Visa and Mastercard Develop AI Agents for Autonomous Shopping

Visa and Mastercard are developing AI agents for autonomous shopping, with commercial rollouts planned for 2026, transforming agentic commerce.

AI Agents Transforming Commerce: Visa and Mastercard's Role

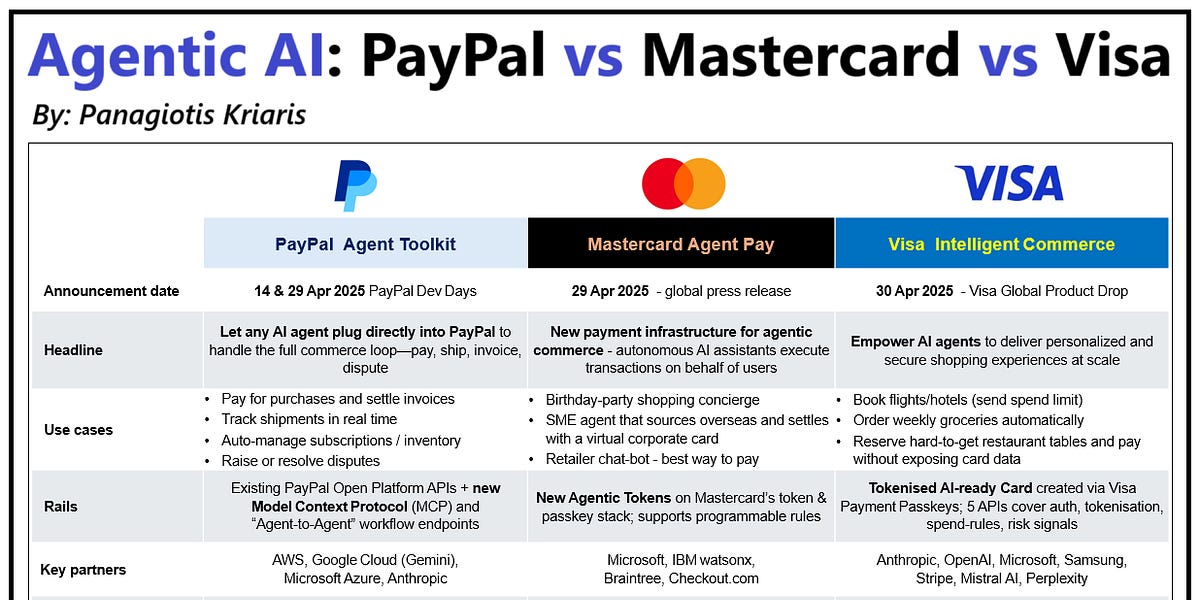

Payment giants Visa and Mastercard are advancing the development of AI agents that autonomously book flights, shop online, and manage payments. These initiatives position them as crucial infrastructure in the emerging field of agentic commerce. Recent pilots have completed hundreds of secure, AI-initiated transactions, with commercial rollouts planned for 2026 across various regions.

Understanding Agentic Commerce

Agentic commerce signifies a shift where AI agents independently perform tasks such as product discovery, price comparison, checkout, and returns without human intervention. Visa's Visa Intelligent Commerce platform, available in AWS Marketplace, offers developers tools for authentication, agentic tokenization, data personalization, and user intent capture. This enables scenarios like instructing an AI to "buy basketball tickets if the price drops below $150," allowing the agent to monitor, decide, and transact securely.

Mastercard's Agent Pay allows AI agents to shop using stored card credentials, emphasizing authenticated, transparent, and monitorable payments. Both companies highlight security features such as spending caps, merchant restrictions, and real-time fraud detection to build consumer trust. According to Visa's October research with Morning Consult, 47% of U.S. consumers now use AI for tasks like price comparisons or recommendations.

Key Developments and Pilots

Visa has completed hundreds of transactions in a pilot program that automates consumer purchases. Rubail Birwadker, Visa's senior vice president, stated, “In 2026, AI agents won’t just assist your shopping — they will complete your purchases.” Over 100 partners are building on Visa Intelligent Commerce, with more than 30 in a dedicated sandbox and 20+ agents integrating directly.

Notable pilots include:

- Ramp automating B2B bill payments with cashback capture.

- Retail Shopping Agent blueprint managing end-to-end experiences: discovery, comparisons, cart management, loyalty, checkout, tracking, and returns.

- B2B Payment Agent integrating with ERP, CRM, accounting, and banking systems for supplier payments and reconciliation.

Mastercard focuses on similar capabilities within chat interfaces. Processor Fiserv adopted Visa's Trusted Agent Protocol and Mastercard's Agent Pay Acceptance Framework, equipping merchants to accept autonomous transactions confidently.

Industry Partnerships and Global Expansion

Visa and AWS publish open blueprints for industry-agnostic workflows, supporting multi-network payments. Fiserv integrates these to help merchants, ISVs, and sales organizations without disrupting operations. Expansion plans target Asia-Pacific and Europe in early 2026, with readiness in Latin America, the Caribbean, and the Middle East.

Implications for Consumers, Merchants, and the Economy

For consumers, agentic AI promises frictionless experiences tailored to preferences, budgets, and rules. Businesses benefit from automated B2B procurement and loyalty optimization, unlocking new revenue. Challenges include authenticating AI traffic, scaling fraud systems, and ensuring merchants adapt without losing customer control.

Payments networks like Visa and Mastercard aim to remain central by embedding AI into transaction flows, evolving from swipe-to-online to intelligent, autonomous commerce. Security remains paramount, with protocols validating agents and protecting against unauthorized activity. With pilots proving viability, 2026 could mark mainstream adoption, reshaping e-commerce from assistive tools to fully autonomous systems.

This infrastructure shift positions fintech leaders to handle AI-driven volume, benefiting a projected explosion in automated transactions while prioritizing trust and control.