Nvidia and AMD Anticipate Billions from China AI Chip Exports

Nvidia and AMD may gain billions from renewed AI GPU exports to China, benefiting both U.S. vendors and Chinese tech firms.

Overview

Nvidia and AMD are poised for significant revenue gains if U.S. authorities allow the export of high-performance AI GPUs to Chinese cloud and datacenter customers. This move could benefit not only the U.S. chip vendors but also Chinese cloud providers, local chipmakers, and geopolitical stakeholders.

Background

Policy Changes

- U.S. Export Policy: In late 2025, the U.S. relaxed export-control policies, allowing a limited set of new chips to be sold to China under a new regulatory framework.

- Nvidia's Plans: Nvidia aims to begin shipping its H200 GPU to China by mid-February, following these policy changes.

Market Context

- Chinese Market: China is a major potential market for AI infrastructure, with rapid expansion in generative AI deployments by Chinese hyperscalers and cloud providers.

Key Developments and Numbers

Nvidia's Opportunity

- Revenue Projections: Analyst firm Raymond James estimates that Nvidia could see an additional $7 billion to $12.5 billion in revenue by 2026.

AMD's Upside

- Revenue Projections: AMD could potentially add $500 to $800 million in revenue from China, contingent on large orders from Chinese customers.

Orders and Approvals

- Chinese Demand: Reports suggest that Chinese cloud players may place significant orders, though these require Chinese regulatory approvals.

Beneficiaries

Direct Beneficiaries

- Nvidia: Gains high-margin revenue and strengthens global market share with its Blackwell-family GPUs.

- AMD: Gains incremental revenue and credibility in the AI datacenter market.

Indirect Beneficiaries

- Chinese Cloud Providers: Companies like Alibaba Cloud, Tencent Cloud, and Baidu Cloud can accelerate AI model deployment.

- Chinese Enterprises and Startups: Access to advanced accelerators can enhance AI development.

Competitors and Structural Winners

- Domestic Chinese Chipmakers: The import flow may boost investment in domestic alternatives, fostering long-term competition.

- U.S. Policy Stakeholders: The ability to impose fees and conditions on sales serves as a diplomatic tool.

Risks and Constraints

- Chinese Regulatory Clearance: Sales depend on China's approval and procurement decisions.

- Geopolitical Risks: Renewed exports could face policy reversals or tariffs if U.S.–China tensions rise.

- Competitive Risks: Domestic AI chip development in China could challenge U.S. market share.

Market and Strategic Implications

- Revenue and Valuation: Potential revenue increases could positively impact investor models for Nvidia and AMD.

- Ecosystem Effects: Nvidia's GPUs in China would reinforce software standards, creating barriers for domestic alternatives.

- Policy Precedent: The U.S. decision sets a template for balancing commercial interests with strategic concerns.

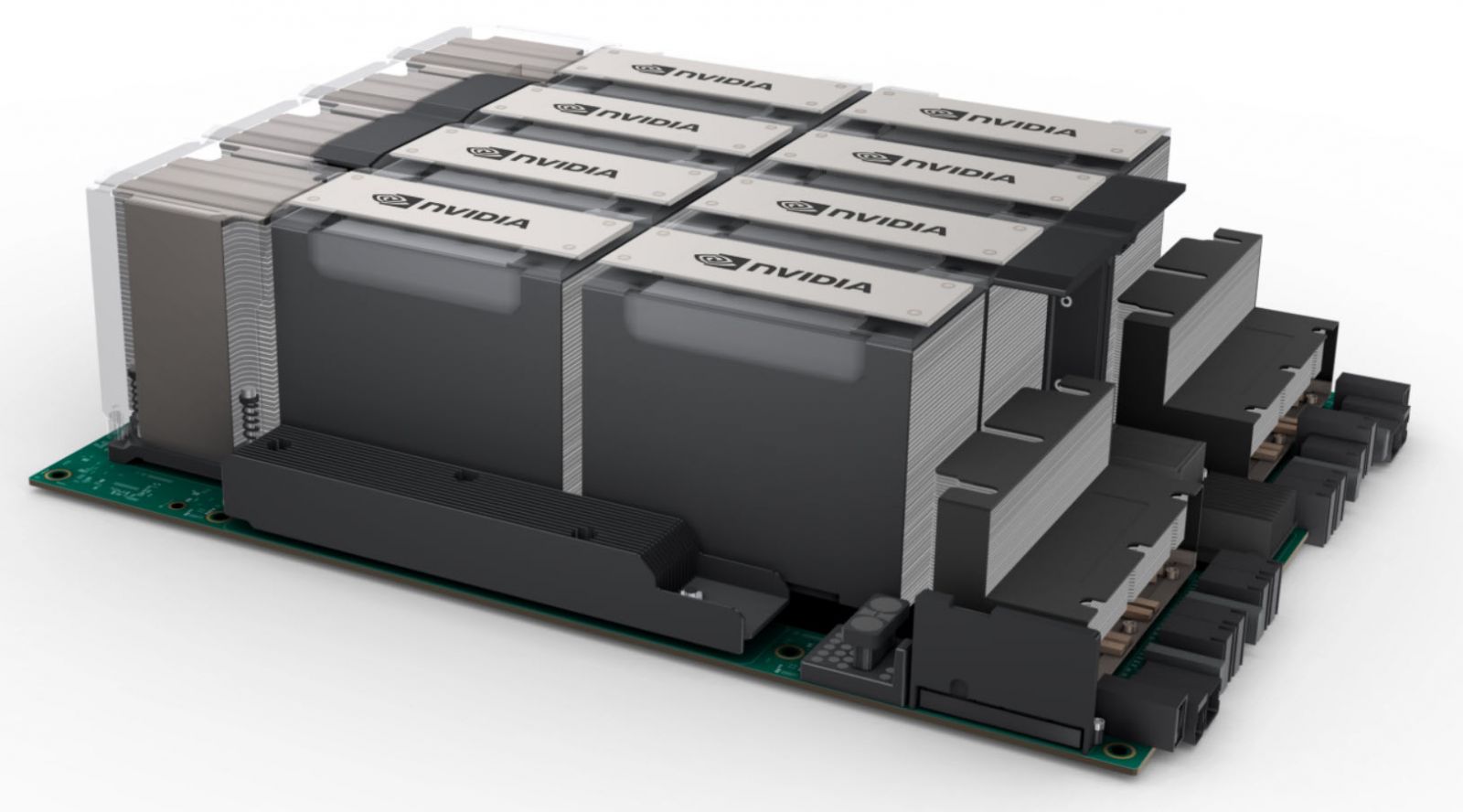

Visual Assets

- Nvidia H200 and AMD MI300/MI308 Images: To illustrate the specific chip families reported for China shipments.

- Chinese Cloud Provider Logos: Representing likely purchasers and deployers.

- Infographic: Visualizing estimated revenue upside ranges for Nvidia and AMD.

Context and Outlook

In the short term, the relaxation of export rules could lead to significant revenue for U.S. GPU vendors and faster AI productization by Chinese cloud players. However, long-term gains may be cyclical due to domestic Chinese chip development and potential policy reversals.