Global Economy 2025: How AI and Trade Wars Shape the Future

Explore how the global economy in 2025 thrives amid trade wars and AI challenges, balancing innovation with geopolitical risks.

The World Economy Shrugs Off Trade War and AI Fears in 2025

Despite persistent concerns about the ongoing trade war and the rapid rise of artificial intelligence (AI), the global economy in 2025 has demonstrated remarkable resilience, shrugging off potential shocks from both fronts. Economic activity remains robust, with markets and investors showing confidence, even as uncertainties linger around AI’s long-term impact and the consequences of tariff policies, particularly in the United States.

Current Economic Landscape: Trade War and AI Impact

The global economy has faced two significant challenges in recent years: escalating protectionist trade policies, notably the U.S.-China trade war, and the surge in AI-driven technological transformation. Initially, fears abounded that tariffs would severely disrupt supply chains, increase costs for consumers, and dampen growth worldwide. Similarly, AI’s rapid expansion sparked worries about job losses, market volatility, and unsustainable speculative bubbles in tech stocks.

However, as of late 2025, these fears have not materialized into a major economic downturn. Instead, the world economy has absorbed these shocks better than expected. Key to this resilience is the underlying strength of demand in major economies and the rapid innovation fostered by AI technologies that continue to drive productivity growth, even if unevenly distributed.

Trade War Effects: Still Present but Managed

The U.S. tariff regime, which imposes taxes on a wide range of imports, has indeed raised import prices and contributed to inflationary pressures, but these effects have been more muted than initially feared. Unlike the 2018 trade war, where foreign exporters absorbed much of the tariff costs through price discounts, recent evidence suggests that American importers and companies are absorbing the tariffs, at least temporarily, delaying direct price increases to consumers.

Federal Reserve officials acknowledge that these tariffs will eventually translate into higher consumer prices, but so far, companies have used various strategies to mitigate immediate pass-through effects. This has helped prevent a sharp contraction in consumer spending, a critical factor in sustaining economic growth.

AI’s Dual Role: Growth Driver and Risk Factor

Artificial intelligence has been a major driver of stock market gains in 2025, particularly in the U.S., where AI-related companies have accounted for about 80% of the year’s equity market gains. This surge has fueled investment and optimism about AI’s potential to revolutionize industries, boosting productivity and economic output.

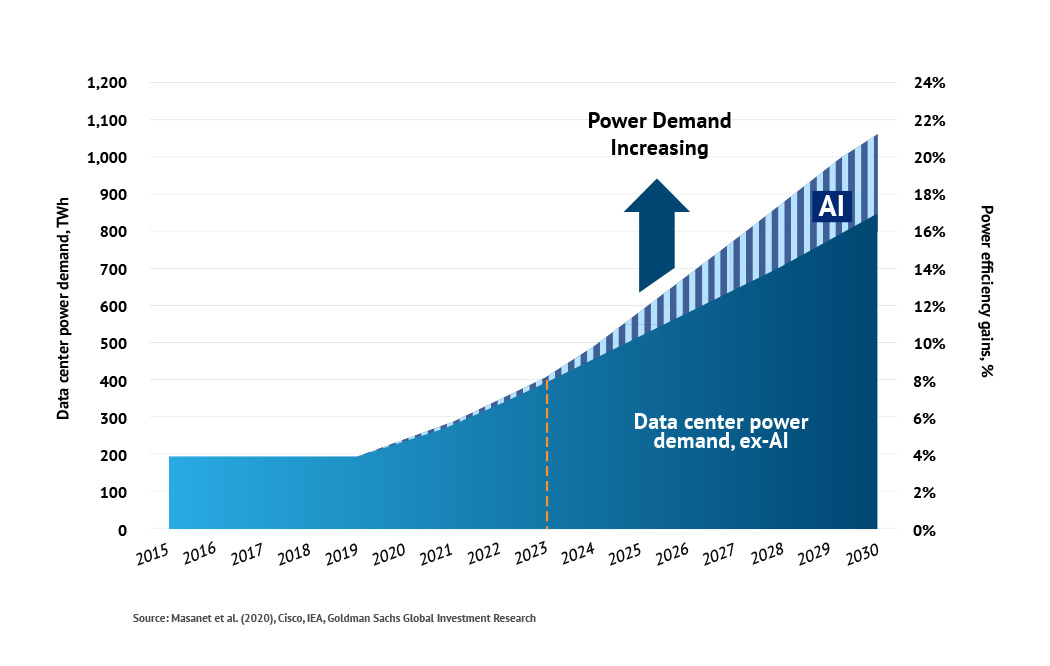

At the same time, the rapid expansion of AI infrastructure, especially data centers, is creating new challenges. For example, OpenAI alone consumes as much electricity as two major U.S. cities combined during peak times, raising concerns about energy sustainability and costs. Additionally, there is a growing debate about whether AI’s promised productivity gains will materialize quickly or remain speculative, potentially leading to a financial bubble. Some analysts warn that AI investment is a big bet that might end in a bust, which could then trigger a broader economic slump.

Market Sentiment and Financial Stability

Market sentiment remains cautiously optimistic but vigilant. The U.S. dollar and Treasury yields have not behaved as they did during the 2008 financial crisis. Instead of a flight to safety, 2025 has seen relative dollar weakness amid tariff-related uncertainties and shifting investor behavior. Global investors are increasingly seeking higher returns rather than just safe havens, reflecting a more complex financial environment.

Kristalina Georgieva, Managing Director of the International Monetary Fund, highlighted this fragile optimism, noting that "easy financial conditions are masking but not arresting some softening trends, including in job creation," and warned that "history tells us this sentiment can turn on a dime."

Broader Context and Implications

The world economy’s ability to withstand both trade tensions and AI-related uncertainties in 2025 reflects a nuanced balance between innovation-driven growth and geopolitical-economic risks. AI continues to reshape labor markets and investment priorities, but its full disruptive impact remains uncertain. Meanwhile, the trade war underscores the risks of protectionism, especially as tariffs raise costs and complicate global supply chains.

Going forward, policymakers face the challenge of managing these dual forces. They must encourage sustainable AI adoption and innovation while addressing infrastructure and energy concerns. Similarly, resolving or easing trade tensions could prevent further inflationary pressures and support global economic stability.

The resilience observed so far should not breed complacency. Economists and market observers caution that underlying vulnerabilities—such as potential AI investment bubbles, energy constraints due to AI infrastructure, and tariff-driven inflation—could still trigger economic downturns if left unaddressed. The next few years will be critical in determining whether the world economy can sustain this robustness or if deeper corrections lie ahead.

Relevant Images for Context

- Global stock market charts illustrating AI sector gains in 2025

- Photographs of major AI data centers (e.g., OpenAI facilities) with energy consumption metrics

- Graphs showing tariff impacts on import prices and inflation trends in the U.S.

- Portraits of key figures such as Kristalina Georgieva, IMF Managing Director

These visuals provide concrete context to the economic narrative, illustrating how AI and trade policies tangibly affect markets, energy use, and economic policy outlooks.

Overall, the world economy in 2025 paints a picture of cautious optimism, tempered by the complex interplay of technological innovation and geopolitical-economic challenges. The ability to navigate this uncertain terrain will define global growth trajectories in the years to come.