Nvidia Projects Strong Growth Amid AI Market Challenges

Nvidia projects strong growth through 2035 amid AI demand, but faces competition and market saturation risks.

Nvidia Stock's Long-Term Trajectory: Bullish Forecasts Amid Emerging Risks

Nvidia Corporation (NVDA), the dominant force in AI chip technology, faces a pivotal decade ahead as analysts project substantial stock growth through 2035, driven by exploding demand for AI infrastructure, though risks like competition and market saturation loom large. Recent Wall Street forecasts highlight potential stock prices reaching $238 by fiscal 2027 and far higher in 10 years, fueled by revenue surges to $45 billion in 2026, but tempered by warnings of a possible "reckoning" from rivals and pricing pressures.

Current Market Position and Recent Performance

Nvidia has solidified its leadership in the AI GPU market, powering data centers for hyperscalers like Microsoft, Amazon, and Google. As of late 2025, the company's market capitalization exceeds $3 trillion, making it one of the S&P 500's top performers. Fiscal 2026 earnings are forecasted to grow at 58%, with bottom-line projections hitting $742 per share by fiscal 2027 starting January 2026—a trajectory that could propel shares to $238 at a 33x earnings multiple, aligning with the NASDAQ-100 average and implying a 33% upside from recent levels.

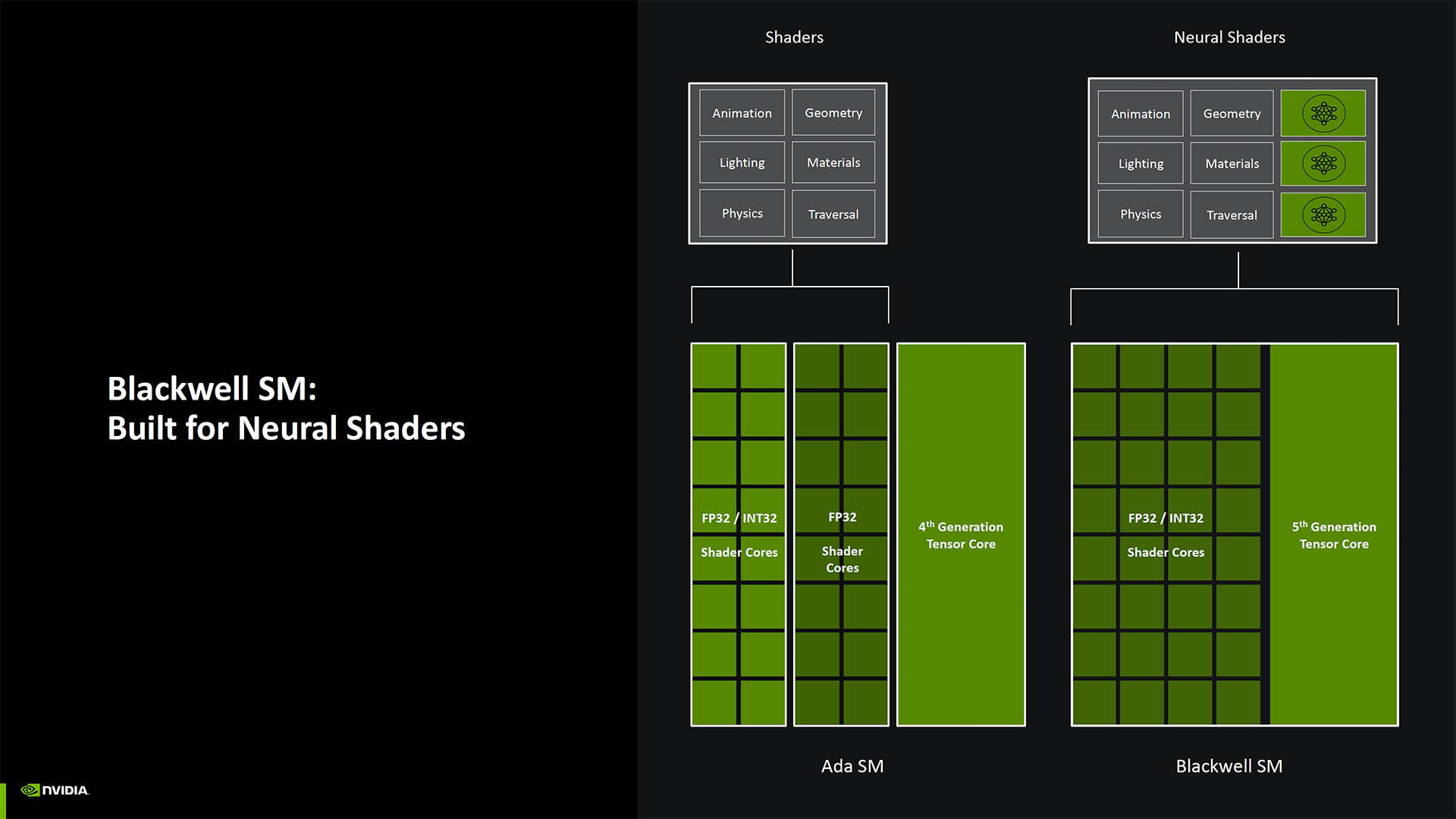

This optimism stems from unrelenting AI adoption. Businesses are ramping up investments in AI infrastructure, with Nvidia's data center revenue expected to climb 62% to $45 billion in 2026, likely higher as demand accelerates. Key products like the H100 and upcoming Blackwell GPUs remain indispensable, capturing over 90% market share in high-performance computing for generative AI models.

