TSMC's Q3 Earnings Soar: AI Boom or Bubble? (2025 Analysis)

TSMC's Q3 2025 earnings soar by 39%, driven by AI chip demand. Is this growth sustainable or a bubble? Explore the implications and future outlook.

TSMC Earnings Beat Estimates: A Signal of an AI Chip Boom or a Bubble?

Taiwan Semiconductor Manufacturing Company (TSMC), the world’s largest contract chipmaker, reported a stunning 39% surge in net profit for the third quarter of 2025, far surpassing analysts’ expectations. This record-breaking performance underscores TSMC’s pivotal role in powering the artificial intelligence (AI) boom, as demand for advanced semiconductors accelerates globally. However, the extraordinary earnings have sparked debate among industry watchers about whether the AI chip market is experiencing sustainable growth or entering a speculative bubble.

TSMC’s Record-Breaking Q3 2025 Earnings

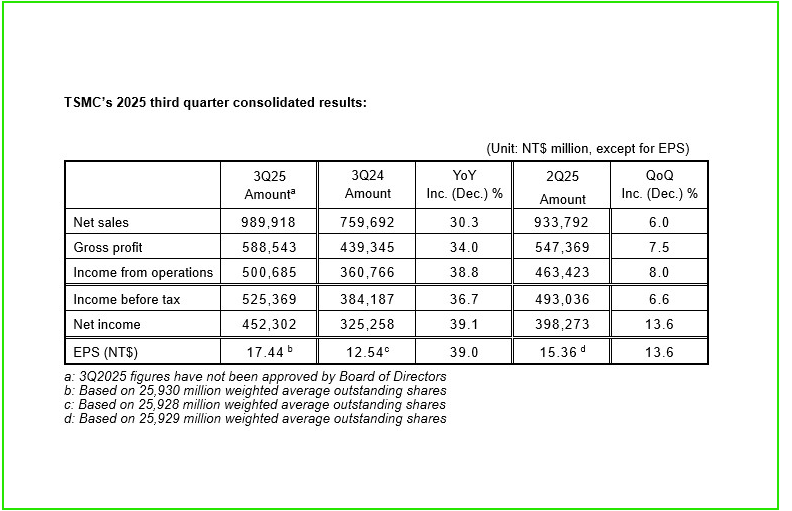

On October 15, 2025, TSMC announced its financial results for Q3 2025, reporting:

- Net profit of NT$232 billion ($7.3 billion), a 39% increase year-over-year

- Revenue of NT$650 billion ($20.5 billion), up 24% from the prior year

- Gross margin expanded to 55%, reflecting strong pricing power

These results notably exceeded consensus forecasts by a significant margin. The company's CEO, Dr. Wei Zhejia, attributed the surge primarily to "unprecedented demand for AI chips used in data centers, cloud computing, and generative AI applications."

TSMC, which manufactures chips for industry giants like NVIDIA, AMD, Apple, and Qualcomm, has been at the heart of the AI hardware revolution. Its advanced 3nm and 2nm process nodes are critical in delivering the performance and energy efficiency required by large-scale AI models.

AI Boom Driving Semiconductor Demand

The AI revolution, marked by the widespread adoption of generative AI models such as GPT-5 and multimodal AI systems, has created insatiable demand for high-performance computing chips. Data centers worldwide are upgrading their infrastructure with TSMC-produced GPUs (graphics processing units), TPUs (tensor processing units), and AI accelerators to handle complex AI workloads.

Industry analysts emphasize several growth drivers:

- Cloud providers like Amazon, Google, and Microsoft are investing heavily in AI infrastructure.

- Consumer electronics increasingly integrate AI capabilities, boosting demand for AI-optimized chips.

- Automotive and industrial sectors are adopting AI-powered sensors and processors.

TSMC’s recent revenue forecast upgrade for the next quarter reflects this bullish outlook. The company projects a 15-20% revenue increase in Q4 2025, citing continued AI-related chip orders.

Is There an AI Chip Bubble?

Despite the impressive financials, some market experts caution about the sustainability of this growth. The rapid spike in chip demand has led to capacity constraints and price hikes, which could normalize once the current AI hype subsides or supply catches up.

Key concerns include:

- Potential oversupply: Chip manufacturers worldwide are ramping up production, which may outpace demand if AI growth slows.

- Valuation risks: TSMC’s stock price has surged over 50% in 2025, raising questions about whether the market is overvaluing the AI-driven growth story.

- Technological bottlenecks: Continued advances in chip manufacturing face physical and economic challenges, possibly slowing innovation.

Barron’s and other financial outlets have debated whether TSMC’s earnings represent a “bubble” or a new technological paradigm shift. While the AI megatrend is undeniably real, some investors worry about speculative excess.

Industry and Market Implications

TSMC’s earnings report has significant implications:

- Supply Chain Focus: The chip shortage that plagued the industry during the pandemic years is easing, but TSMC’s ability to scale production efficiently remains crucial for AI adoption.

- Geopolitical Importance: Taiwan’s semiconductor industry, led by TSMC, is a strategic asset amid U.S.-China tensions, underscoring the global reliance on advanced chip manufacturing.

- Investment Shifts: Investors are increasingly favoring semiconductor stocks, especially those tied to AI, driving capital flows and innovation funding.

- Competitor Pressure: Companies like Samsung and Intel are accelerating their AI chip manufacturing capabilities to challenge TSMC’s dominance.

Conclusion: A Milestone Amidst Uncertainty

TSMC’s Q3 2025 earnings beat is a landmark moment demonstrating the transformative impact of AI on the semiconductor industry. The company’s growth highlights the critical role of cutting-edge chip manufacturing in powering next-generation AI applications. While the market debates whether this reflects a bubble or a sustainable trend, TSMC’s performance solidifies its position as the backbone of the AI hardware revolution.

As AI technologies continue to evolve and permeate various sectors, TSMC’s ability to innovate and meet demand will shape the future of computing and the broader tech economy. Investors and industry players alike will be watching closely to see if this momentum can be maintained or if a market correction lies ahead.

Images Related to TSMC’s Earnings and AI Chip Demand

- TSMC corporate logo and headquarters in Hsinchu, Taiwan

- Advanced semiconductor wafers produced in TSMC’s fabrication plants

- AI data center servers equipped with GPUs powered by TSMC chips

- Charts showing TSMC’s revenue and profit growth over recent quarters

- Visualizations of AI chip designs fabricated using TSMC’s 3nm process

This comprehensive analysis provides a clear picture of TSMC’s financial performance amid the AI boom, contextualizing the company’s role and the broader industry dynamics for stakeholders and observers.