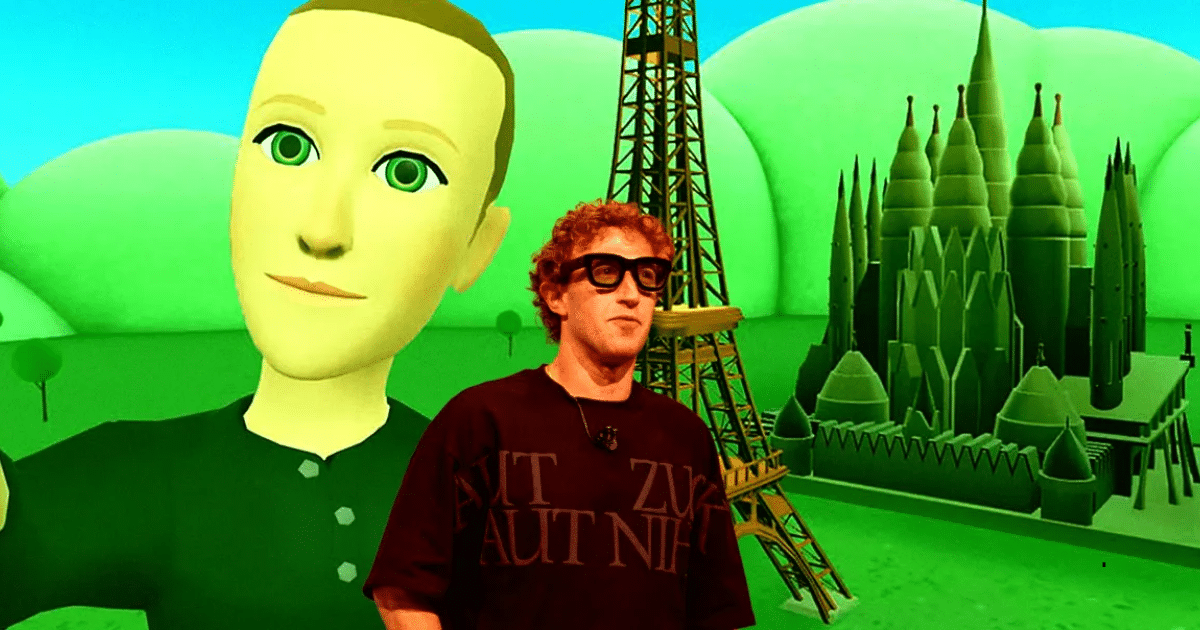

Meta Reality Labs Faces Potential 30% Budget Cuts as Zuckerberg Pivots Strategy

Meta's Reality Labs division is bracing for significant budget reductions as Mark Zuckerberg reassesses the company's metaverse ambitions. An emergency meeting signals a major strategic shift away from VR hardware and toward AI investments.

The Metaverse Reckoning Arrives

The metaverse dream is hitting a financial wall. According to reports, Meta's head of Reality Labs has called an emergency all-hands meeting to discuss potential budget cuts of up to 30%, marking a dramatic reversal in the company's VR strategy. The cuts represent a fundamental acknowledgment that Zuckerberg's multi-billion dollar bet on the metaverse has failed to deliver returns, forcing the tech giant to reallocate resources toward artificial intelligence—where the real competitive battle is heating up.

This isn't a minor budget adjustment. It's a strategic reckoning that exposes the widening gap between Meta's metaverse vision and market reality.

What the Cuts Mean

The 30% reduction would reshape Reality Labs' operations across multiple fronts:

- Hardware Development: Reduced investment in next-generation VR headsets, including the anticipated Quest 4

- Third-Party Partnerships: Meta has already suspended its third-party VR headset program amid the budget pressures

- Software Ecosystem: Potential slowdown in metaverse platform development and content creation initiatives

- Workforce: Likely headcount reductions across engineering, design, and product teams

According to Android Central, the cuts directly impact the Quest 4 roadmap and broader VR hardware strategy, signaling that consumer VR devices may face extended development timelines or scaled-back specifications.

The Bigger Picture: AI Over Metaverse

The emergency meeting reflects a larger corporate pivot. While Reality Labs has consumed an estimated $40+ billion in losses since 2020, Meta's leadership has increasingly focused on generative AI as the next frontier. The company's strategic shift away from metaverse spending demonstrates Zuckerberg's recognition that artificial intelligence, not virtual worlds, represents the immediate competitive advantage.

This reallocation matters because:

- Competitive Pressure: OpenAI, Google, and Microsoft are aggressively investing in AI capabilities. Meta cannot afford to fall behind.

- Market Validation: Consumer adoption of VR remains niche, while AI applications are already generating tangible business value.

- Investor Expectations: Wall Street has grown impatient with metaverse losses, and Zuckerberg faces pressure to demonstrate profitability.

The Reality Labs Reality Check

A deeper analysis of Meta's Reality Labs division reveals a unit struggling to justify its massive expenditures, with limited commercial success outside of gaming and enterprise applications. The VR market has matured slower than anticipated, and competing platforms from Apple, Sony, and others have failed to ignite mainstream adoption.

The emergency meeting signals that Meta's leadership has finally accepted what critics have argued for years: the metaverse as originally envisioned—a persistent, immersive digital world replacing the internet—remains a distant, uncertain prospect.

What Comes Next

The 30% cuts will likely trigger:

- Restructuring: Consolidation of overlapping teams and elimination of redundant projects

- Focus: Narrower product roadmap centered on proven revenue streams (Quest gaming, enterprise VR)

- Timeline Delays: Postponement of ambitious metaverse initiatives

- Talent Exodus: Experienced engineers may seek opportunities at companies with clearer VR strategies

For Meta, this moment represents a humbling acknowledgment that even the world's largest tech companies cannot will markets into existence through sheer spending power. The metaverse may still arrive—but not on Zuckerberg's original timeline or at his preferred cost.