Visual: Detailed schematic of Nvidia's Blackwell B200 GPU, showcasing its advanced AI tensor cores essential for next-gen data centers. (Source: Official Nvidia technical documentation)

Analyst Predictions for 2026 and Beyond

Wall Street's outlook blends aggressive growth targets with caution. A prominent forecast envisions Nvidia stock hitting $275 by 2026, citing sustained AI capex from tech giants. Longer-term, Motley Fool analyses ponder a 10-year horizon where Nvidia could multiply its value 10-fold if AI permeates industries from autonomous vehicles to drug discovery, potentially valuing shares at $1,000+ by 2035 assuming 30-40% annual compounding growth.

However, not all views are rosy. EE Times warns of an AI empire reckoning in 2026, as customers diversify away from Nvidia dependency amid rising costs—GPUs now command premiums exceeding $30,000 per unit. Seeking Alpha highlights Alphabet's custom TPUs exposing Nvidia's vulnerabilities in efficiency and scalability. If competitors like AMD's MI300 series or Intel's Gaudi chips gain traction, Nvidia's growth could decelerate to 20-25% annually post-2027, pressuring valuations.

Barchart.com counters with a bullish case for $275 in 2026, backed by Nvidia's R&D edge: over $10 billion annual spend on innovations like NVLink for multi-GPU scaling. Yahoo Finance debates if NVDA is the premier S&P 500 buy, pointing to its 150% YTD gains in 2025 despite volatility.

Visual: Nvidia (NVDA) stock performance chart from 2020-2025 with analyst-projected lines to 2035, illustrating exponential growth phases tied to AI booms. (Source: Yahoo Finance interactive graphs)

Key Drivers and Technological Edge

Nvidia's fortunes hinge on AI infrastructure dominance. The CUDA software ecosystem locks in developers, while hardware leaps—like Blackwell's 208 billion transistors—deliver 30x inference speedups over predecessors. Statistics underscore this: global AI spending is projected to hit $300 billion by 2026, with semiconductors claiming 40% (McKinsey estimates). Nvidia CEO Jensen Huang recently stated, "AI is transforming every industry," positioning NVDA as the pick-and-shovel play.

Enterprise adoption amplifies this: 70% of Fortune 500 firms use Nvidia tech for AI pilots, per company filings. In automotive, partnerships with Tesla and Mercedes integrate Nvidia's DRIVE platforms for Level 4 autonomy. Healthcare sees DGX systems accelerating protein folding, slashing drug development timelines by years.

Visual: Nvidia CEO Jensen Huang unveiling Blackwell platform at GTC 2025, highlighting leadership in AI hardware announcements. (Source: Nvidia GTC event coverage)

Risks, Competition, and Valuation Concerns

Despite strengths, headwinds mount. Customers seek alternatives to mitigate Nvidia's monopoly risks—Amazon's Trainium2 and Google's Trillium chips aim to cut costs by 50%. Pricing pressure could emerge if supply chains stabilize post-2025 shortages. Regulatory scrutiny intensifies: U.S. export curbs to China shaved $8 billion off Q3 2025 revenue.

Valuations flash caution—NVDA trades at 50x forward earnings, versus the S&P 500's 22x. A Seeking Alpha piece argues Alphabet's in-house chips reveal Nvidia's weaknesses in power efficiency, critical as data centers grapple with energy demands equivalent to small countries.

Macro factors like interest rates and AI hype cycles add volatility. If ROI on AI investments disappoints, capex could plateau, echoing dot-com bust dynamics.

Industry Impact and Investment Implications

Nvidia's trajectory reshapes tech: AI chips enable $15 trillion in global economic value by 2030 (PwC). For investors, the 10-year bet favors patience—historical parallels like Cisco's internet-era surge suggest multibaggers, but with drawdowns.

Diversification tempers risks: pair NVDA with AMD or TSMC. Analysts consensus (FactSet average): $150 short-term target, but 2035 bulls eye $2,000+ if AI delivers.

In summary, Nvidia stands at AI's epicenter, with stock poised for robust gains through 2035 barring competitive disruptions. Investors weigh explosive upside against frothy multiples in this high-stakes saga.

(Word count: 782)