applications in e-commerce, customer service, and content creation.

Meta's 2025 spree reflects urgency: earlier deals included AI chip investments with Nvidia and joint ventures with SoftBank. This caps a year where Meta deployed Meta AI to 1 billion users, but agentic features were nascent. Manus fills that void, potentially powering features like autonomous shopping agents on Instagram or research bots in WhatsApp.

Critics raise antitrust flags, given Meta's dominance, but regulators have greenlit similar deals. For startups, it's a blueprint: build fast, scale users, attract giants. Manus's trajectory—from zero to 147 trillion tokens in months—validates the agent hype.

Visual from Manus product page illustrating AI agent executing complex tasks like research and automation.

Future Outlook

Expect rapid integrations: Manus agents could debut in Meta's ecosystem by Q1 2026, blending with Ray-Ban smart glasses or Quest VR for embodied AI. Challenges remain—agent reliability hovers at 80-90% in benchmarks, per industry reports—but Meta's resources promise leaps.

This acquisition underscores 2025's theme: AI consolidation. As Xiao Hong put it, it's about the "next era of innovation," where agents evolve from tools to teammates. Meta, now armed with Manus, leads the charge.

(Word count: 782)