Jim Cramer Advocates for Bold AI Investments Despite Risks

Jim Cramer supports aggressive AI investments despite potential market disruptions, emphasizing long-term gains over short-term challenges.

Jim Cramer Advocates for Bold AI Investments Despite Risks

Jim Cramer, the influential CNBC host and former hedge fund manager, has reiterated his strong support for aggressive investment in artificial intelligence (AI) infrastructure and technology buildout. Even if this process leads to significant disruptions or “casualties” in the market, Cramer believes the long-term benefits outweigh the short-term challenges.

Context of Cramer’s Statement

Cramer’s remarks come amid increased scrutiny of the massive capital expenditures companies are making to develop AI capabilities. These investments include cloud infrastructure, AI chip production, and software innovation. Often, these require reallocating resources, restructuring business models, or cutting legacy operations — actions that can cause short-term pain for companies, workers, or investors.

Despite these risks, Cramer emphasized that the long-term gains from building AI capacity justify the upfront costs and disruptions. He views AI as a transformative force that will redefine productivity, competitiveness, and market leadership. He describes this as a necessary “creative destruction” where some entities may falter, but the overall industry and economy benefit from AI’s advancement.

Jim Cramer’s AI Investment Philosophy

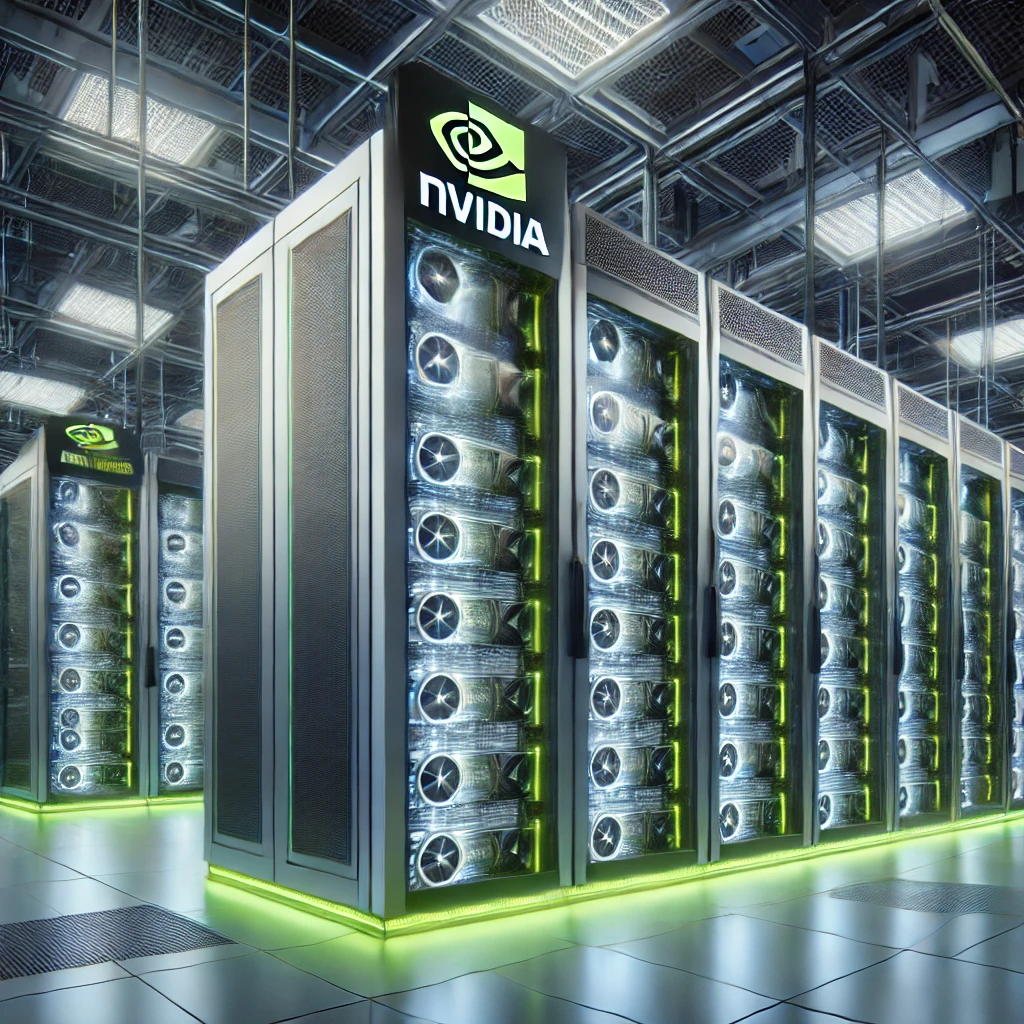

Cramer has been a vocal proponent of companies leading in AI hardware and services. Notably, he has praised NVIDIA, a dominant player in AI chips and machine learning platforms, for its visionary leadership and robust earnings growth driven by AI demand. NVIDIA’s success epitomizes the kind of AI buildout Cramer advocates: heavy upfront investment that fuels sustained innovation and market expansion.

Other AI-related stocks Cramer has favored include cybersecurity firms like CrowdStrike, which leverage AI for threat detection, and biotechnology companies like Eli Lilly, increasingly using AI for drug discovery. His investment framework for AI stocks involves:

- Evaluating growth in earnings and revenues tied to AI adoption

- Assessing management’s strategic foresight in AI deployment

- Considering industry trends positioning the company at the forefront of AI transformation

- Benchmarking against market indices to gauge relative performance

Market and Industry Implications

Cramer’s stance reflects a broader market reality: AI is driving a reallocation of capital and talent, pushing companies to invest heavily in AI infrastructure despite some inevitable disruptions. This can lead to:

- Short-term volatility in stock prices for companies undergoing AI-related transformation or those displaced by AI innovation

- Job displacement and reskilling challenges as AI automates certain functions while creating demand for new skills

- Consolidation in tech sectors where only the most agile and well-capitalized firms survive and thrive

However, the long-term outlook remains optimistic. According to market analysts, AI spending could add trillions to the global economy by enabling automation, enhancing decision-making, and spawning new products and services. Cramer’s call to “justify the spend even if there are casualties” aligns with this vision, advocating for bold investments to capture AI’s upside rather than retreating from the risks.

Visualizing AI Buildout: Key Players and Technologies

- NVIDIA’s AI chips: The backbone of AI computing power, enabling everything from data centers to autonomous vehicles

- OpenAI and its partnerships: Driving advances in large language models and AI applications

- Cloud infrastructure providers: Expanding capacity to support AI workloads globally

Images of NVIDIA’s AI GPUs, Jim Cramer on CNBC, and diagrams of AI cloud architecture can help illustrate the scale and impact of this buildout.

Implications for Investors and the Economy

For investors, Cramer’s message is clear: embracing AI-driven transformation is essential, even if it means accepting short-term losses or market “casualties.” Those who invest wisely in AI leaders could benefit from outsized returns as AI reshapes industries.

For the broader economy, this phase of AI buildout represents a critical juncture, requiring balancing innovation enthusiasm with measures to mitigate workforce displacement and ensure equitable growth.

Cramer’s perspective reinforces the imperative for companies, investors, and policymakers to navigate AI’s disruptive potential with strategic foresight and resilience, ensuring that AI’s benefits outweigh the costs over time.